I don’t know about that. @hanera might be a tiger parent

Don’t worry, I’m a dragon child for a tiger parent.

Hahahaha!

Ryan Cohen — who sold Chewy (CHWY), the company he co-founded, for $3.35 billion back in 2017 — from throwing diversification out the window and plunking almost his entire payout into just two stocks: Apple (AAPL) and Wells Fargo (WFC)

Why bank?

He’s saying Apple will be just like Wells Fargo.

I am not into stocks, except S&P funds, but here are the positives about banks.

Banks like WFC get third party money, such as our FED or other market, and earn revenue from servicing credit, loans, commissions, trading, investment…etc. They are the backbone of finance to economy.

WFC has appx 20% profit margin (like AAPL) with higher cash flow 6.5% yield. Too big to fail (by FED/Gov help!).WB is behind yield (not on market pricing).

Cramer said, Apple set a new all-time high Tuesday for reasons unrelated to the economic reopening or growing sales in China. Rather, he said the usage of Apple Pay has taken off due to the pandemic as people want contact-less payments.

“At the same time, Apple’s service revenue stream is growing by leaps and bounds,” he added. “It shows no signs of stopping, even as the pandemic gets tamped down.”

Sell your RE and plough proceeds into AAPLs ![]()

Apple To Let Users Trade In Their Mac Computers For Credit At US, Canada Stores

Apple to Launch Mac Trade-in Program at U.S. Retail Stores

This news is worth $8 ![]()

Announcement by Fed to keep interest rate at zero till 2022 is worth $2.

I ordered a couple of Apple Watches recently. Is that worth anything?

maybe 0.00000000000000000000001?

![]()

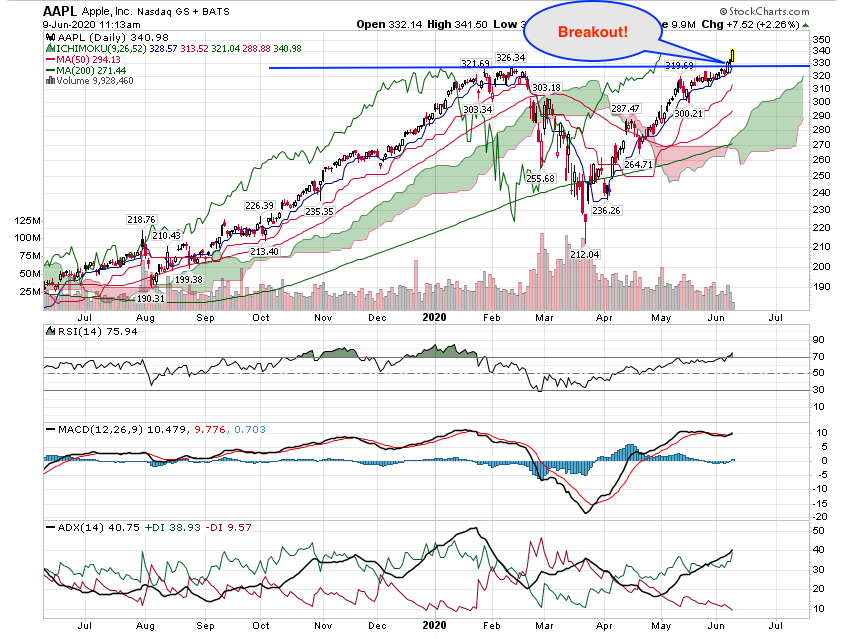

Previous ATH is $327. Closed at auspicious number $338.80 ![]() above previous ATH. Hence can consider as a pullback to test the resistance turn support before resuming the bull trend

above previous ATH. Hence can consider as a pullback to test the resistance turn support before resuming the bull trend ![]()

https://apple.news/AAyXPgExvRGq9HIUGrdp_ug

Apple Card is at the center of the services business drive.

.

I wonder if it isn’t time for someone to start the next great U.S. chip manufacturing company.

Already started by a group of ex-Apple semi-guys.

Apple is facing rage and insurrection from developers over the commission it charges apps on the App Store

Developers’ attitude is:

Head I win - I don’t want to pay hosting and marketing fees.

Tail you lose - I don’t want to revenue-share.

The current business model of apps and App Store are conflicting. Apple needs to modify the business model of App Store. The model works fine with old biz model of buy apps once.