By then Apple no longer sell iPhones.

Yes, time to invest $$$ into metaverse (AR/VR). However, I need to hedge with position in U, TDOC and ZM. Is why I sold 50% of AAPLs and start scaling into these three stocks in this buy n hold account. Four stocks to bet on this mega trend. Still hesitating on SKLZ.

Yet Cathie continues to dump AAPL. Two probable reasons:

a. Annualized return for the next 5 years is expected to be less than 15%.

b. She thinks Apple stock buyback and dividend strategy is selling investors short.

If you are bullish on AR/VR you may need to check out Facebook. Zuck is desperate to get out of Apple’s shadow and to have his own tech platform. A recent report claims that 20% of Facebook engineers are working on AR/VR.

I am aware of this. But can FB 10x?

Cathie is selling both AAPL and FB i.e. she doesn’t think both can even double over 5 years.

I have been waiting to enter AR/VR stocks for a long time… I think now is the right time. Well you get onboard earlier than me. Well done. Other than U and SKLZ, what other AR/VR stocks do you have? Btw, I view TDOC and ZM as AR/VR stocks too.

FB could buy Unity.

.

That would be the biggest acquisition by FB. Would Mark pay $50B for U?

Zuck tried to kiss too many asses but in turn stepped on too many toes. It’s become fashionable in the Valley to shit on Facebook. Not sure the Unity guys want to sell to Zuck.

Anyway, I actually think Apple has an excellent chance in AR/VR. Its silicon team is the best in the world, and you need some kick ass chip kung-fu to do AR glasses that don’t suck. Google tried and theirs sucked, badly.

Has to be no different from current offering. That is prescription glasses and sunglasses. It should be able to use for cases such as touring, museum visits, … in addition to replacing the navigation panel in the car ![]() , playing video games ofc. Work with AirPods

, playing video games ofc. Work with AirPods ![]() … Glasses, AirPods and Watches would enhance experience of Apple Car dramatically

… Glasses, AirPods and Watches would enhance experience of Apple Car dramatically ![]()

![]()

Did I say disrupting the eyewear and eyeglass frames industry? Just incidental not the main goal.

The global eyewear market size was valued at USD 147.60 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 8.5% from 2021 to 2028.

The global earphones and headphones market size was valued at USD 25.1 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 20.3% from 2020 to 2027.

The global watches market size is expected to reach USD 117.8 billion by 2025, according to a new report by Grand View Research, Inc., expanding at a CAGR of 13.0% over the forecast period.

The auto industry is worth an estimated $2 trillion and is wide open to disruption.

Technicals are more bearish than bullish. How come?

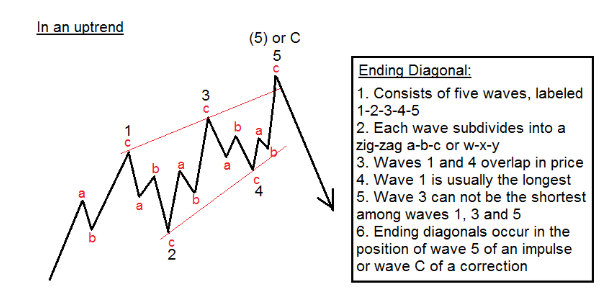

For wave v is ok to have zigzag as wave (1) ![]() Heard of ending diagonal?

Heard of ending diagonal?

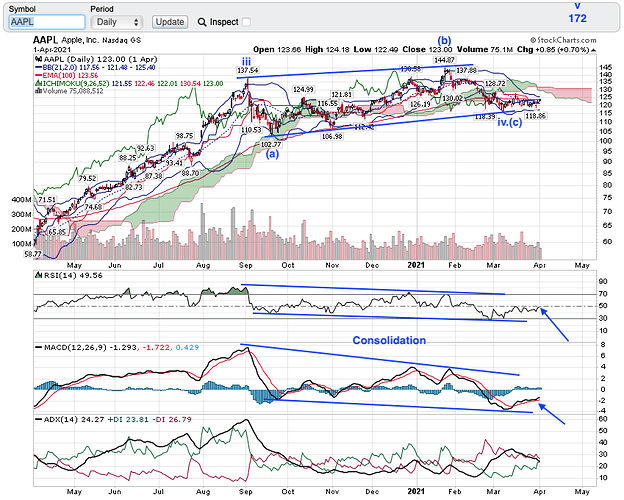

Updated EW picture for AAPL, target for v remains at $171.

Here again, Master WU is totally wrong like TSLA mistake. He is always bearish outlook. Now, correction is done with Mar 4th or 8th low and we are not going to retest the low until it reaches peak. If I am right, yesterday very likely the second bottom (after the Mar4th/8th low) and market will fly upwards in apr 2021 onwards, starting from tomorrow.

Read Master WU, do your own analysis and find out the best or correct direction…

QQQ corrected 50% on EW (low 266.97 high 336.62) on Mar 8th and now it is 61.8% on EW (low 266.97 high 336.62) – may be wave 4c ends here.

Now, up swing has to reach $331-$335 range soon.

I am just posting my view, whether viewers take it or ignore it, I will leave it to you…

BTW: I am totally loaded with TQQQ or similar instruments (and my view may be biased bullish). You can also ignore me and do your own research…

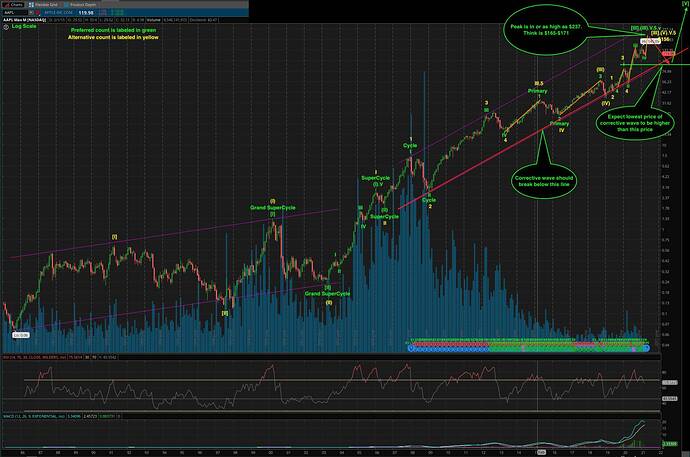

Since I am a buy n hold (hopefully forever) investor in AAPL, I look at the EW picture since AAPL IPO ![]() Is that long duration

Is that long duration ![]()

Grand SuperCycle degree: Century trend, label as [I] [II] [III} [IV] [V]

SuperCycle degree: Multi-decade trend, label as (I) (II) (III) (IV) (V)

Cycle degree: Multi-year trend, label as I II III IV V

Primary degree: Multi-month trend, label as 1 2 3 4 5

Intermediate degree: Multi-week trend, label as i ii iii iv v

Below is the EW picture of AAPL since IPO ![]()

Preferred count is in green labels. This count completes multi-decade wave (III).

Alternative count is in yellow labels. This count completes century wave [III].

Worse case: At the lowest point of the corrective wave (be it [IV] or (IV), my worth of AAPL holdings would be chopped by 1/3. Should I try to time to sell at the peak? I am not that good, so I just ride ![]() After all, the peak of century wave [V} is higher than whatever price [III] or (III) completes at.

After all, the peak of century wave [V} is higher than whatever price [III] or (III) completes at.

Shares of Apple (AAPL) - Get Report traded lower Tuesday after its biggest and most important supplier Foxconn cautioned that a ‘materials shortage’ could hit its supply chain in the coming months.

Cramer said Apple will likely go lower in the short term. "There are things that are not great right now.

Peak might be in… lead QQQ into century corrective wave?

Short term is not next day open ![]() Anyhoo, there are many resistances along the way, $123 (current), $127, $130, $138… many technicians (including Panda) say $138 is max re-bounce before resuming downtrend… many think $145 is peak.

Anyhoo, there are many resistances along the way, $123 (current), $127, $130, $138… many technicians (including Panda) say $138 is max re-bounce before resuming downtrend… many think $145 is peak.

Assume this way:

If AAPL crosses above old peak $145 , which is very likely in 3 months, we are going to see downtrend after new peak. Bullish run may take appx to October timeframe.

If AAPL does not cross old peak $145 and market goes to downtrend, you can fairly say that we are already in series of downtrend from Feb 2021 onwards!!

My guess is first scenario bullish trend is still there, but we ( at least I never know ) never know so much ahead of future clearly…

All are pure BS guess work…market can go anyway…and very hard to predict the future.

AAPL lags QQQ and the other FAANMG stocks. It needs to break above $127 for a run towards $172 by Apr 28 earning day… ignore the date, just a wish… however pretty sure it will peak at $172 if it can break above $127.

Meanwhile, Mr. Williams’s ability to identify the right projects and reject the wrong ones, and to push software and industrial designers forward, will go a long way to determining Apple’s success.

![]()