Maybe need a chart like this for the various forum members ![]()

Apple is in fact planning two distinct versions of the headset. The first will offer high end VR capabilities but at a high price, which could be aimed at developers.

The more mainstream version would have smaller hardware and a lower price point, aimed primarily at augmented reality is expected to follow later.

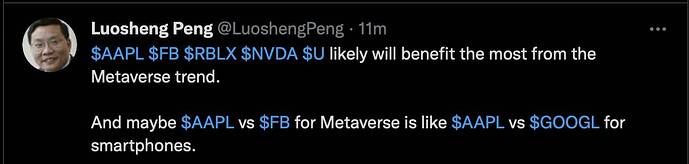

Faceripper said AAPL is the right stock to buy in 2022, he thinks there would be multiple expansion in 2022. Ofc, AAPL ![]()

Face ripper said the entire FAANG complex.

![]()

AAPL target $325.

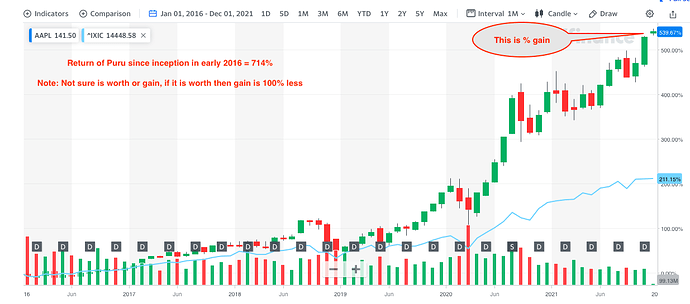

AAPL vs Puru portfolio

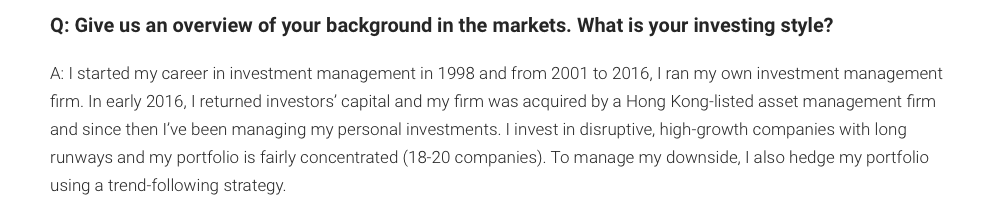

Return of Puru portfolio is ahead of AAPL. Please take note that without hedging it would be below AAPL. That is, his choice of stocks are not that great. His hedging skill is ![]() So I don’t agree with his claim that he had managed to choose the best disruptive high growth businesses with long runways. That is to say, has he chosen the core stocks to be AAPL or any of the FANGMANT, he should perform even better because of his superior hedging skill.

So I don’t agree with his claim that he had managed to choose the best disruptive high growth businesses with long runways. That is to say, has he chosen the core stocks to be AAPL or any of the FANGMANT, he should perform even better because of his superior hedging skill.

Same as Cathie ARK funds

18 days ago…

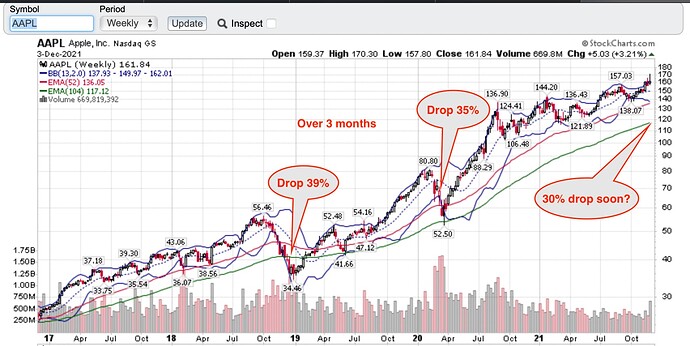

Yesterday, AAPL hits $170.30. Possibly completion of wave (5) of wave v of … Century ![]() correction ensues? Have to see how price action play out.

correction ensues? Have to see how price action play out.

Who is telling the truth?

Bloomberg: Apple Tells Suppliers iPhone Demand Has Slowed as Holidays Near

or

Spent like $5k on apple products last night.

Merry Christmas!

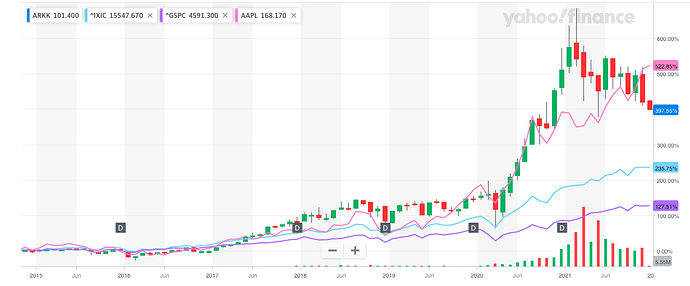

Looks like ARKK has been outperforming AAPL all along until 3 months ago? You are writing Cathie off based on 3 months of underperformance?

.

Outperform from mid 2020 to Sep? 2021, mainly due to TSLA.

Cathie has always told her investors that we should look at 5-year timeframe since that is how she plans. But ARKK can’t beat AAPL in a five year timeframe,

Based on above two points, won’t you think directly investing in AAPL and TSLA would outperform ARKK? That is, no need for her and her team’s help, no value added.