Extend your channel to July. There’s still more upside without breaking above the channel. This is why I use 10-day as a stop. It removes all guess work, emotion, etc. if you have momentum on your side, why sell becisse if a channel? Ride momentum until it disappears which to me is the 10-day.

I only read about 1/3 of the book. Not knowledgeable enough to give opinion on options trade.

According to this guy on SA, here’s his way to trade MU:

How to trade MU right now?

-

BUY the stock straight away at current market price, plain and simple. The upside is big enough to justify this and the risk/reward profile is too attractive to ignore.

-

SELL the MU 01/18/2019 $45 PUT (308 days to expiry) for $4

This will allow you to benefit from one of two scenarios:

- If the options are assigned: Getting MU for a net price of $41 (=$45-$4), 30.3% below current market price

- If the options aren’t assigned: Extra income of $4 per contract sold for an annualized return of 10.6% = (1+$4/$45)^(365/308)-1

- SELL the MU 01/17/2020 $90 CALL (672 days to expiry) for $7.52

This should be executed only if you hold MU shares that turn this trade into a covered call sale. The premium here is actually too small if it’s up to us. However, if you own the stock and in light of our TP - this is the best deal you can get.

This will allow you to benefit from one of two scenarios:

- If the options are assigned: Selling MU for a net price of $97.52 (=$90+$7.52), 65.7% above current market price and 2.7% above our PT.

- If the options aren’t assigned: Extra income of $7.52 per contract sold for an annualized return of 4.5% = (1+$7.52/$90)^(365/672)-1

That’s not enough (in our book) but that’s the best the market currently gives. Frankly, we would wait for MU share price to be higher enough (~$70) in order to execute this leg for a higher enough premium that would generate at least 10% annualized return.

That’s how I’ve been trading lately except shorter term. It’s too much to follow a ton of stocks. So I follow fewer stocks and use more strategies to profit off the stocks I follow. It’s great if you own stocks that have weekly options.

I still use a 13-week high screener to look for trade ideas, but a lot less of my trades are from that. It’s more the core list that I follow.

![]()

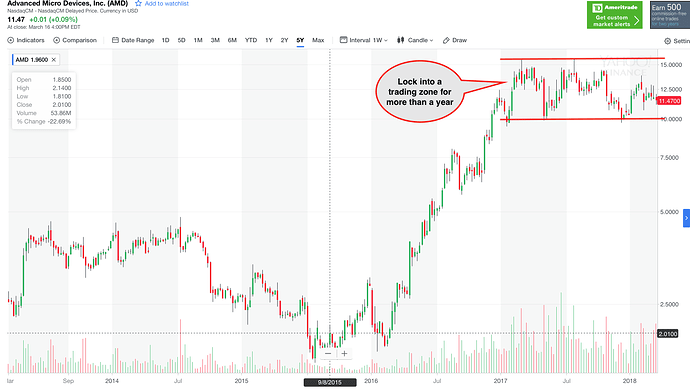

Did you own AMD? Casually looking at the charts in the article, correction might be almost over.

Correction for NVDA is about to begin.

No. AMD is a loser. Its chief GPU architect just defected to Intel not too long ago. And it’s obligated to use global foundry’s outdated process to fab its cpu. Don’t go near it.

It’s also much more exposed to the crypto mining market.

How many are you following closely? Finally force myself to follow only 8 ![]() thinking of cutting down to 6, obvious drop is IRBT, still haven’t decided which is the 2nd one. At first was thinking of NTNX, now it seems it should be UBNT

thinking of cutting down to 6, obvious drop is IRBT, still haven’t decided which is the 2nd one. At first was thinking of NTNX, now it seems it should be UBNT ![]() CEO of UBNT is a little distracted and a little inexperienced… meanwhile just hold their stocks and LEAPS calls… doing nothing i.e. not following closely.

CEO of UBNT is a little distracted and a little inexperienced… meanwhile just hold their stocks and LEAPS calls… doing nothing i.e. not following closely.

I have 15 in my watch list. It’s gone up a few recently. I try to keep 10 on it then rotate the other spots as there are opportunities.

I will open a small initial position on WDC next week. Looks interesting.

Don’t want to go all out in MU? Fortune Teller says buy the stock straight away, the risk/reward profile is too attractive to ignore!!!

I am too timid to go all out. I am already buying a batch on every 5% increment.

Too much diversification is anemic to rewards, thought you know that!

Riding the momentum is your motto too.

Your action is not consistent with your beliefs ![]()

Is it really?

Hope I get lucky again his year. ![]()

What is your current 10?

AAPL

GOOG

FB

NFLX

NVDA

SHOP

UBNT

NTNX

BABA

TCEHY

I didn’t count AMZN in the 10, since I can’t trade it.

MU, BA, VEEV, and TWLO are the more temp members.

7 out of 10 F10 ![]() AMZN - Can’t trade. Missing TSLA and BIDU

AMZN - Can’t trade. Missing TSLA and BIDU ![]()

Actually I just want to know the smaller companies ![]()

SHOP

UBNT - Still think is ok?

NTNX

MU

VEEV

TWLO

So you didn’t own PANW, SPLK and IRBT ![]()

My all time gain for TSLA is 800% and BIDU is a healthy 150%. Trash them all you want but they are winners in my eyes.

Just a statement of fact… how did you read that deep?

Edit: Removed your avatar from original post.

I’m still bullish on UBNT. Their margins are great. Half their business is growing 40%+ with a lot of opportunity while half is growing 3%. As long as the 40% portion keeps growing at that rate, it’s good.

I feel security is crazy crowded with no way to differentiate the companies. I also think security is eventually a standard feature and not a standalone product or company. It’ll just be part of what AWS, google cloud, Azure, etc and all the companies building on their platforms offer. I’m sure it’ll just be a feature of networking equipment too.

I never understood the bullishness on IRBT. The revenue growth is way too small, and the R&D spend is way too high. It’s been 20 years, and they haven’t really branched out into new products.