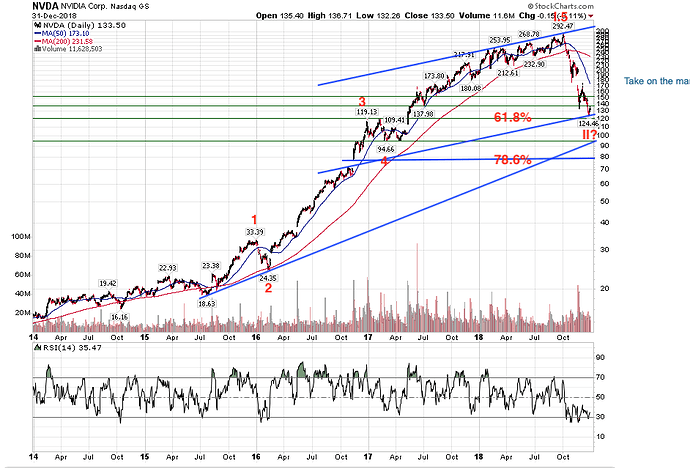

From retracement perspective, many stocks re-bounce from 61.8% retracement. Same for NVDA.

NVDA stock may go up like other stocks, but may not likely reach the peak again or it takes longer time for NVDA to reach the peak.

Potential slow growth likely for NVDA as they lost AI market (with AAPL, Google and TSLA…etc).

Would you like to see the growth prospects of PFE, JNJ, BA, LMT, ABBV, VZ, AVGO, T, SYF(like AAPL too low) and GIS. All are dividend payers.

I know you have VZ, but trying to analyze others.

Memory market is weak:

Their smartphone shipments were also down 13% yr/yr.

Mobile wave is going to die soon. Bull market needs new leadership instead of aapl

People have been saying that for YEARS though. Everyone’s been trying to figure out what’s next. It certainly wasn’t 3D which flopped. HD TV isn’t it. There’s hardly any profit in TVs. IOT stuff is there, but it’s not exactly revolutionary with must have products. I honestly think 5G roll out will unleash a new mobile wave.

I remember reading somewhere Samsung only has very small market share in China for smartphones, something along the line of 2 or 3%. Its weakness in smartphones most likely doesn’t have much to do with the Chinese market.

What’s so special about 5G? I thought it’s just extra bandwidth. May be people will get rid of their Comcast internet at home. Is there anything else?

It’s unleash new capabilities, apps, etc. It happens with each new generation of technology.

Higher bandwidth, esp mobile, increases usage of smartphone and tablets. Lot of apps , utilities, audio, video , games will be there. It leads to major usage internet using smart devices.

Read somewhere 5G obsoletes wi-fi.

Higher bandwidth and lower latency. But, the biggest issue is the heavy investment by telcos. Will they find it economical to invest that many billions of dollars in a commodity market? Will AT&T ever recoup the billions invested if Verizon and T-Mobile will also have 5G?

I don’t think telcos are that eager to waste that money. 5G I think is farther than people think. Read somewhere AT&T will relabel their slightly faster LTE as “5G” to fool people.

Yes, I read the same, but 5G network is evolving now and stability may take around an year.

See nowadays they started charging on usage basis.

VZ and T profit margin is 24% and 20% level, increase network speed will increase usage.

Above all, internet has become mandatory for urban life, same way mobile usage.

Jim Cramer: Here’s Why Semis Turned Around After Months in the Doldrums

Today they are reversing and it is all about the bold Micron call. I should also add that Jensen Huang, the visionary CEO of Nvidia introduced some fabulous new chips with low price points that could reignite the flagging gaming cohort.

What should you do if you want in?

And finally I think Micron is cheap; one more bad quarter and there should be little inventory in the system. No I don’t think it can make the estimates yet. One more guidedown. But you can’t wait for that guidedown. Better to go with BMO and this very big call.

Bought MU 300@$33.28 on auspicious day of Jan 8 ![]()

Surprisingly the horrible news from Samsung didn’t hurt Micron much.

.

When bad news don’t hurt the stock, you know it has bottomed ![]()

.

FOMO buy 200 more on longevity day of Jan 9 betting it would rise above 50-day SMA to 200-day SMA quickly.

.

Analysts Think Micron Stock Has Bottomed Out, But Proceed With Caution

750 shares now ![]()

3 Top Digital Memory Stocks to Buy in 2019

Results could continue to get worse before they get better, but Micron’s stock has fallen so far that it is now trading at a price-to-book ratio of 1.1. Though the business has wild swings up and down, a price-to-book ratio close to 1.0 has historically been a good indicator that Micron is a good value. Management thinks so too, as it commenced a new $10 billion share repurchase authorization during the first quarter.

Make it 1000 ![]()

NVDA & AMD owners, look at the challenge !

Motley Fool writer doesn’t know what he’s writing about. NVDA chips is the only thing for training. Inference is what everybody else is working on.

Jil,

Current AI can’t do intuitive leaps like humans, they have to be trained before they can infer. AI is still pretty dumb, just more efficient at trained skills ![]()

NVDA re-bounced from 61.8% retracement, still below 50-day SMA, firmly downtrend. Anyhoo, expect at least a counter trend that retrace 38.2% of the 61.8% ![]() i.e. zigzag to $188 (probably touch 200-day SMA then)

i.e. zigzag to $188 (probably touch 200-day SMA then)