Should I cry? Everybody say overbought, so I sold 10% today ![]()

You followed the wrong people.

You should get a buying opportunity next week with the debt ceiling drama.

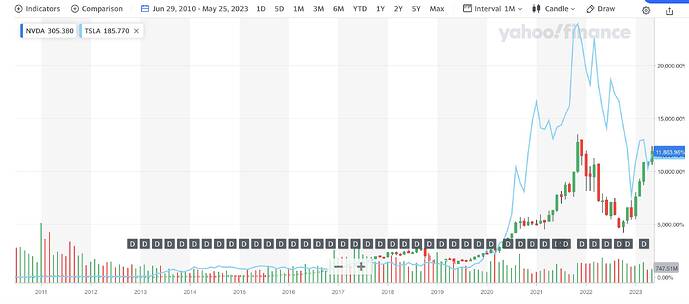

NVDA will pass 1T

.

The question is will it hit $3-5T within 5-10 years.

At $380s, market cap is $940B.

When is the right time to enter nvidia for long term hold?

NVDA guided 2Q rev to 11B. Consensus prior to earnings call was… 7.2B.

52% higher than consensus.

Bananas.

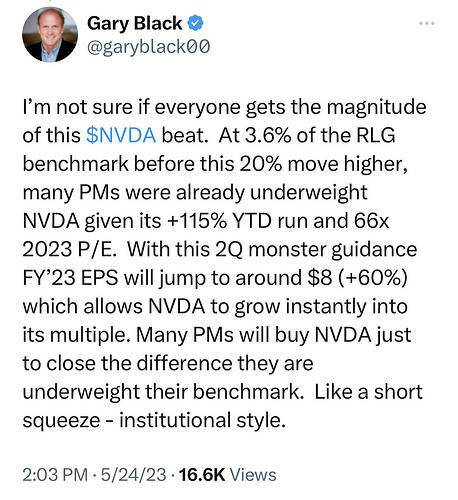

This is what I have been thinking. Most institutions are positioned bearishly anticipating a recession (that never comes). If those bearish conditions are not met they will find themselves massively underperforming. To make themselves look like less of an idiot they will have to FOMO in.

Not only wrong people, but also following wrong stocks (hyped PLTR will kill NVDA!!).

When is the right time to enter nvidia for long term hold?

I remember buying NVDA at $55 (never knew this much)!

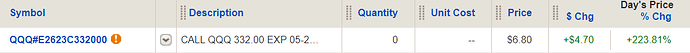

Even today, I would have bought NVDA call options, but stayed away from it, but stayed with QQQ calls

![]()

So the nvda train has left the station? No more chance of buying it low?

There is always another chance. Don’t FOMO.

Seeing many skeptics actually sold or initiated short position on NVDA. Bearish sentiments still prevail for some reason. Why are people so stubbornly bearish? Because they are absolutely convinced a recession is coming?

.

When is the right time to enter nvidia for long term hold?

So the nvda train has left the station? No more chance of buying it low?

Weird question to ask. @manch, @marcus335 and me have been talking about NVDA for ages.

yes but I’m asking about the current situation with panda and @Jil predicting downfall in few months

yes but I’m asking about the current situation with panda and @Jil predicting downfall in few months!

I try to avoid here (many times broke that rule!) as lot of people are blind bulls. Just visit my one page site (until Nov 2023) and if that Ranking or grade is RED stay away, green buy.

Of course, that wont help about NVDA or TSLA or AAPL …etc as the individual stocks are following company fundamental growth.

Forget NVDA or others that went up, just focus some companies 2B-20B, read fundamentals, try to invest.

Buy x at some price, if it dips 5%, buy double x (if company is good), if it dips another 5%, buy 4x …and so on (as long as company must be profitable with revenue and income).

If correction (recession) comes, it is an opportunity, keep some cash for that.

bye …bye now.

…focus some companies 2B-20B, read fundamentals, try to invest…

Ride the AI megatrend. DD SOFI (AI + bank + fintech) and U (AI + games + metaverse).

Lol. You’ve been bearish for years now. The market has far more up than down years. It makes more sense to invest and keep adding to it. Unless you’re making significant sized trades, your returns are going to suck if you calculate your return based on the total amount of your portfolio. You’d make far more being fully invested and not touching it.

You’ve been bearish for years now. The market has far more up than down years. It makes more sense to invest and keep adding to it. Unless you’re making significant sized trades, your returns are going to suck if you calculate your return based on the total amount of your portfolio.

Return LOL !

Whatever I posted is for @mcp (and others) who does not have any algorithmic help like me. They do not have any way to spot where is the top and where is the bottom.

Truth is:

For me, it is always positive delta, either bearish side or bullish side, as I mainly focusing on SPX, QQQ, SMH, TQQQ, SQQQ…etc.

I have told many times, my way is completely different and no one can , here, match the accuracy.