Could be.

But one could also argue that AI’s strengths are in things like building (in the broadest sense), coding, designing and even selling while specializing in abstraction is a harder to replicate human trait. Maybe MBA’s just need to better optimize themselves toward those things AI struggles with.

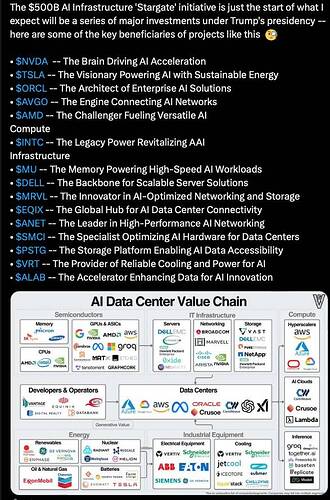

This pod goes over the Stargate project:

Elon is just sour grape. Nobody says Masa is going to show up with 500B on Day 1. Surely most of the money will come from loans anyway, not equity. The project will be gated by how many GPU’s Jensen will sell them, and the available power supplies. But over the course of multiple years, surely it can get to around 500B.

I think the main reason the initial build out will be in remote Western Texas is power supplies. They will need to build new power plants for all those massive data centers.

Billion dollars spent by hyper scalars down the drain ![]()

Also, datacenter need to be upgraded with new generation of GPUs every 3-5 years ![]()

Deep seek is open source, anyone can download and adapt codes to their use cases. Also no need for expensive NVDA chips. What will happen on Monday? Hopefully NVDA didn’t crash.

Most consumers use free gen-ai chatbots. Cheaper has no meaning when it is already free.

Hyperscalars have to write off their past investments faster instead of 3-5 years. However, they save huge on future Capex and operating costs. Many smaller companies who can’t afford to buy compute to host their own LLMs can do so now. Nerds can run their own LLMS on Macs and iPhones locally (without the need to access internet).

AAPL turns out to be the wise man who didn’t FOMO into purchasing expensive GPUs.

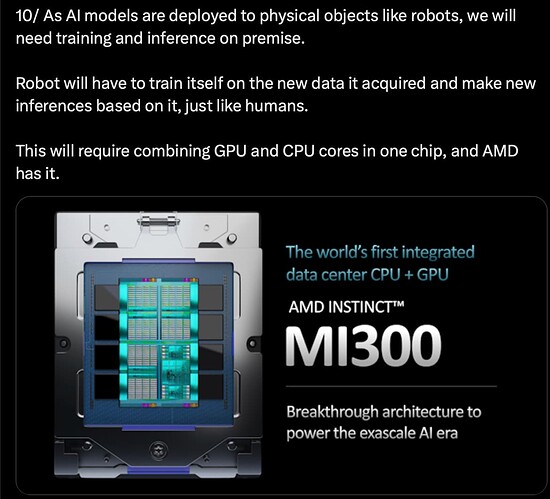

The real losers are NVDA, AMD, MU, TSM, ASML, SMCI, DELL, utility stocks, … including their investors (well, I didn’t sell any NVDAs yet ![]() )

)

Jan 26, 9:37pm CST

Current prices in HOOD.

Wrong application of Jevon’s Paradox… sound like a fanciful way to explain high elasticity of a product re: demand and supply theory… price decline, demand increase. I have read this guy’s view and answered in my previous post in response to Kris Patel.

Users of NVDA data center GPUs are hyperscalars and not the consumers. There won’t be any increase in use of AI by consumers because is already free. So hyper scalars are happy to reduce Capex to serve the consumers. However, they can still spend more to race towards AGI if they want… so the demand for NVDA chips is uncertain… could be less, same or more. IMHO, would be less since they are awakened that they should focus on algorithm/method (finesse) rather than just throw money (brute force approach) at the problem.