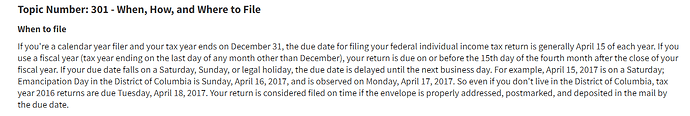

Btw, for tax purposes, only when money is deducted from your bank account then count as paid.

So mailing a cheque to IRS may not work as your cheque may not be cashed before Dec 31.

Are you saying that we are all too late?

Paying on SCC website via eCheque counts so you are safe!

Btw, for most of you, it shouldn’t make a difference since you’ll hit AMT for 2017 hence extra property tax payments may get excluded.

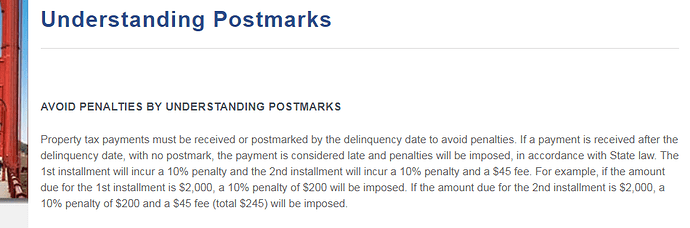

Are you sure post office mark in 2017 is not sufficient? I would check your specific jurisdiction on this. Seems to me some cities just say be sure to be postmarked before due date…

My wife is mailing property tax in today…In Eldorado county the money needs to be received by Jan 2, 2018…12/31 is on Sunday

I think the postmark is for county considering property tax was paid on time. However, IRS probably has different interpretation wrt which tax year is applicable for the payment. So do check on that.

This is for SF County… as long as you get post mark (wait in line and ask postal clerk to post mark in your presence, that should do it…

County - postal rule works.

IRS - based on money deducted from bank account. However IRS won’t know unless they audit your account.

This concurs with my comprehension of the rules.

My IRS buddy said probably postmarked date but check cashed before in 2017 is best. The issue is that if you HAD to prove it you would have to get the stamped envelope from the county (forget that) or have to pay a few bucks for a return receipt of some sort at the post office that indicates 2017 mailing.

Looks like a postmark is ok with county

Exactly why I paid the second installment by eCheck a few days before Christmas to ensure the funds were debited from my bank account before year-end.

IRS says 2018 property taxes are deductible only if assessed and paid in 2017

The IRS said Wednesday that people can deduct their 2018 state and local property taxes only if they were assessed and prepaid during 2017

I’m thinking should work for Bay Area right?

The IRS said that taxpayers can claim an additional property tax deduction when paying their 2017 taxes if they pay the tax this year and if the local tax authority has notified homeowners prior to 2018 of how much they owe in property taxes, known as a tax assessment. State and local laws vary as to when this occurs.

Wow, you are certainly marriage material…

Echeck is really fast. County took my money the next day.

If you pay by echeck they will give you a printable receipt that it was paid on that date. That should be good enough for the IRS. If not you could always threaten to take it to tax court. They don’t like going through that. My CPA was an ex IRS auditor. I found that out from him.

You paid early? Good! One less number to add to the postal card size tax declaration:rofl:

Ooh…sorry, it’s next year. My bad…