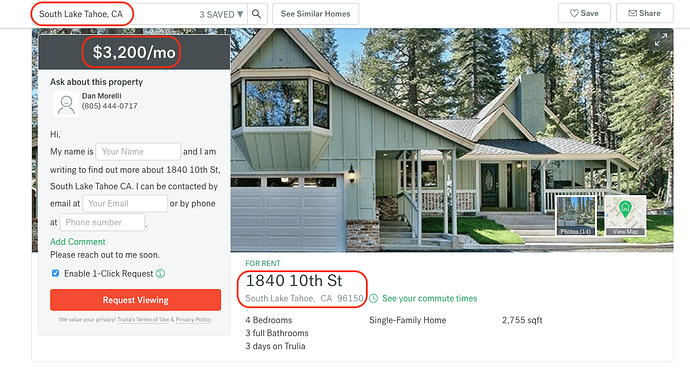

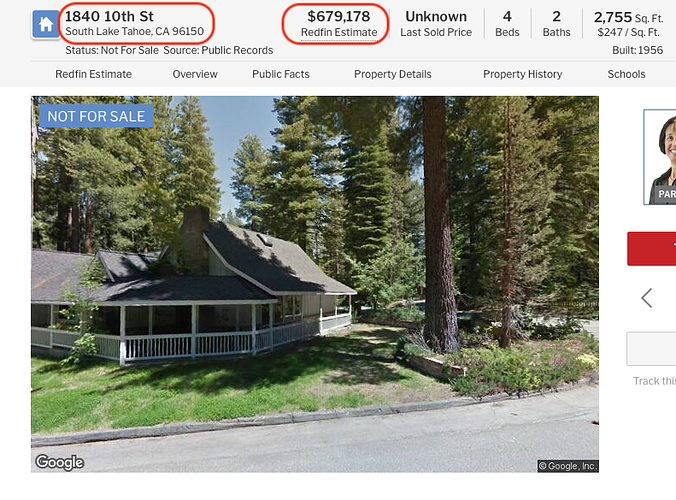

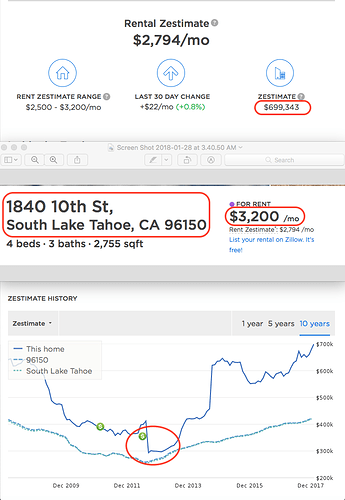

$3200 rent for a SFH costing $680-$700k yields 5.5-5.6% is impossible to get a 5% cap rate.

Looking from another perspective, is it possible to buy a $680k-$700k SFH for $340-$350k in today hot RE market?

The east bay home I bought last year yielded 5 cap.

Purchase price was 750k and renting for $4k per month.

Wake up so early just to tell me you’ve bought another house ![]() Your net worth has to be re-rated upwards. Better

Your net worth has to be re-rated upwards. Better ![]() than 5%, say 8%

than 5%, say 8% ![]() Me got 5% in Austin. Looking for better than 5%

Me got 5% in Austin. Looking for better than 5% ![]()

That’s what you get for shopping at 30000ft

Buying from far away guarantees you get crappy deals

I found a house with a cottage a year ago for $345k. Other Buyers just saw a project. I saw cash flow. Converted the office into a forth bedroom.

$850/m for the cottage. $2550/m for the 4/2 house on a 3/4 acre lot.

Nobody would buy a $700k home here as a long term rental. I bought a 7 unit building with a house that now gross $112k for $660k in 2016.

It is all about homework and having an MLS account. Shopping on Zillow is a waste of time.

There you are ! And your real estate acumen !!