I’m wondering too. Thought I will make a killing in BIDU but instead in deep red with 200 shares.

Mr Market can’t be fathomed easily. IQ made huge losses, share price up 18%!!! So confused that I played it safe, sell 3000 IQs, holding 300 ![]() Just in case next week the opposite happen, BIDU up big, IQ down big. Market can do anything

Just in case next week the opposite happen, BIDU up big, IQ down big. Market can do anything ![]() Take profit or missing some profit is better than losing profit.

Take profit or missing some profit is better than losing profit.

Alibaba: This Could Become Painful

Two horse race, Jack Ma vs Pony Ma.

The nod here has to go to iQiyi.

iQiyi Bulls Are In Charge, And There Is More Upside Potential

If I am long IQ stock then I stay in it. But this being a momentum stock, it never leaves easy entry points for new investors. Those who want to be long it for the long term they don’t need to nail the perfect entry point.

Sold ![]()

Since the December bottom, IQ has rallied 90%, so clearly it would be reckless to just buy it.

![]()

Above $31.10 and $32.50 per share, IQ will invite more momentum buyers, so those could be entry points for a fast traders. But those are probably also exit point for those already long the stock from much lower prices. As it approaches $34 per share the resistance will be much stronger and at $38 the rally will be really long in the tooth.

Momentum trader @manch

So on the way down, I would look for $22 per share area to be strong support. If I sell a naked put to generate income I would hide at or below it.

Thanks ![]()

Jim Cramer: People want me to recommend every Chinese stock. No, I won’t. I will only recommend Alibaba (BABA) – although on pullbacks I like Baidu (BIDU) , and now, perhaps Nio (NIO)…

From charts, probably should wait. BABA looks like want to pullback, and BIDU might establish a new low.

Cramer is onto Nio? Wow. This guy is a fast learner.

Given that Washington and Beijing Are Near Deal That Could End Most U.S. Tariffs on China, timely to start a China index  comprises 5 stocks: IQ BIDU BABA TCEHY HUYA. As of Mar 1 Friday close,

comprises 5 stocks: IQ BIDU BABA TCEHY HUYA. As of Mar 1 Friday close,

iBATH 0% Baseline

China portfolio -6.26%, big losses in BIDU and HUYA

Why Bidu dived so low is still a mystery to me. Makes the least sense.

Because of this,

Baidu was placing low-quality pieces from its Baijiahao service, which selects articles from both legacy and independent media outlets for display on Baidu’s own webpages, and other Baidu properties toward the top of its search results, journalist Fang Kecheng wrote in an article on Tuesday.

“Baidu no longer plans on being a good search engine. It only wants to be a marketing platform, and hopes to turn users searching for content into traffic for itself,” he wrote.

Ok we’ll see about that.

Baidu’s Slow Growth May Be Reflecting China’s Slowing Economy

The company said it expects to see the slowest growth in seven quarters during this quarter, as a slowdown in the Chinese economy and tighter regulations at home are hurting its ad growth.

However, a fool thinks is a buying opportunity,

A cheap play in China’s big tech trends

Baidu reported fourth-quarter earnings in conjunction with its streaming video spinoff iQiyi (NASDAQ: IQ) after market close on Feb. 21. I purchased more shares in the Chinese search giant after the stock sold off post-earnings and plan to continue adding to my position at current price levels. While Baidu’s net income fell 22% year over year in the fourth quarter because the company has to absorb losses from iQiyi, the divergent paths the two stocks took after earnings has made the parent company’s shares even more attractive.

While Baidu stock has sunk roughly 6% post-earnings, iQiyi stock has rallied 20%. An investment in Baidu is also an investment in iQiyi, and this means that it’s possible to build a position in the streaming video company indirectly at a price that’s cheaper than before the earnings and guidance the spurred iQiyi’s big gains. Such a move might not make sense if Baidu’s core growth engines were in trouble, but that doesn’t appear to be the case, and the stock is off more than 40% from the high it hit last summer.

Not counting businesses that it’s divesting from, Baidu’s core segment grew sales 20% year over year. Its overall business with iQiyi factored in grew 28% annually. The company retains a roughly 60% stake in the streaming video offshoot, and it looks like Baidu is getting punished for its spinoff’s operating losses but not fully feeling the benefits of the unit’s impressive sales growth.

Baidu is consistently profitable, and its stock trades at roughly 18 times this year’s expected earnings. That valuation looks cheap in historical context, and it presents a worthwhile buying opportunity for a company that’s at the forefront of trends like digital advertising growth, artificial intelligence, and the rise of streaming media distribution.

Baidu sucks.

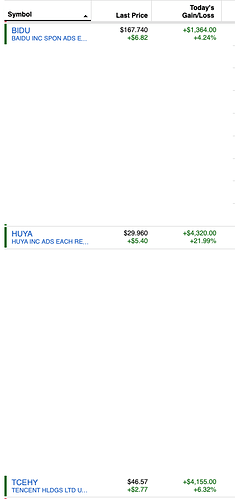

BIDU and HUYA continues to embarrass me, tarnishing my otherwise green record. Today wasn’t that bad because of TCEHY which I have a lot ![]()

Don’t worry about being embarrassed. People are lemmings and know very little.

Naked dancing time again?

You didn’t buy when I hint to you to buy Sunday 2 days ago? HUYA is up over 20%, with your 1 for 5 portfolio margin, you could have made 100% in just 1 day assuming you bought on Monday yesterday. Stop wasting time flipping houses or admiring other people’s houses. Get to work.

Too much anxiety … time to relax.

Daily fluctuations mean nothing

“BIDU and HUYA continues to embarrass me, tarnishing my otherwise green record. Today wasn’t that bad because of TCEHY”

Yearly fluctuations should also mean little.

That is for you alone, long holder of stocks ![]()

Yes