That was a multi year bottom. Big big bottom.

No foreign stocks except STNE and TEVA ( Warren buffet ones) . Since STNE dropped 10% by follow on sale, I am more with STNE. The fundamentals, profit margin, growth are good and also certified stake from WB. The percentage gain in STNE will be better than BIDU. Let us wait and see.Current down is your chance to bottom fish STNE !

This is like square or PayPal of Brazil ![]()

BIDU sucks. Their map led me to this alley in the middle of nowhere a few years ago in mainland.

That’s because you haven’t invested early enough. You should have bought some back in 2011, like those homes in Sunnyvale which you could’ve gotten for $500k back then.

That’s Screamer-in-Chief’s investment style. He doesn’t get into stocks unless they have been well proven but the upside is already largely reduced, so in a way he is a bit risk averse.

I think my RE investment from 2011 on has worked out very well for me. Coulda woulda shoulda.

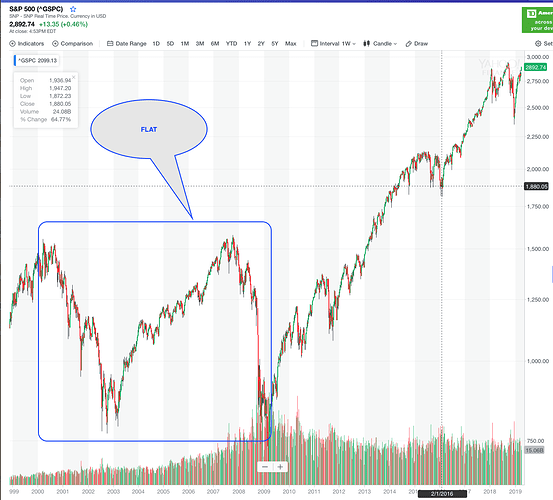

Your chart looks better than mine? Showing the same chart that I have posted twice! It shows a f… text-book FLAT pattern!!! Allow me to show a typical flat pattern that I have shown you at least 2 times! Flat of S&P…

BIDU sucks only if it didn’t learn and led you to the same place if you visited today. Wtf. How come you and @manch presume people don’t learn? I can understand @manch, he didn’t seem to learn… show him a flat EW pattern a few times still can’t recognize one. He needs to be trained “more” times like AI.

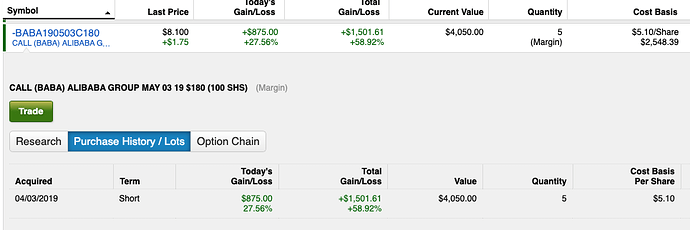

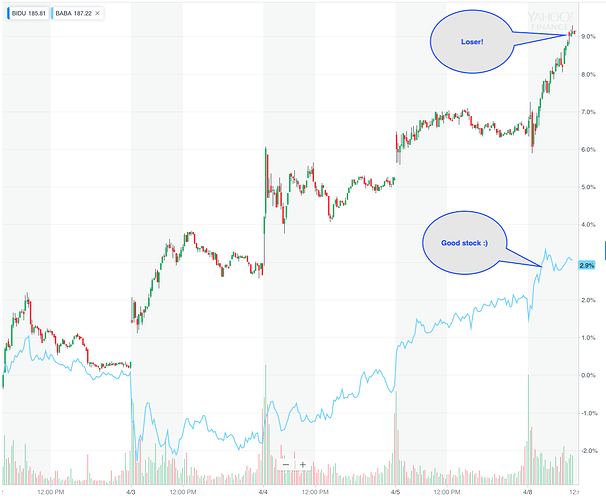

So damn easy to make money trading BABA calls ![]() 2 days made 59%!

2 days made 59%!

@manch, since Mar 1 till now, gain of option trading portfolio is 30%. If your portfolio margin is not doing as well, you may want to switch to option trading ![]() Low risk high return

Low risk high return ![]()

One month in and want to extrapolate to indefinite future? If it’s so easy why not go all in? Imagine how much you’ll make if you 100x your option portfolio.

Assume, market is unpredictable, Going all in is greedy and risky to lose as we do not know what the market will do.

IMO, hanera is always cautious, measured to gain with minimum risk.

The safety of our initial money is important (Margin of safety) than taking a greedy risk. I mainly stay away from options by its higher risk (and my novice knowledge).

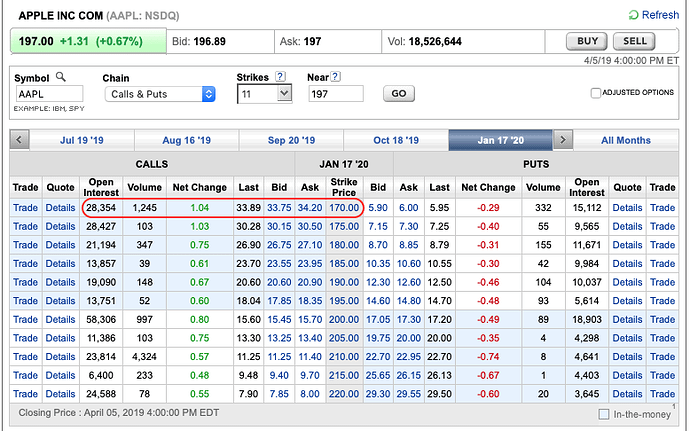

Can’t remember whether I have explained to you why options is actually safer than shares. Allow me to illustrate using AAPL (not saying is good to buy at this price),

Say, you want to buy 1000 shares at $197, total capital outlay of $197,000. You can achieve the same delta (same gain/loss profile as underlying) with say, call(Jan 17, 20 $170), current delta 0.72, by BTO 14 calls(Jan 17, 20 $170) for $34.20, total capital outlay of $47,880. So less capital outlay of $197k-$47.88k = $149,120. What you do with this $149,120 determines the perception of risk.

Keep $149,120 as cash, long calls is less risky than long underlying since max loss is $47.880 whereas max loss of shares is $197k. Experienced option traders’ thinking.

Plough $149,120 to buy even more calls then long calls is more risky because you can lose all $197k should AAPL trades below $170 on expiry. Most people think and do this, so they think is option is more risky. Amateur/ novice traders’ thinking.

Options has time-decay and when times like Sep-2018 to Dec-2018, I would have been disturbed by high volatility.

Supposing I buy some options AAPL $220 strike price Jan 17, 2020, if AAPL price drops to $170 (It can happen as we are just 40 points just shy of Sep 24, 2018 peak) in 30 days, I will be disturbed for sure.

If it is stocks, I used to buy more at $170 (May not be buying options) to hold forever. I need to time the market for options play or time the stock (say at $145 AAPL price).

Options has time-decay and when times like Sep-2018 to Dec-2018, I would have been disturbed by high volatility.

Supposing I buy some options AAPL $220 strike price Jan 17, 2020, if AAPL price drops to $170 (It can happen as we are just 40 points just shy of Sep 24, 2018 peak ) in 30 days, I will be disturbed for sure.

Volatility increases mean calls become more expensive. That is to say, while underlying lost $50, calls dropped less for same initial delta.

If it is stocks, I used to buy more at $170 (May not be buying options) to hold forever. I need to time the market for options play or time the stock (say at $145 AAPL price).

When stocks become suddenly volatile which causes IV to be higher than normal, has to wait for stocks to settle down to long calls or has to long vertical call spread to mitigate the high IV. There are option strategy to exploit high IV which should return to normal eventually yet neutral to delta ![]()

So far you don’t seem to hold stocks longer than a quarter ![]() Btw, with rolling, I am taking money off the table with each roll while for underlying you are still as invested as initially. Hence, built in protection against sudden sharp drop. Bear in mind, each roll would add to the $149k cash.

Btw, with rolling, I am taking money off the table with each roll while for underlying you are still as invested as initially. Hence, built in protection against sudden sharp drop. Bear in mind, each roll would add to the $149k cash.

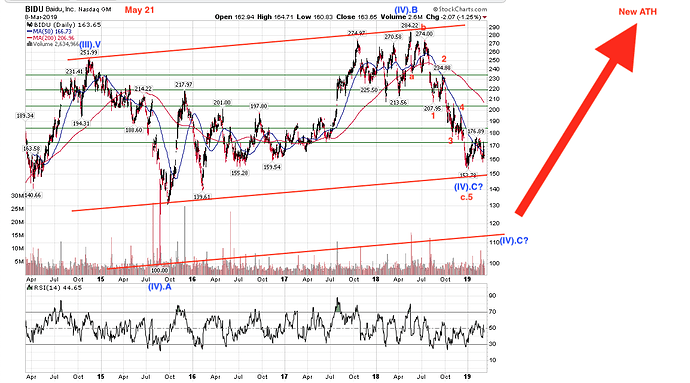

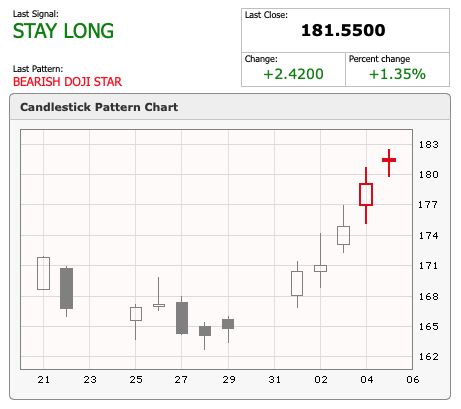

If BIDU can’t break above the upper channel next week, the other (IV).C would be likely i.e. BIDU could decline to $120. Next week, Mr Market would tell us which (IV).C is correct.

Bearish doji star ![]()

$120??? No. Will rise for sure.

Consider these five China investments as trade talks progress

Buy CHL IQ HUYA TCEHY MSCI

Owned IQ HUYA TCEHY ![]()

Will Autonomous Cars Make Baidu Stock Self-Driving?

With talks of the trade war ending, it has already begun to move up this year. The real test comes when it approaches the $265 per share range. Will it break through and spark a bull market in Baidu stock, or will the range-bound trading continue?

Hmm… load up BIDU and hold till $250-$270 ![]()

BIDU is rocketing from @manch

BIDU is almost same price as BABA ![]()

Your only target is $250? My target is $500.

Your only target is $250? My target is $500.

Quoting the article. Your $500 is a multi-year target, need to verify. $250 should be hit by year-end. Is a completion of a multi-year regular flat, 100% would hit $250, as to new ATH, I didn’t bother to compute because too busy messing with other shares, need to do a proper analysis and compute, haven’t really did much analysis. In rare occasion, flat does result in a truncated fifth wave… so need to think…