The ultimate would be charging on the roadways. Wired pavement and wireless charging. Could change the industry

The technology came four or five years before appx 2017 period

Is this a sick joke by Mr Market? After I sold BIDU at a great loss, it shot to the moon and Cathie invested $185M in BIDU!

Have you changed your religion from JC to Cathie?

hello electric cars at $1 per kwh. As China and Europe diversify. The remainging buyers in Asia dont realize how important volume buyers in China and Europe are for them to get lower prices.

it is not just direct energy prices but the cost of shippments just like cost of shipping container.

Only foreign companies? Cathie is betting BIG on China! Ex-Trump Admin and anti-China media give you the untrue impression that every foreign companies are running away from China.

Top 11 - TCEHY

Top 12 - BIDU

…

Many more China stocks, you can look through this All 141 Combined Ark Invest ETF Holdings

Good thread on Alibaba. It’s not as rosy as I thought.

excellent thread, thanks for posting

https://finance.yahoo.com/news/china-opens-door-ant-groups-034047410.html

But the government has been grappling with new technologies and their possible implications for the stability of China’s financial system, and reforming the sector is a long-standing policy goal.

Is the obvious reason for halting the Ant IPO yet pundits cooked up conspiracy theories. The right question to ask is what prompt the reforming and what are the concerns about the stability of China’s financial system. The answer is…

Mr Yi described the decision to stop the listing of Ant Group as a “complicated issue”.

Financial technology companies have opened up China’s financial system, and have given more options to smaller borrowers, but the changes have created some possible risks, Mr Yi said.

“That benefit is obvious, but at the same time we can see also some risks to consumer information and protection and also some monopoly potential and also some misuse of the monopoly power,” he added.

Implications of those risks? ![]()

This essay fleshes out the twitter thread I linked to earlier:

This paragraph struck a note for me:

I think the idea of switching costs doesn’t hold as much for Chinese consumers. They are, on average, incredibly adaptable. They are a group who experienced 200 years worth of industrialisation in a few decades. They know it’s an existential risk not to adapt.

It’s hard to find nuanced writings on China in English. It usually falls on either extreme. Either China is poised to overtake the West in 10 years and leapfrog us, or China will collapse under its debt burden and lack of political or speech freedom. As usual, things are more muddled and nuanced. Li’s writing is refreshing as she paints a more 3D realistic view of China.

So are you saying ANT issue is not political? Is China wanting to rein-in spendthrift habits of youth and is not directed at business in general and Jack in particular. And calling out by Jack is not political, is aimed at growing BABA business. And you agree with Li’s

I think Alibaba has created an incredible data moat with its ecosystem for the record, and I don’t think a fall will be swift. But I see it more as a value investment with a robust financial profile than a growth stock.

In other words, BABA is a value trap. Avoid. Right?

The Ant issue is not entirely political. Maybe regulators have always tried to rein in Jack Ma but he has backing of some powerful people. His infamous speech crossed the emperor and regulators now have the royal sword to cut his head off.

CCP is made up of over 90m members. It’s not monolithic. People have different agendas.

Li’s essay highlights the competition Alibaba is facing in China. Ant is an important piece of its growth. I wouldn’t call it a value trap. Chinese businesses lag behind American in their cloud migration, but I think it’s a matter of when, not if. Baba is still the lead player in Chinese cloud infrastructure. I don’t think Xi will allow American firms control China’s cloud infra.

Panasonic out of Solar panel production. If Japan de-industrilization continue. It will make Tesla alone to fight EU.

Japan’s Panasonic to end solar panel production - domestic media | Nasdaq

Does the EU manufacture anything anymore?

Except overpriced unreliable German cars that are now obsolete thanks to Tesla? To me the only reason to buy a luxury German care is as a status symbol. Tesla stole that from them. They are like the Emperor with no clothes.

do you think this world can run without EU engineering?.

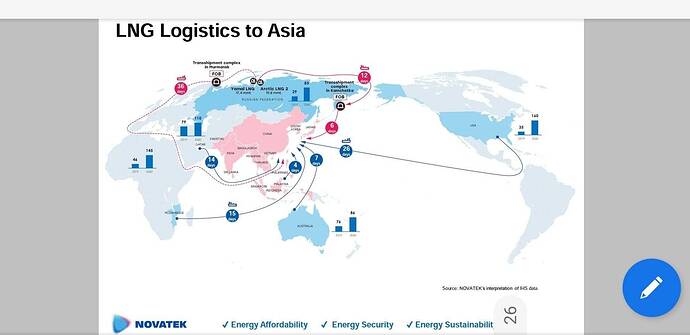

There is EU engineering behind where LNG is stored near most expensive markets and no need for long routes through Panama Canal.

South Korea most innovative in index but 7 out of 10 are Europeans.

Korea always have this backend deals that make them innovate faster than the rest. Korean knew ahead of time.

https://pulsenews.co.kr/view.php?year=2020&no=1260625

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(21)00191-4/fulltext

Korean is a big cheater. Samsung stole many ideas from AAPL using mentioned technique.

You have to look at the context why South Korea is in driving seat.

Europe is going towards Android/Linux type software systems.

Samsung is putting separate event for its own chip version of phones for EU and other international countries.

Samsung to hold a dedicated event for Galaxy S21's Exynos 2100 chipset on January 12 - GSMArena.com news.

French dont like Japanese. They have that Renault-Nissan dust up. Corporate Japan not understand that France in cooperation with Russia and Germany can basically wipe out all Japanese firms from Europe/Africa/Middleast/Latin America. Not even French speaking Canadians will help them.