Indeed, if Texas expats who arrived in California since 2000 had their own city it would be close to the size of San Jose — about a million people. But the Texodus to California bears a sharp distinction: While Californians headed east are drawn in by the promise of affordable suburban tract homes, many of the Texans bound in the other direction are recent college graduates seeking a fresh start to their young careers and lives. California continually attracts talents — and drains brains — from Texas.

Good story. The root cause of the problem is really that the government officials are simply ok with the crazy price tag. That is the problem.

Seems like we need to be contracting with our Bay Area governments. Sure the paperwork sucks but the rates are clearly insane.

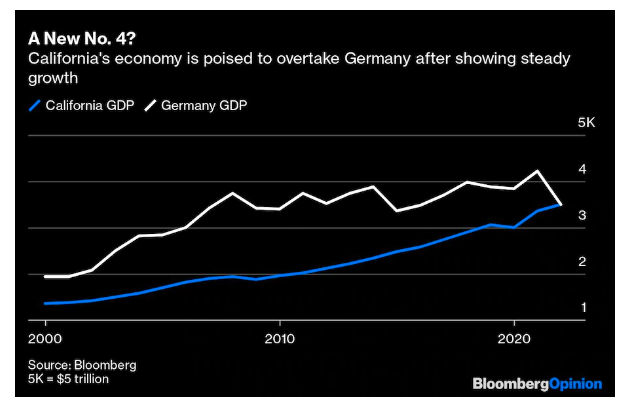

Mainly because Germany is tanking.

Think Homeowners Will Stay Put? Austin Suggests Otherwise

The “lock-in effect” is supposed to forestall a drop in US housing prices. The Texas capital shows it’s not so ironclad.

I wonder if it’s mostly landlords selling to lock in gains. Overall, I see a lot of vacant homes listed. It’d make sense to get rid of the tenants before selling.

“lock-in effect” article is written by an amateur?

Make an assertion that some1 said that and then argue is not true.

I wonder who made that assertion.

Btw, the lock-in effect refers mostly to mom-n-pop homeowners (who has the intention to move-up). May not work for other profiles. The article intentionally mislead readers to interpret the increase in inventory is due to the profile that have “lock-in” only.

There are many new construction in Austin. So list of inventory = new construction + existing homes.

Author didn’t give breakdowns, what are increasing. Builders of new construction are not subjected to lock-in effect.

…

many more issues… enough said.

Austin Builders Couldn’t Finish Homes Fast Enough. Now Their Product Is Piling Up.

The pandemic-induced buying frenzy has cooled significantly, leaving new luxury homes to linger on the market

I think it was under 20% in the 80’s. Yet all people do is bitch about how the rich aren’t paying their fair share. I struggle with how 40% of households have a fair share of zero.

They don’t pay because they don’t meet the income threshold. Don’t know how it can be compared with rich who manipulate the system to avoid tax.

40% is a TON of people. They don’t meet it because of all the deductions and credits. You’re telling me 40% of Americans are so poor that they can’t afford to pay any income taxes? A median US income is top 1% in the world. Our median household pays a 3% effective rate. Meanwhile, people are demanding Scandinavian style programs where the median household pays 25%. It’s such an irrational conversation. It’s the equivalent of saying I want to pay for a bicycle and get a Tesla.

I think WE can ALL agree the tax system is too complicated.

It’s too hard for most folks to understand. The complicated system also makes it easier for super rich folks to exploit.

Edit: I guess we don’t all agree. Oh well.