Where are you buying? I am definitely bullish on research triangle area of NC from tech standpoint same as Austin.

I own an sfh in Durham, 8 miles from the Apple office.

Just read an old article saying Colorado Springs is super hot. Anybody looked into that market?

Sure . My best one was 100K PP and 20K Rehab and then it got rented for 1200. It’s in Lincolnton , NC

Charlotte , I sold a condo for 230K last year and exchanged the proceeds to a SFH for 230K. This year this SFH Aporoaser for 318K and thus I was able to refinance my entire money out . Rents for 1800 and PITI of $1400 ( I have no money in it )

Another good one was 200K PP last year one acre lot 1800 Sq feet house and I had to put 10-15K and it got rented for 1900. This one was in Gastonia, NC

I got inspired and bought one from market in Gastonia in 2021 for 182K and rented for 1600/pm

I bought two brand new homes for 358K each in Belmont, NC from Meritage homes which I rented for 2300 each .

Basically very happy with the out of state purchases so far

Very good results. How did you do all those improvements and renovation if you are not on the ground there? Out of states deals generally limited by having a good team there. Let me know if any of you have good PM / realtor you can recommend for NC Charlotte area.

Any build quality problem with meritage? There’s a Fb grp swaying ppl not to buy from them. I bought from meritage though.

If you don’t mind what is the sq footage of these meritage homes? And what lot sizes are these on?

If you pm me . I would loop you in and would love to exchange notes about your austin rental also.

I don’t understand the appeal of managing rentals 3000 miles away. Management fees are 5-10% off the the top.

Does the $2300 include water sewer garbage and gardening.

Property tax goes up most places and can eat you alive in a high appreciation area.

Assuming property tax is 4%, which scenario is better?

- $50k annual appreciation hence annual incremental property tax increase of $2k.

- $10k annual appreciation hence annual incremental property tax increase of $400.

- $0 annual appreciation hence no annual increment in property tax.

I prefer 1.

@Elt1 2300 is only for rent and all utilities are paid by renter .

This is for a 358K brand new house and I picked 2 of these last year

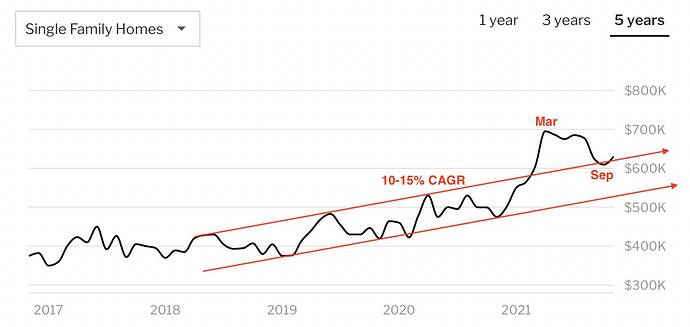

Typical price chart of a SFH in NW Austin & N suburbs…

It has been declining from Mar-Apr to Sep-Oct, the digestion of the extremely fast rally from late 2020 may be over.

Here is a contrarian opinion. Personally Tilson is a total fraud. But he may have some points.

He didn’t say anything in the article.

Note: I didn’t click on the links in the article. If he is referring to WFH tech, then don’t bother about it. We know.

It is click bait. Mainly touting meta verse. About a year too late.

I didn’t dig deep enough to see his RE theory. But stock touts always bash RE. They guy is a complete con artist.

Hello,

once you found the properties that you like, this tool will help you decide which one is the best for you: www.compareprop.com

Skiing ![]()