Seriously? Which data points? If you’re convinced he’s right, why aren’t you shorting open door and other walk street home buyers? That one video was pretty easy to debunk as garbage with actual data.

Man you are really full of shit. Learn to give credit where its due. RE tech companies stock did CRASH and he called that out right. I wish I had shorted.

Zillow, Redfin, Opendoor, Compass, etc. all dropped 80-90+% from their pandemic highs. One could have made millions shorting them. They have fallen so much already that I am not willing to short them at this moment but there is good chance they will fall more and some will go out of business.

When did he call that? The video posted here was dated August 5th, 2022. He’s saying they are going to crash going forward.

He predicted RE tech stock crash almost a year ago. And it did crash almost 90%.

There is a good chance RE will follow them, of course not 90% but even 40-50% will destroy many owners, investors and landlords life savings.

You realize housing never crashed, right? The issue is iBuying not RE. Invitation homes actually hit new highs after his video. Right now, it’s down <10%. The iBuying was always a suspect business, since it’s capital intensive with low margins.

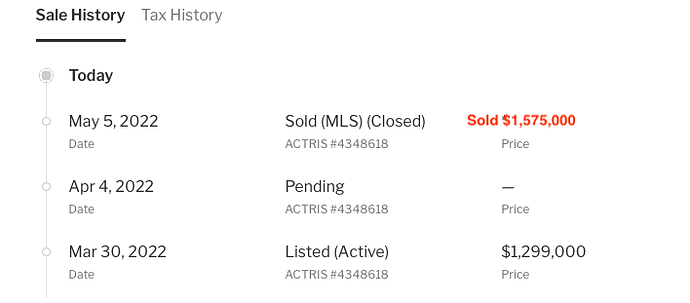

A house closed on May 5 for $1.575M.

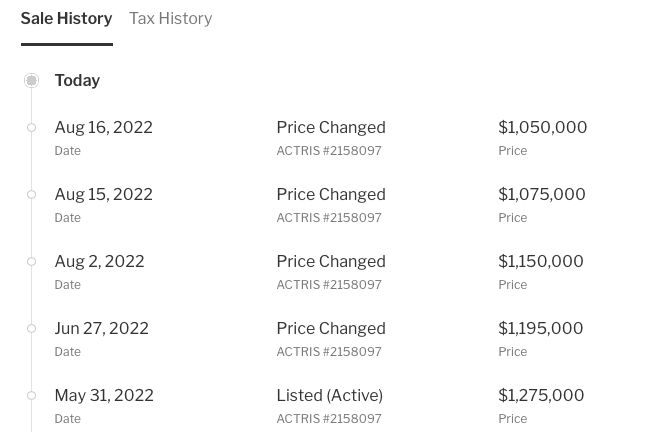

A similar house listed on May 31 for $1.275M, still can’t sell, now asking $1.05M (18% drop).

The latter misses the peak and have to drop asking price by more than 1/3 from the last peak. Peak is only 4 months ago.

A video to educate @manch ![]() I am not going to insinuate that you’re not in the top 20%… I think you’re in the top 20%

I am not going to insinuate that you’re not in the top 20%… I think you’re in the top 20% ![]()

Market is shifting fast, video posted 9 days ago, some points feel outdated (or just difference in opinions).

RE is local so I like to monitor by neighborhood/ community, not by zip code, not by city.

I notice some listings are asking 20% less than the peak in Apr-Jun and still no takers after 3 weeks. Is market expecting 30-50% decline or just want to wait till Q1? Thinking aloud: Should I lowball now or wait till Q1?

Buyers evaporate?

If you have capital to buy one home then wait.

If capital to buy 4, start lowballing for the 1st one.

My 2 cents.

Two kinds of buyers out there. Vultures like me are always looking. First time buyers are taking a pause.

But you’re not buying

![]()

I’m always buying if I spot a deal.

When was the last one?

What’s considered a deal?

Enlightened us.

Last I bought in second half of 2020. All were fixer upper and Got great deal (2017 prices). After doing extensive renovations, I’m sitting at almost 80% appreciation now and cool cash flow. And 2.5% mortgage.

Great timing. ![]()

Old story ![]()

Yesterday saw a house that just listed, price looks like a good deal, went to the open house, thought of bidding after Labor Day. Well, seller is reviewing an offer. Good deal go fast.

Another listed at 18% below ATH and today is the 11th day, also thought of bidding after Labor Day. Under contract now. Good deal go fast.

Look like I’ve been too greedy.

You can’t bid 40% below asking price and win bids? Weird.

![Why Everyone is STILL Moving to Texas | What You Need to Know [2022]](https://img.youtube.com/vi/SUCwP1KuRrY/maxresdefault.jpg)