we have moved up for our primary resident and kept our first property and rent it out. As current tenant’s lease is ending, we are wondering if we should sell property and take the profit and invest in Index. We are still in 3 year period where we can claim 500K tax free.

Current Mortgage + Property tax + Insurance = $3200

Rent = $3900

With monthly $250 expense budget Yearly cashflow is around $5000/ year

Current Equity in home - $800K. (bought for 700K worth 1.35M)

Owes 400K @ 3.5%

Reason to keep it rented

- Bay area home appreciation

- Lower interest rate - 3.5 with $400K left on mortgage

- Expected job growth in San Jose downtown in next 7-8 year is 30 - 40K Tech jobs. Double the current office space.

- Lower property tax - Prop 13

- Allow us to downsize if we need to in future and live in desirable neighborhood for $3200 in Bay area.

- Market seems soft for seller. Houses are staying longer on market

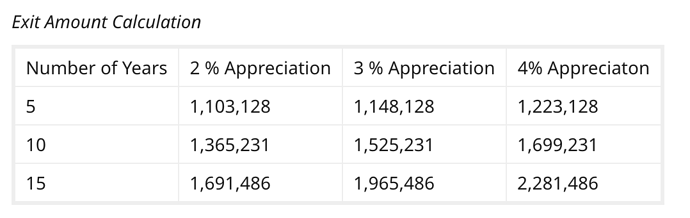

Exit Amount Calculation

Exit price = Total Price + Cashflow - Mortgage owed - Expenses

5 Year expense = $250/Month + $10K

10 Year expense = $250/Month + $20K

15 Year expense = $250/Month + $35K

Reason To Sell:

- Major equity/NW invested in same kind of Asset and in Same Market

- Higher mortgage on 2nd home. Offset some of that by putting more money in it. Thinking putting $200K to reduce monthly payments

- @ 3 % appreciation home price in 10 years will be $1.8M. Fear that Bay area Salary will keep up with that to support medium size home. Affordability will reduce demand.

- Take 500K tax free

- Not leveraging higher equity in home.

- Take the nice run in home appreciation and tax benefit.

Compound investment return of $780K ( Proceed after taxes and realtor fees)

| Year of investment | 4% | 5% | 6% |

|---|---|---|---|

| 5 | 970,146 | 1,016,882 | 1,065,395 |

| 10 | 1,180,331 | 1,297,828 | 1,425,738 |

| 15 | 1,440,755 | 1,663,143 | 1,917,247 |

Planning to invest $780K over 2 years in 70% VTI + 20% VXUS + 10% BND. If Market goes down in next year, it will allow me to DCA. Also looking to explore some Syndication deals where I can invest 50K for 15% IRR.

Based on the calculation both the investment may return similar results. In 10 Year horizon.

?? Am I missing anything in my calculation.

?? How would you calculate numbers for similar comparison.

?? Would you recommend keeping Real-estate over taking profit and re-invest

Other Information - 2M in Equity between Taxable & Retirement

Goal To retire / FIRE by 2028 @ Age of 50