Am I starting a NC sub-group???

Supposed to be a great crab season. Pros start in two weeks so sport fishing will be great till then

Maybe

If prop 10 passes some landlords will get out of rental business. So less rentals and hence higher rents.

Agree. 6 months is for other markets.

No way.

I plan to sell stocks but not RE.

Counter-intuitive. Don’t landlord needs to up rent to compensate for the higher cost of servicing the mortgage loan? Notwithstanding, is a fixed interest 30 years loan but new comers need that yield to buy, unless the price drops that much.

Too many apartments were built in the last few years. You can push your city to build more condos, not too many rental apartments.

You can use this argument:

- condos can sell for more money thus more property tax.

- Condo can be resold more frequently thus higher property tax.

- Condo owners are easier to manage than renters, city can save money on police cost.

- Condo owners have higher income than renters thus good for the image of the city.

- More condos means no rent control thus city would enjoy a better citizen relationship and less hostile conflicts.

Exceptional mean?

Moving to Austin ![]()

Cause and effect. Didn’t you learn demand and supply in econ 101?

Prop 10 passes, Less rentals, rents go up, more rentals, rents go down.

When stable, the magnitude depends…

Good but not for non-white or non-black. Certain neighborhood is good for Koreans.

I heard that NC is a good place with low crime and good people. But how is the historical appreciation? Is it too easy to build a house there with abundant buildable land?

They have no restrictions on land. I read that Dallas metro area is 100x100 miles. Now, even if you include the mountains and the water in the bay, we will be much less than that.

Come back when you are ready again. ![]()

I don’t buy a stock after it’s gone way up and I missed the big run… same with RE. The future appreciation may be better elsewhere, unless you think the average house in the peninsula will be worth 5 million in 20 years.

Just because there is plenty of land to build on, people will pay extra for quality neighborhoods, schools, commutes, no matter what. The land to build on is not in the desirable areas, those are already built up (Houston’s Medical Center/West University area are great examples). They are basically their own “limited land” islands.

We are in an everything bubble right now. Everything is expensive - stocks, real estate, art, cars, etc. A decade of near zero interest rates have caused the entire world to misprice risk in search of yield… the biggest being the mispriced risk in the corporate bond market right now.

Once the corporate bond bubble bursts, the trick will be to hang on to whatever asset class you think will decline the least. The “slow and steady” approach to wealth is to “lose less than everyone else when times are bad” and let solid gains and compounding work for you.

![]()

Which one?

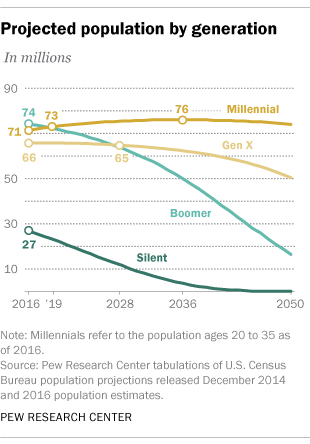

I wish I was clairvoyant. I will make this observation though - assets that will decline the least are assets that will continue to be in demand. In the USA, Gen X are currently in their prime earning years (and can afford the most house). Gen Y will hit their prime earning years in the not distant future, and their numbers exceed Gen X by a considerable number.