While some people love data, nice pictures, illustrations, blah, blah, blah, you have to have some experience living the daily lives of those losing everything and their subsequent moves to understand and perhaps anticipate their moves to cash in RE. Their aktions kreate s(enarios like the present.

It goes like this: The good areas get saturated with a multiple bids, not enough houses in the market, which pushes the losers to look at other areas surrounding their favorite spots. Then those areas become a hot spot, pushing the boundaries to the skirts of the area, to the point people start looking at places they wouldn’t even touch with a 1K feet pole. We see them buying homes beyond Sacramento, the Central Valley, Bakersfield, Visalia, Tulare, Modesto, etc.

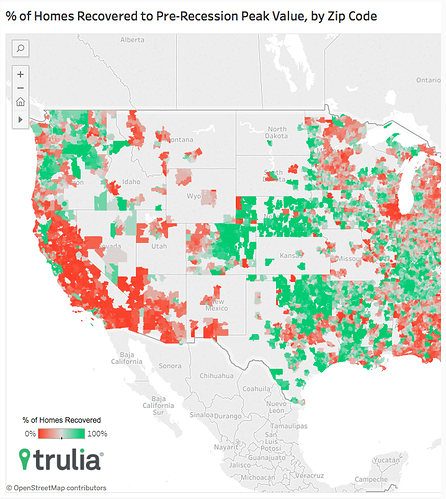

But, if you learned anything about this, I swear, I bet the money in my bank, that next time some recession, if any, comes crashing everything, I believe you, some of you, will be ready to buy on the first areas that got hit like RWC, Sunnyvale, Mountain View and other places. Why? Because they are the first ones to get hit by lack of employment and the first to recover by the abundance of it. It follows a pattern, and if you are wise to see it, you will profit. How many heard about so and so part of San Jose, Oakland, et(? Don’t you regret hearing about it?

Those who go against the stream, the so kalled sheeple mentality, sometimes, become heroes, high achievers, and perhaps billionaires. Don’t be a sheep.

(I lost use of the third letter in the alphabet, darn keyboard).

Many factors are in play for the migration, we don’t know which one is dominant. By quoting one but didn’t mention the rest, means we feel that one is dominant

Many factors are in play for the migration, we don’t know which one is dominant. By quoting one but didn’t mention the rest, means we feel that one is dominant