Senseamp was 100% wrong.

http://www.cnbc.com/2016/07/08/this-will-be-the-best-summer-for-the-housing-market-in-a-decade-commentary.html

There is a difference between News and Senseamp.

Almost all news media tell the facts after the fact or create sensational news with vague 50%:50% chances, confusing readers.

Senseamp predicts unrealistically to suite his desire (more 20% down).

He was wrong when FED Stopped rate hike. Otherwise, he would have been right.

In addition, there is no rate hike in near future (100% likely until Feb 2017).

If I guess right, 2016 there is not rate hike, 2017 possible. The real estate picked up after sagging few months, between Feb and Jun with one rate alone. It may be a possibility that FED may hike once a year that can make sure economy is not going down.

Since everything is on prediction, it can easily go wrong as no one knows about the future.

All the bears were wrong…Some vehemently attacked me…I don’t forget. …media, TomP, Mike, Lexa, Crazyman were a bunch of jerks…at least Media bought a house inspite of his stupid predictions. …maybe he sold and moved back to Maryland…not!!!

And Trump says Obama wrecked the Economy & we should “Make America great” AGAIN

Can’t even call Trump a joker because his sense of humor is terrible.

Having said that CNBC is a shill where they need to create news to fill the hours. They report all kinds of forecasts. When the forecasts hit their mark they tom-tom about it and when the forecasts don’t work, they don’t talk about it.

As a home owner, I hope it’s a great summer in Bay Area.

OK I’m going to hold you to this prediction ![]()

Yes, I agree. There is a logical reasoning behind it.

We have four FOMC mtg before Feb 2017.

- With wide range of countries fall into recessions/corrections, esp oil related, FED will unlikely raise the rate.

- Before elections, no one (FEDs) wants to disturb economy and get into Senate/House Committee review next year start.

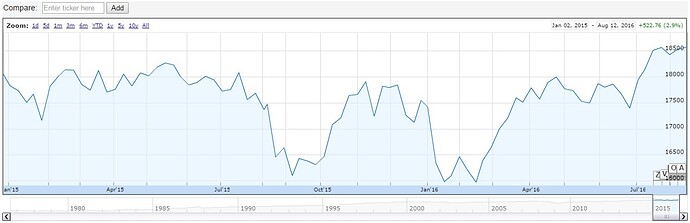

- Almost all known countries are facing economic issues/crisis. It can easily come to USA any time. See DOW/S&P is almost flat since Jan 2015.

My chances are high on this prediction !!

Many people made the case first half of this year, that because the stock market was dropping, so local high end RE market was softening? But now all 3 indices are at record high, including the tech heavy Nasdaq. Nobody has come out yet to make the opposite case that high end will boom again. Why not?

I still stick to my plan to NOT be bothered by short term price fluctuations. Just buy whenever I am ready. Cost average my buys. If one year I pay a little more, another year I will pay a little less. Not a problem as long term trend is still solidly pointing up.

One thing I learned from the article is that even developers are having trouble getting loans. Really? Did not know that before. I know it’s hard getting mortgages. Did not know the big guys are also having trouble.

I’m not saying your prediction is wrong. I’m saying that " I can’t be certain on the future 100%".

I’m not sure if Janet Yellen knows what she will do for sure by Feb 2017.

I actually think that the Fed will raise in December, after the election. If the current bull stretch continues and S&P hits 2500 everybody will be happy and nobody will mind.

The high end over $10m is soft, but who cares…Those few rich folks dont matter much to the rest of us…The rest of the market is still hot…I put $100k into Vegas Games…the promoter sayas it will sell for 100x…Then I will shop for a $10m house…more than likely I will use the loss as a write off…lol…100 to one shot…

Tell me what you think…Suppose d to be a billion dollar company? ???

Even above 2M itself, only few cares. Common look out is between 600k and 1.5M, mainly to take care 1.1M max tax deduction range.

Game companies are very hit driven. It’s a lot like movie studios. If they stop producing hits they die. Do you get a large slice of the company?

It’s odd since we are hitting 6 straight quarters of year-year profit declines. Yet the market pushes higher. At some point profits needs to increase, or we will have a wicked correction. The market is propped up by ZIRP driving people out of bonds. I agree with Jill that there won’t be another rate increase until 2017 at the earliest. We are limping along at ~2% GDP growth. The bull market has more legs. The hangover from this party will be insane though. Unless ZIRP is the new norm.

I clicked on poker and blackjack and neither of them would load on my computer. Do you have to live in Nevada to play?

This is the real issue what we have. FED officials clearly know these ! The impact of year 2008 downturn is not completed yet. Job market has come up, but income has not raised defeating the inflation.

Yellen has already pointed all these in her last Senate Committee review.

I still remember how market was during year 2000 and year 2007. Whenever FED raised rates during those times, all three markets used to swing up telling “Economy grew, Market already priced in rates”, keep on going up until last rate hike. This means people had surplus cash with borrowed money, they made quick profits. Savings was poor, spending was high. Whatever may be the rate, people started buying recklessly. Any item, any shop puts on sale, we will not get those items by 10 am as it was consumed before then.

This is not the case now. Any rate hike is associated with reduction in economy which was witnessed in the first rate hike.

2% growth is fine in a deflationary environment. …We are in a totally different era from the inflationary seventies when we had high growth and booms and busts…I think the internet keeps prices down. Consumers have knowledge and power over producers…Plus the global economy makes it hard to raise wages locally…Inflation is caused by rising wages…Wages have been stagnate for years except in tech…

I would rather have slow steady growth with no inflation than the boom bust economy of the past…

Not all tech are shining, many started falling since Aug 2015 onwards as a result of China economy and rate hike. This is the main reason stocks are flat since Jan 2015 (DOW Chart).

World economies are failing, China - three times down market, Japan and OIL countries including Venezuela, Brazil, Mexico, Canada.

Dollar is getting stronger as other world currencies are falling. This attracts foreign investors to move their money to US, for better ROI, Stock market and other markets such as real estate. Stocks going up ( & down) depending on company results, technology changes and lot of foreign investments towards USD.

But, the base economy is fragile except good job market. Until it changes to really crazy stage, FED can not the rates soon, very unlikely in 2016.

We could bump up our GDP easily…Of course it would mean putting all the regulators out of work. …

No kidding, this is the first time I heard someone used that term on real estate. In order for cost averaging to work, the same cadence for same dollars amount invested regardless of market condition is needed. If you still margining now (as you said you are using mortgage) on bull market, then how can that possible to add up on the bear market where all of equities and rental income would be decreasing… I have no problem on long term trend solidly up, just not sure how much (or little) the downward stress is needed to break the model…

Not that I don’t trust you, probably you do not mean what you said ![]()