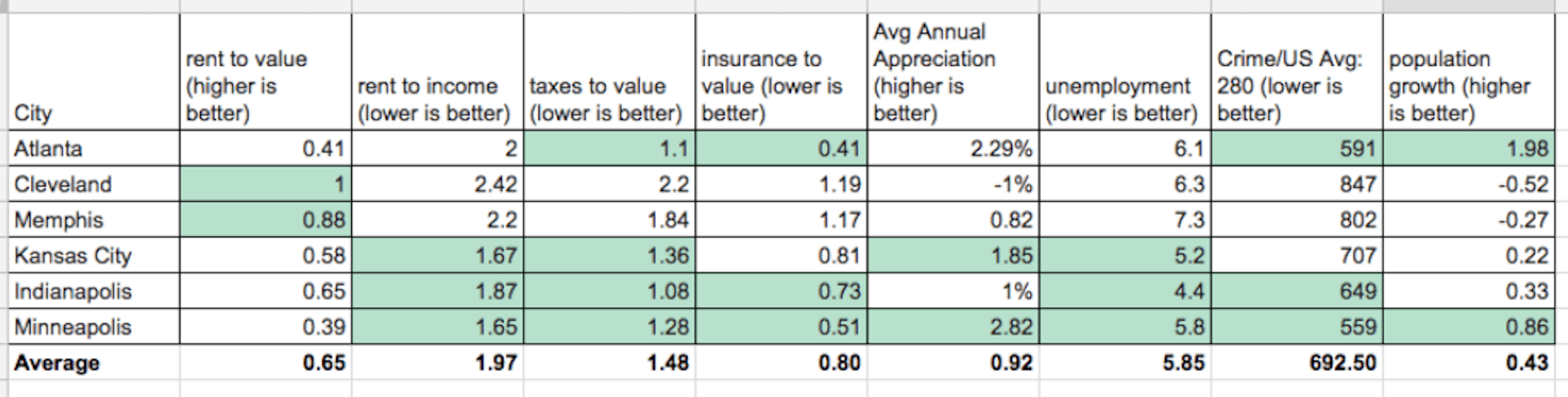

Assuming all metrics are equal, Minneapolis is the clear winner for this data set. It outperforms the other cities in 7 of the 8 metrics, and is followed by Indianapolis, which has strong scores for 5 of the 7 metrics. Two major losers here are Cleveland and Memphis, both of which have high crime stats, poor population growth, and fairly high taxes.

What’s interesting about this chart is the pattern we see in the rent to value column. This is calculated by dividing the median rent by the median house/condo value. So, for Minneapolis, you see that the cost of homes is moving up faster than the cost of rent. On the inverse side, you can command more rent in Cleveland and Memphis compared to the cost of the home. That said, we still think Minneapolis is a better value with less headaches when you look at all the other metrics present here.

1 Like

I will need to sell my houses in CA and 1031 elsewhere if Costa Hawkins were repealed…

Appreciation is almost nil…What makes these cities so great for investing? High crime, low growth, except Atlanta. BEST, not!!!..the big problem is depreciation…New homes are easy to build and old homes

In harsh climates are hard to maintain…This chart doesn’t even compare maintenance costs…Must have been created by Matthew Stewart…lol

1 Like