Robin Manthie and her husband have been looking for their first home in Minneapolis since last May. They thought this spring would bring a flood of inventory, making their search easier. But by most measures it is getting tougher.

The inventory of homes for sale in Minneapolis dropped by about 25% in February compared with a year earlier, while the median sale price rose by 7.6% to $223,000, according to the Minneapolis Area Association of Realtors. That’s on par with the national median home price of $228,400. The average number of days homes in the area are spending on the market is at a 10-year low of 81 days so far this year.

Ms. Manthie, a 33-year-old consultant, is 41 weeks pregnant, but she and her husband are still trudging to open houses most weekends in search of a four-bedroom home in the $700,000 range—up from $400,000 when they started.

“It’s shocking. The house [two doors down from] my mother-in-law went in three hours,” she said.

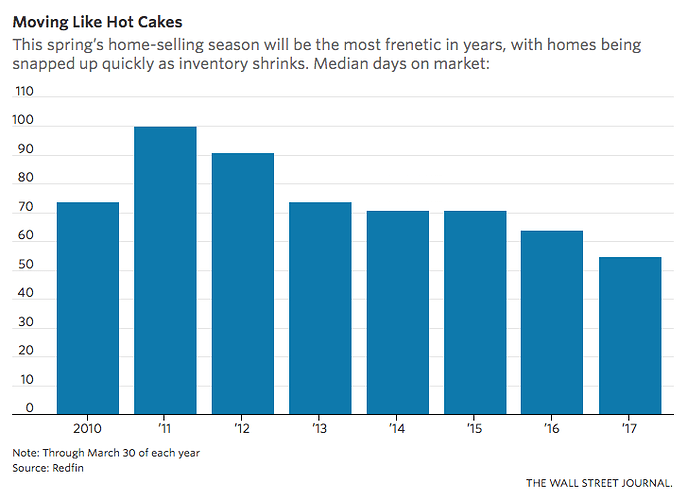

This year’s spring selling season promises to be the toughest for buyers in a decade, economists said, as rising prices and mortgage rates combine with inventory near 20-year lows.

“We think that 2017 will be the fastest market” since the peak of the last housing boom in 2006, said Nela Richardson, chief economist at Redfin. So far this year, homes are selling an average of eight days faster than last year.

It isn’t just hot spots like Seattle and Denver that are seeing scarce supplies of homes for sale but also sleepier locales like Minneapolis, Cleveland, Nashville, Tenn., Tampa, Fla., and Louisville, Ky.

These markets typically are enjoying strong job growth with young first-time buyers out looking for homes, but also declining inventories, according to Svenja Gudell, chief economist at Zillow.

Economists had predicted the inventory crunch would ease this year, as several years of solid price gains induced more sellers to put homes on the market and spurred home builders to break ground on more new homes.

Instead, inventory has gotten tighter as demand has increased rapidly and the pickup in construction has lagged behind. Sellers also have become hesitant to put their homes on the market because rising prices and mortgage rates have made it more expensive to trade up.

In December, the number of homes for sale hit the lowest level since the National Association of Realtors began tracking such data in 1999. It has ticked up slightly since, but inventory in February remained 6.4% below a year earlier and about 30% below the long-term average.

What’s more, there is a growing mismatch between an abundance of high-price inventory on the market and increasing demand for starter homes. In Minneapolis, 32% of online searches are for starter homes but 21% of the inventory is in the appropriate price range, according to real-estate tracker Trulia. There is a relative glut of luxury homes, which account for 40% of searches but 58% of the inventory.

Single-family housing starts rose to a 10-year high in February but remain about a third below the 50-year average.

The lack of inventory is pushing up home prices, which grew at the fastest rate since mid-2014 in January, climbing 5.9% compared with a year earlier, according to the S&P CoreLogic Case-Shiller Indices.

Adding to affordability challenges for buyers, mortgage rates have risen to 4.14% from about 3.5% in November, according to mortgage-company Freddie Mac.

Economists expect strong price growth and soft sales this year because there isn’t enough supply to meet demand. Freddie Mac predicts home sales will decline slightly this year to 5.9 million from 6 million from last year.

“Looking at 2017, we feel pretty good about housing but we don’t think we’re going to match [last year’s] volume,” said Len Kiefer, deputy chief economist at Freddie Mac. “The main reason for that is this tight inventory and that, when many buyers come to the market in the spring, affordability is going to be a real challenge.”

Unlike boom-bust markets such as Las Vegas, Miami and parts of coastal California, Minneapolis has typically been a fairly stable housing market. Investors are fairly rare and the area has long been an affordable place for young families to buy homes.

Home prices have risen 55% since the market bottom in 2012 and hit a new high in 2016, according to the local Realtors association.

Chris Prescott, an agent at Redfin, said he has seen examples of sellers receiving 25 offers, including cash buyers bidding significantly over the listing price.

“I don’t know where these cash buyers are coming from,” he said. “We have not seen a market like this in the Twin Cities in a very long time.”

Katey Bean, a Realtor for Keller Williams Realty in Minneapolis, recently held an open house for a three-bedroom bungalow priced at $265,000 and counted at least 80 attendees.

“You can see in their face, they just look distraught,” she said of the would-be buyers. “You just almost want to hug them.”