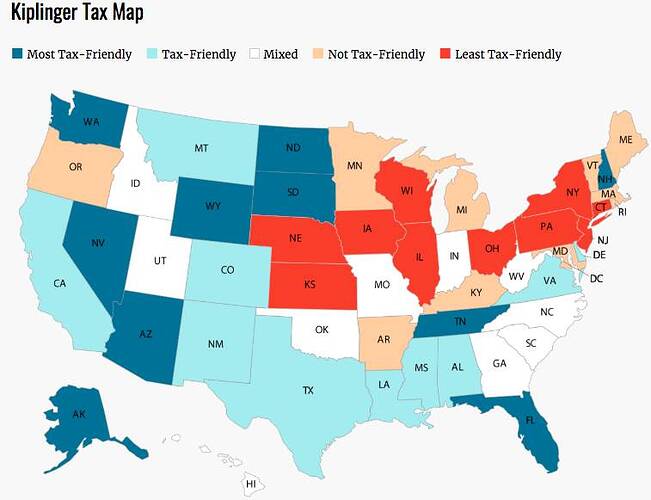

Color of the map is not consistent with the key.

The methodology is a bit flawed. They looked at property tax rate per $100k of home value. California is is actually pretty low by that standard but home values are so high it’s one of the highest states for property tax per home.

California is also very generous on state income tax for lower income people. The top earners carry most of the burden. The state population has doubled while the number of income tax payers is flat.

California is the ultimate welfare state for lower income people. It’s more generous with Medicaid, housing, free college for kids, etc, etc. Someone has to pay for all of that.

Even with these generosity, lower income can’t afford the high cost housing ![]()

New Props are coming… those props will fix it…NOT.

A lot depends on a person’s situation. An older person in CA with a low basis on their home and modest retirement income of say 60k or less does well, especially if they don’t drive much. Here in AZ gas is much cheaper and electricity is about half the cost but you need more electricity for climate control and more gas to get around because things are so spread out. Also, food is subject to 2% sales tax. So one could easily come out better in CA. I come out better here.

"When you look at the traffic, when you look at the economic despair, when you look at the homelessness problem that’s accelerated radically over the last six, seven, ten years, I think there are too many people here.”

For a moment, thought he is talking about 7x7 ![]()

Wondering how much do Elon Musk saves if he moves to Texas. $Bs ![]() Cancel the previous $B grants and issue new $B grants to bypass the greedy California rule of tax accrual based on date of grant? If TESLA would become very profitable going forward, should also move the HQ to Austin

Cancel the previous $B grants and issue new $B grants to bypass the greedy California rule of tax accrual based on date of grant? If TESLA would become very profitable going forward, should also move the HQ to Austin ![]() , would be saving $B in corporate tax - Buy buy buy TSLA.

, would be saving $B in corporate tax - Buy buy buy TSLA.

![]()