Fake news???

I am glad I just did a two year tax free flip…Hoping this whole bill goes away. .Favors Wall Street over main street.And we thought Trump is a real estate guy…NAR is totally opposed to the House tax Bill

NO.

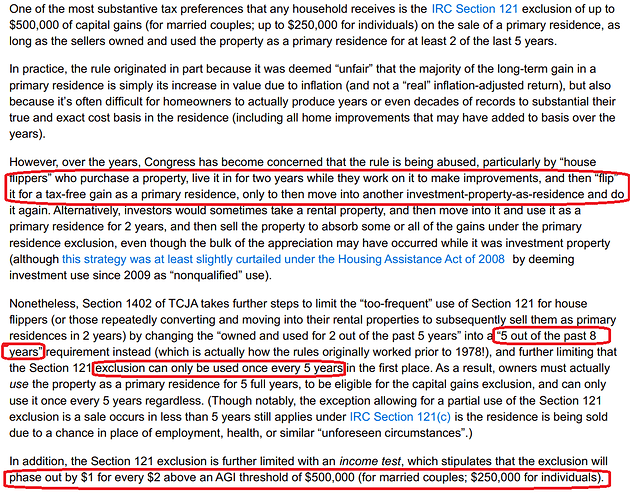

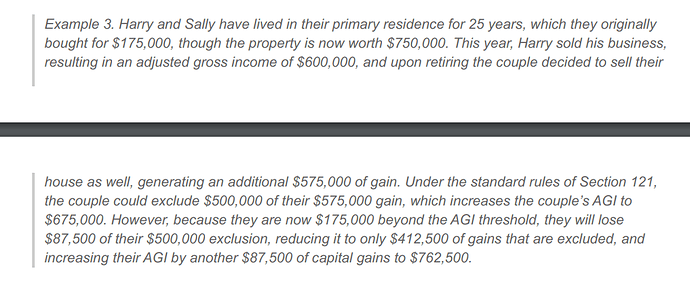

This is from a financial Planner. He has also provided the link for tax reform bill

https://waysandmeansforms.house.gov/uploadedfiles/bill_text.pdf

In order to reduce corporate tax reduction, they find every way to increase the revenue !

Fuck the corporate world. They are hoarding $4trillion overseas and they say Kapernick is unpatriotic?

I say force them to bring the money back first and then talk about a tax break. Trump says he is tough… Let’s see him stand up to the big corporations instead of kissing their ass.

His cabinet is full of these pigs… Show some balls and make the big corporations work for America instead of against it…

Wow, good stuff, @Jil. So, my plans might be thwarted then somewhat (trade rental 4plex for SFH) but I can still do it, just that I will need to live there longer (planned anyway) and I will more than likely just do it once. I guess I should have done it sooner than later but oh well at least the value has been going up ever since in Oakland. Still, here’s hoping the tax bill goes down!!!

Not if I can help it…

Well, his track record is not very good. See Healthcare Reform. And besides, not sure if you saw my post yesterday but it appears that the House tax proposal would not pass mustard in the Senate in its current form anyway. Ballgame is still way early to make a legitimate call on outcome…

Fox News is refusing his commercials now.

Sooner or later, those not opening his eyes to the truth will get their butts hurt.

But, let’s hope for the best. He again went playing golf, but Obama!