Hah, I covered this short (put) around that price but I think it might go even lower…  Tesla has to go down a lot more for this to move lower likely though.

Tesla has to go down a lot more for this to move lower likely though.

.

The uncanny accuracy of fib ratios used in EWT has made fib ratios very popular for all technicians and fundamental analysts, regardless of whether they are Elliotticians. Btw, ARKK is well followed and has similar count as QQQ. No need to re-invent the wheel. Randomly, pull out a count from the web…

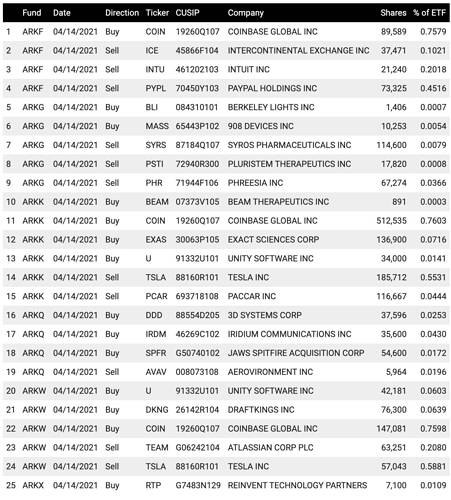

Cathie continues to buy TDOC U SKLZ ZM  She is aggressively buying China stocks, BIDU PDD yet dump TCEHY BABA… counter intuitive.

She is aggressively buying China stocks, BIDU PDD yet dump TCEHY BABA… counter intuitive.

Cathie bought boatload of SE, did you follow? I bot 1 share to remind myself that I should support this Singapore based company. It is into video gaming, e-commerce and payment i.e. tcehy + baba + WeChat/ Alipay.

No I didn’t buy SE. I think buying SE is an indirect bet on EM like Malaysia and Indonesia. They are hugely cyclical and I don’t much about them.

There are enough growth opportunities here in my own backyard that I know more about. Better for me to stick to them.

That’s not what Cathie said. She said opportunities in USA are now limited and is why she is going outside USA. Perhaps, she has more investment $$$ than you?

Just because the US market is overpriced does not mean there is not a huge risk premium for foreign stocks . Cathie is an amateur. Wait for her collapse

She has 80B under management. Maybe she has more?

![]()

And yet another issue may soon rear its head as a result of Cathie Wood’s own remarkably successful run, which helped balloon the firm’s assets from around $3 billion to more than $50 billion in a little over a year. It’s the diminishing returns that come with managing larger sums of money.

Just follow WB, buy AAPL.

Although Ark’s unique problem of holding high percentages of less heavily traded companies is arguably the largest unacknowledged risk factor to its funds, Johnson’s observation is another issue.

Don’t have to sell those. Sell liquid ones like AMZN FB GOOG PYPL NFLX… Her funds contain many such highly liquid stocks as “cash” in case of redemptions. Instead of holding cash, she holds liquid stocks as cash.

https://finance.yahoo.com/news/cathie-wood-etfs-ditch-ownership-124005670.html

“It seems like they’re willing to take on more single-stock risk if they truly believe in a company,” said Mohit Bajaj, director of ETFs for WallachBeth Capital

All in ![]() buy n hold!

buy n hold!

Cramer said to look at Cathie Wood’s portfolio when it comes to Tesla. “I follow all her ETFs. They are moving up, they are not down. You want to watch those because they are barometers of what the millennials want.”

I knew ![]() Buy whatever Cathie buys not because she is good at sporting innovative companies, is because she understands millennials, the group that is as big (or is it bigger) than the baby boomers, that would shape the future of the market. Buy whatever millennials buy, period.

Buy whatever Cathie buys not because she is good at sporting innovative companies, is because she understands millennials, the group that is as big (or is it bigger) than the baby boomers, that would shape the future of the market. Buy whatever millennials buy, period.

Helping Individuals with Neurological Disorders

By Sam Korus

Analyst

Neuralink is developing an implantable brain-machine interface to help address or cure neurological disorders. Previously, the company demonstrated its ability to capture a pig’s brain activity.

This week Neuralink released a video of a monkey playing pong on a computer with its brain only. To achieve this end, Neuralink implanted two devices in a monkey’s motor cortex, the part of the brain responsible for planning and executing movements. With a banana smoothie as its reward, the monkey first used a joystick to control a cursor while playing a game on a screen. By tracking which neurons fired when the monkey moved the cursor toward the goal and reward, Neuralink constructed a predictive model that allowed the monkey to control the cursor in real time with its brain activity alone.

According to Neuralink, its first goal is to give people with paralysis the digital freedom to text, search the web, create art, and play video games. Then, it aims to help people with paralysis regain their physical mobility.

ARK is not surprised that some neuroscientists have downplayed Neuralink’s achievements, dismissing “outsiders” like Elon Musk. Ironically, Neuralink is leveraging upon decades of neuroscientific research. ARK believes Neurlink’s ability to increase the number of implantable brain electrodes by orders of magnitude will advance the field much faster than otherwise would have been the case.

GPT-3 Is Generating 4.5 billion Words Per Day

By William Summerlin

Analyst

In a recent blog post, OpenAI announced that its GPT-3 autoregressive language model is generating 4.5 billion words per day across 300+ commercial applications, an important milestone for deep learning. According to artificial intelligence (AI) experts, GPT-3, or Generative Pre-trained Transformer 3, is the most powerful language model ever built.

With 175 billion parameters trained on roughly 500 billion words, the model uses deep learning for a diverse set of text-generation tasks. Given a list of ingredients, for example, GPT-3 can generate a recipe. Alternatively, it can serve as a chatbot guiding customer support or turning text commands into SQL code.

Research indicates that the size of a neural network is important to the performance of language models. The human brain, for example, has at least 100 trillion synapses - the brain’s version of a parameter. GPT-2, GPT-3’s predecessor, had 1.5 billion parameters, while most other language models have fewer than 1 billion parameters. In other words, GPT-3 is at least 115x larger than its predecessors but only 0.175% the size of the human brain.

While the value of additional parameters and training data is likely to asymptote over time, the point of diminishing returns seems to be far in the future. The near-term challenge is finding massive amounts of training data. GPT-3’s training data included most of the text available on the internet. Now, creative researchers are compiling data by converting the audio from podcasts and videos. Enabling this research, for example, Spotify recently released audio-text data from 100,000 podcasts.

Cathie has been loading up COIN like crazy.

Some COIN insiders dumped all their shares.

Fair value of COIN is ~$250 for current fundamentals.

If crypto go out of vogue like Tulip, fair value = $0.

The variants of crypto is like cult-var of Tulip.

Don’t forget, crypto was driven to such heights by a few billionaires as pied piper.

Could A Decline in Physical Retail Sales Drive US Digital Advertising to New Heights?

By Nicholas Grous

Analyst

Last year was momentous for everything ‘digital.’ In most sectors, digital solutions solved problems as the COVID-19 pandemic forced sheltering in place.

Despite the success of vaccines, we believe the acceleration towards digital everything is likely to continue. Digital advertising solutions are a case in point. According to Kagan estimates, legacy advertising solutions declined significantly during 2020 while digital advertising scaled to roughly 50% of total US ad spending.

In our view, a decline in the US retail footprint could turbocharge the next leg of digital ad spending, as shown in the chart below.

According to online figures and our estimates, US retail vacancy rates jumped 350 basis points last year to 13%, shrinking the retail rental market by $35 billion, from $312 billion to $277 billion, as the pandemic forced a shift to online shopping. As with digital advertising, this trend was in place before 2020, suggesting that it will continue as merchants try to boost online sales.

If this thesis is correct, US digital ad spending could grow 17% at a compound annual rate, from $121 billion last year to $265 billion, during the next five years. As a result, and as shown above, relative to GDP, digital advertising at 1.04% would be higher than retail rent at 0.95% in 2025.

What is the Nvidia Ominverse?

By Yulong Cui

Analyst

This week Nvidia announced more than a dozen new products during its annual GPU Technology Conference (GTC). Among them were the ARM-based server Grace CPU, the Bluefield DPU to accelerate the performance of next-generation data centers, and the Omniverse open platform. Omniverse is Nvidia’s infrastructure- and platform-as-a-service solution enabling photorealistic simulations of the real world and the Metaverse.

Omniverse is a collaboration platform with multiple GPUs for 3D production. Nvidia’s CEO Jensen Huang once described Omniverse as the Google Docs for physics-based simulation. The platform consists of Nucleus servers for live syncing, KIT for Omniverse native applications, Connect for third-party design applications like Unity and Autodesk, and RTX Renderer for ray tracing technology. Since December, the Omniverse platform already has attracted more than 17,000 beta users, boding well for the launch of its enterprise license this summer.

In our view, the Omniverse platform has two distinguishing characteristics. First, it will accelerate automation in the enterprise with “digital twins”, as illustrated by WPP and BMW. In a simulated environment, enterprises can create synthetic data to augment real world data as they train neural nets. Second, the Omniverse platform illustrates Nvidia’s strategic move up the tech stack from chip design to infrastructure-as-a-service or application platform-as-a-service.

and me!  since january

since january

Editas Medicine (EDIT)

Editas Medicine (EDIT), a gene-editing company, harnessing the power of CRISPR Cas9 and Cas12a, traded down 15% last Friday after Goldman Sachs Analyst, Madhu Kumar, initiated on the stock with a sell and a $20 price target. ARK believes that Editas’ newly appointed CEO, James Mullen is the right leader to move the company’s pipeline further into the clinic.

Organovo (ONVO)

Organovo (ONVO), a biotechnology company focused on 3D-bioprinting, traded up 21% on Wednesday, possibly because investors and speculators could be gaining confidence in Organovo’s ability to maximize its 3D-bioprinting assets and deliver on a revitalized commercial strategy. We believe shares will be volatile until Organovo reveals more about its path forward.