From a week ago:

The Queen has spoken.

Is Inflation or Deflation the Bigger Risk to (or Opportunity for) Equity and Fixed Income Markets?

By Cathie Wood

Founder, CEO, CIO

During the last nine months, in response to a V-shaped recovery, global equity markets rotated away from growth stocks toward value stocks. Commodity prices soared, increasing fears of inflation and higher interest rates, while the earnings growth of cyclically sensitive companies offered stiff competition to that of growth companies given the short-term time horizons of most investors in the public equity markets. Dramatizing these dynamics, during the three months ended March the 10-year US Treasury bond yield doubled to 1.74%,1 a record-breaking increase for such a short period of time.

While others extrapolated those trends into the future, ARK has maintained that inflation would prove temporary thanks both to the base effects caused by the price collapses last year and to supply chain bottlenecks that will cause double- and triple-ordering of supplies, a massive inventory overhang, and a commodity price collapse. With the exception of oil, we believe cracks in the commodity markets are becoming clear. During the past six weeks, lumber prices have dropped more than 46% from $1,686 to $897.90 per thousand board feet while copper prices have dropped roughly 12.78% from $4.77 per pound to $4.16.2 We believe oil prices will not be far behind, despite the significant cutbacks in energy-related capital spending, particularly if drivers in the ride-sharing space take advantage of the lower total cost of EV ownership.

In our view, exacerbating the cyclical deflation will be two secular sources of deflation, one good for economic activity and another bad. Please read our latest market commentary (published on May 21st) or view our latest YouTube update (published on June 4th) to learn more about our thoughts.

[1] Source: Bloomberg

[2] Source: Bloomberg. Information as of 6/18/21

Oil cannot go much lower as droughts make less hydroelectricity and heat waves increase energy consumption for air-conditioning/water cleaning plants etc.

There is no lower cost of ownership of EV. infact EV eat tires faster and due heat on pavements that trend accelerates.

Oil/Gas industry produces alot of byproducts that needed for creating helium/polymers/synthetics. that are the building blocks of Semiconductors/rubbers/plastics etc.

writing is on the wall for everything in the south.

https://www.nasdaq.com/articles/brazil-on-drought-alert-faces-worst-dry-spell-in-91-years-2021-05-28

Cathie and commodities… Has she checked Iron Ore price? . she should invest in advanced steel making firms as global railway need the steel.

Karpathy Explains Why Tesla Is Shipping Cars Without Radar

By Tasha Keeney

Analyst

At the Conference on Computer Vision and Pattern Recognition, Andrej Karpathy, Senior Director of Artificial Intelligence (AI) on the Autopilot team, recently spoke about Tesla’s decision to drop radar from its perception system. He reiterated what Elon tweeted not too long ago: camera-based vision is more accurate than radar, and radar introduces more noise than helpful data in a sensor fusion system. Karpathy compared the performance of vision-only with sensor fusion when a vehicle moves toward and then under a bridge, concluding that the superior vertical resolution of the vision-only version of FSD (Full Self Driving) helped distinguish the bridge from a stationary object that would stop the car.

Why, unlike Tesla, have most other companies opted to include data from inexpensive radar and LiDAR in the autonomous solutions space? One argument could be that its 1.3-million-unit vehicle fleet gives Tesla the ability to train cars with 6,000 hand-picked clips of a new release. In other words, Tesla may have “earned” the ability to remove radar from Autopilot thanks to the size of its fleet, a significant advantage we believe relative to its autonomous competitors.

Telsa Shares Details on Its In-House Supercomputer

By Frank Downing

Analyst

Tesla recently unveiled details on an in-house supercomputer that will train artificial intelligence (AI) and enable autonomous driving. Estimated to be the fifth largest globally, Tesla’s supercomputer is powered by a vast array of Nvidia GPUs and volumes of ultra-fast storage totaling 1.8 exaFLOPS to churn through billions of miles of real-world driving data. Clearly, Tesla is aiming to produce AI models that will meet and exceed human-level driving abilities.

Along with its successor, Dojo, which will “take this to the next level” according to Telsa’s head of AI, this supercomputer could reduce the time and cost necessary to train models so that AI experts can experiment and tune them more quickly. Once ready, the models will be deployed on custom-designed chips running inside each vehicle, fulfilling Tesla’s strategy of vertically integrating its AI capabilities.

one hit wonder, perma bear.  that being said, I agree. this reopening is going much to fast for my liking, LA county just required masks again indoors, and there are still a lot of unvaccinated people (including kids).

that being said, I agree. this reopening is going much to fast for my liking, LA county just required masks again indoors, and there are still a lot of unvaccinated people (including kids).

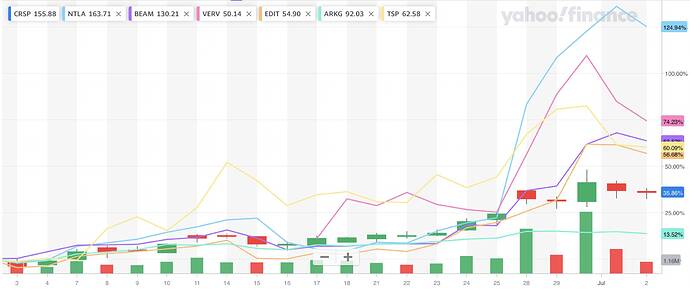

Intellia Therapeutics (NTLA)

Intellia Therapeutics (NTLA), a pioneer in CRISPR gene editing, closed up 50% on Monday after publishing the first-ever clinical data demonstrating the safety and efficacy of in vivo genome editing. The drug candidate, NTLA-2001, is positioned as a single-dose cure for the hereditary form of ATTR amyloidosis (hATTR), a deadly disease caused by excessive expression of the amyloid protein. NTLA-2001 works by silencing the TTR gene which, in this Phase 1 trial, reduced the amyloid buildup by nearly 87%. These data compare favorably to the current standard of care which achieves an 80% amyloid reduction through weekly injections throughout a patient’s life. These breakthrough results supercharged investor enthusiasm for companies with gene or base-editing exposure.

Verve Therapeutics (VERV)

Verve Therapeutics (VERV), a leader in gene editing therapies for cardiovascular disorders, rose 25% and 21% on Monday and Tuesday, respectively. Intellia’s (NTLA) landmark data showing the safety and efficacy of in vivo genome editing ignited investor enthusiasm for companies like Verve that also are engaged in CRISPR genome editing.

Beam Therapeutics (BEAM)

Beam Therapeutics (BEAM), a leader in base-editing medicine, appreciated 16% on both Monday and Wednesday of this week. Intellia’s (NTLA) landmark data showing safety and efficacy of in vivo genome editing ignited investor enthusiasm for companies like Beam that also are engaged in CRISPR genome editing or base-editing.

Editas Medicine (EDIT)

Editas Medicine (EDIT), a premier CRISPR-based gene-editing company, traded up 23% on Wednesday. Intellia’s (NTLA) landmark data showing safety and efficacy of in vivo genome editing ignited investor enthusiasm for companies like Editas that also are engaged in CRISPR genome editing.

TuSimple (TSP)

TuSimple (TSP), an autonomous trucking technology company, closed up nearly 16% on Monday on no particular news. Perhaps investors are learning more about the opportunity in autonomous trucking as more companies in the space go public. TuSimple’s competitors, Embark and Plus, recently went public via SPACs.

Don’t have any of the above but have ARKG ![]() and CRSP

and CRSP ![]() hoping for 10x over 10 years. I am dumb (since I don’t have a Master in CS from university of Minnesota) so don’t know how to do fundamental analysis

hoping for 10x over 10 years. I am dumb (since I don’t have a Master in CS from university of Minnesota) so don’t know how to do fundamental analysis ![]() and have no resources like Cathie so can only hope.

and have no resources like Cathie so can only hope.

Cathie is one of the few voices out there arguing the inflation scare has been overblown. The other notable one is Paul Krugman. Maybe you will agree, maybe not, but it’s interesting nonetheless.