@manch god mom went to St Petersburg, Florida for lower income tax and cost of operation.

TSLA is relegated to number 13?

@manch god mom went to St Petersburg, Florida for lower income tax and cost of operation.

TSLA is relegated to number 13?

@manch god mom tries to fool us. NYC experiences deflation but St Petersburg experiences inflation.

- “We believe that St. Pete wants to become the next Austin and attract tech companies, attract innovation,” Wood said during an Ark Invest.

Copies the successful copier ![]()

Tampa, FL is a nice city. Just two hour or so worth of drive from Orlando, FL.

Her theory of deflation sounds remarkably similar to the deflation theory proposed earlier by Gary Shilling, author of book Deflation - how to survive coming wave of deleveraging.

Wood, whose flagship $19.7 billion Ark Innovation (ARKK.P) fund was the top-performing U.S. equity fund in 2020, said that China’s recent steps to crack down on sectors ranging from gaming to education to financial firms are increasing the likelihood of a policy mistake that leads to a sharp slowdown.

“I really do think that the policy makers in China are beginning to play with fire,” she said, adding “We will look back at this period in six months and say ‘Wasn’t it obvious there will be a major and unexpected slowdown in China?’”

Looks like Cathie finally wised up. Xi is not playing with fire. He’s playing with nukes.

![]()

On episode XXI of In the Know, ARK CEO/CIO Cathie Wood, weighs in on China, inflation, supply chain shortages, oil prices, crypto, Zoom, and more . As always, she also discusses fiscal policy, monetary policy, market signals, economic indicators, innovation, and more. While the market remains in a state of heightened volatility, ARK is here for you. Join ARK’s CEO & CIO, Cathie Wood, as she provides a short review during this period of uncertainty related to the coronavirus (COVID-19) pandemic. Stay Healthy. Stay Innovative.

https://finance.yahoo.com/news/cathie-wood-says-meme-stocks-135741359.html

Please note that she could be a Fintech dinosaur, she has missed out on the monster rally going on in the Fintech space.

No UPST AFRM SOFI MQ in ARKF? She holding stocks that are languishing.

By Tasha Keeney

Analyst

This week, Tesla launched its insurance service in Texas, the second state to offer its insurance and the first to offer its usage-based program based on user safety scores. Vehicle owners who sign up for the beta release of its Full Self Driving software will provide Tesla with driving data that generates a score out of 100. Owners with higher scores will enjoy lower insurance fees.

Unlike other online usage-based insurance programs, users will not need to buy hardware to enable the service. Tesla will onboard users through touchscreens in their vehicles or on their Tesla apps. Tesla believes that over time it will lower auto insurance costs by 20-40% based on real-time driving behavior data in addition to traditional underwriting metrics like credit, age, and claim history. Data on the average distance between cars while driving, for example, could help Tesla lower rates relative to its competitors.

By Frank Downing

Analyst

This week, Coinbase announced plans for a peer-to-peer Non-Fungible Token (NFT) marketplace which will broaden its crypto-focused product suite. Competing with leader OpenSea, Coinbase’s marketplace will allow users to mint, sell, and trade NFTs through its user interface. To facilitate trades, Coinbase will activate smart contracts on Ethereum and, in the future, will support other blockchains. With more than 1.5 million users on the waitlist after the first few days, well above OpenSea’s user base of 400,000, Coinbase’s offering seems destined for early success.

During the last year, NFT marketplace volume has surged to more than $10 billion last quarter. In addition to Coinbase, FTX US has announced a marketplace that will support both Solana- and Ethereum-based NFTs.

We believe that given its broad reach and ease of use, Coinbase should be able to diversify its revenue stream from brokerage and custody services with NFTs. With a recently announced feature, Direct Deposit, for example, it will reduce the friction associated with converting fiat currencies into cryptoassets, enabling decentralized finance (DeFi) and NFT applications.

Recently, Coinbase decided to terminate a lending product called Lend after the SEC issued it a Well’s notice. While NFTs do not seem to be in the crosshairs of regulation, OpenSea’s recent delisting of several projects, seemingly out of fear that they might be considered securities, might be a signal that they may not be immune for long.

With ownership and value embedded in the internet, blockchain assets continue to challenge regulatory frameworks. While the SEC is advocating for oversight, Coinbase and others are proposing a new regulatory framework to govern this new asset class.

By William Summerlin

Analyst

Last week, Microsoft made history with its Megatron-Turing Natural Language Generation model (MT-NLG), the world’s largest natural language processing model. At 530 billion parameters, MT-NLG is 3x larger than the next-largest model, the 175 billion parameter GPT-3. Tuned with just a few examples, the model achieved state-of-the-art performance in multiple language tasks including LAMBADA. Notably, the model demonstrated that increasing the number of parameters resulted in better performance, corroborating results from previous foundation language models.

Interestingly, Microsoft has invested $1 billion into OpenAI, the creator of GPT-3. Setting new AI records, Microsoft now seems to be competing with OpenAI’s AI research teams. In our view, this competition will up the ante and advance the state of the art faster than otherwise would have been the case.

Frankly, I don’t understand her logic at all. I don’t think those sources she mentioned are fundamental drivers of general inflation.

If you believe blindly tweets by strangers, you would be surprised.

He claimed that Cathie has been buying TSLA for the past few months. The truth is…

What people are saying why is she cutting winners and buying losers. This is causing her ARK funds to underperform badly this year.

Deflation might happen for goods. But services are on an inflationary spiral to the moon. Jackpot situation. Boomers too old to work. Millienals too vain and bored to work. Would rather gamble on meme stocks and shitcoins. And Gen X worked to death supporting kids and aging parents. No wonder there are strikes and people not looking for work.

Sigh…I need to fix a sewer shitstorm at a rental

Plumber wants 450$ to bring out the big snake and use it from the roof.

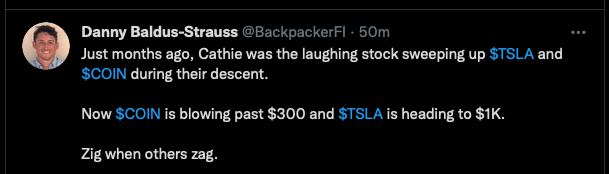

I think she needs to keep certain ones under 5 or 10%. It makes sense to rotate. She’s been buying COIN and DNA too. Those are rocketing today.

.

Not the reason for selling TSLA. She sold out of SE too.

.

I know. She loves the bashing. You profit too ![]() Is what matter.

Is what matter.

Shares of Twilio (TWLO) traded down 17.6% on Thursday after the company guided to a weaker-than-expected forecast for the fourth quarter and announced the departure of COO George Hu. Third quarter revenues were much better than expected, up 65% on a year-over-year basis. Despite the weaker than expected guidance, our conviction in Twilio’s ability to execute remains high given its active customer account growth of 20% year-over-year and continued net revenue retention rates above 130%. Twilio provides a cloud-based communications solution that allows developers to build digital experiences and campaigns over SMS, voice, video, email, and other communication channels.