diworsification

When Xi grabbed power to become emperor for life I already worried about China sliding backward. Under Xi the little freedom of speech China had was further stripped away. Now it looks the country is moving towards more “rule of man” further away from “rule of law”.

Tencent’s result suffered a great deal this quarter because China was withholding game licenses. Yeah, in China you need government approval to publish games. Without new games the old tired ones pull in less revenue. Not only that Tencent can’t get approval to monetize a game it already published.

China seems to be sliding backward towards its worst illiberal instincts. Hopefully this is a short term problem but I am doubtful.

Worrywart.

杯弓蛇影

Not 庸人自扰

There seems to be a lot of discontent and self-doubt among the policymakers and elites inside China. Something is not right…

Both.

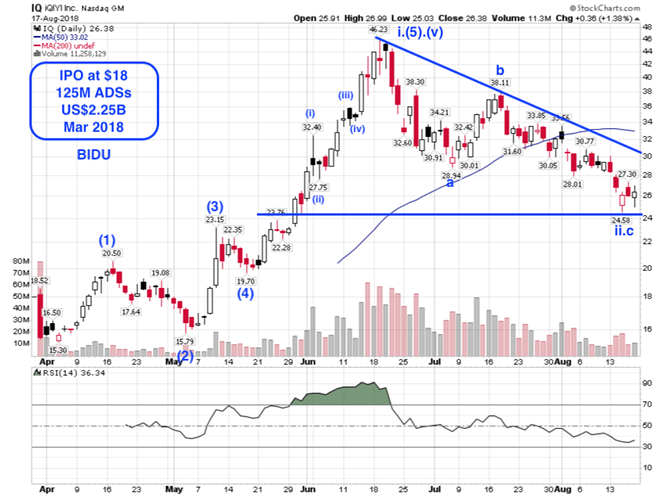

After consuming Ambien, bought 1000 shares of IQ ![]()

No idea where is the bottom but should scale above $65 after bottom, is why I’m into this POS ![]()

IMHO, living streaming everything is a mega trend. People is willing to pay big bucks for live aka reality streaming.

Tencent has more video subscribers than IQ. From Tencent’s most recent quarter report:

Our video services reached 74 million subscriptions, up 121% year-on-year and maintaining our industry-leading position in China. We attribute this success primarily to our exclusive content in key video genres. For instance, an exclusive drama series, Legend of Fuyao, which was sourced from an IP developed with our listed subsidiary China Literature, was ranked the number one exclusive drama series by video views industry-wide in the first half of the year. Our self-commissioned variety show, Produce 101, was ranked the number one online variety show by video views industry-wide. Additionally, our Chinese anime traffic more than doubled on a year-on-year basis, leading the industry in terms of video views, thanks to our strong IPs and proven production capabilities.

IQ, from its quarterly report:

The number of total subscribing members were 67.1 million as of June 30, 2018, representing a 75% increase from 38.3 million as of June 30, 2017. The number of paying subscribing members were 66.2 million as of June 30, 2018.

I thought I said anything less than $50k is not worth discussing… ![]()

Ok, would buy more next week.

IQ total rev for Q2 is around 930M. Content spend is 700M. Year run rate should be north of 3B USD. This shit is expensive. That’s more than what HBO spends.

No worries, Baidu has lots of cash to burn.

I’m gonna stop responding to your insanity ![]()

Is it one of these: Chan, Lee, Chiang, Wong, Yeung, Lum, and Lau?

She hinted that I got it right ![]() Next is to guess her name Ms Chu Kar Ling?

Next is to guess her name Ms Chu Kar Ling?

Tencent’s Biggest Business Becomes a Major Liability

Investors will likely remain focused on Tencent’s video game business or its costly ecosystem battles against Alibaba and Baidu , but the company still has plenty of irons in the fire. Its sales and earnings growth will likely remain lumpy for the next few quarters, but I believe that Tencent – along with Alibaba and Baidu – remain essential long-term plays on China’s booming tech sector.

Revenue of businesses

Gaming 30%

Value-added services (10c video & music) 25%

Online ad (WeChat) 20%

Other biz (WeChat Pay & 10c cloud services) 25%

You guys are crazy. Not taking any bait. Basically what I got out of this is Yoda calls me a ![]()

Pig is right…

Chu 楚 is not Zhu 朱

Chu Kar Ling 楚嘉玲