Who won 3G and 4G? It wasn’t carriers who spent on spectrum and billions more building the networks. Even the network hardware makers didn’t do that great. The carriers spent so much on spectrum there was a ton of cost pressure on building the network. The real winner were device makers. It makes their devices more capable and desirable, and they don’t have to spend the billion on the network.

More because of iPhone new design paradigm. Perhaps this time, the winners are live streaming businesses🤗

Streaming is already quite fast on today’s network. Maybe something like AR/VR that uses way more data can benefit. So Facebook? Also if more compute will be shifted to cloud instead of being done on device, amazon will benefit.

I thought the trend Is towards fatter clients😀

Tick tock. Centralize, then decentralize. Centralize again, decentralize again…

That sums up computer history in a nutshell.

VR will use all the bandwidth you got. Also 4K streaming.

Ar maybe, but anything that requires a bulky sevice to be around is hard to win. Phones wom because they were practical. Maybe when home you can have more real 3d movies, but you need comcast for that, unlikely for phones.

Netflix or hollywood might win  more people to watch on trains. In car / flight entertainment systrms would all use streaming services too.

more people to watch on trains. In car / flight entertainment systrms would all use streaming services too.

They are bulky now. But they won’t stay bulky forever. See the size of cell phones in the 90s.

See the size of vr devices in 90s. The only practical thing i know is googles cardboard  and maybe gear vr.

and maybe gear vr.

Vr devices are not new. Improved graphics are

I want hololens, i think, so i cam read emails while i drive… Or not.

This video explains what the heck is Bibilili’s “bullet chat”.

China innovation may not work in USA, Americans don’t like people to talk while watching shows.

That’s fine. American innovations may not work in China either. It’s good we have two big players instead of only one.

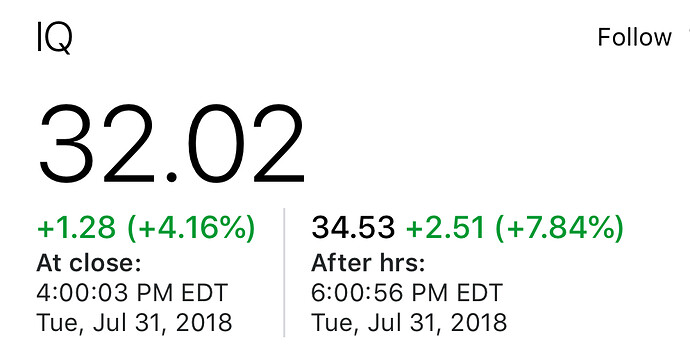

IQiyi Stock Could Reach $50 This Year

Earning Jul 31. Today, SOGO crashes almost 10% after earning.

In order to understand Chinese stocks more easily, American investors often compare Chinese companies to U.S. companies. Netflix is the American tech giant that is most similar to iQiyi.

But the comparison isn’t 100% fitting. For one thing, iQiyi has a substantial social media element that Netflix doesn’t have. Specifically, iQiyi allows its users to upload video and enables them to interact with other members, including celebrities, in various ways. Called iQiyi Paopao, the social component of iQiyi has more in common with Alphabet’s YouTube or Twitter (NASDAQ:TWTR) than Netflix. At its core, Netflix offers a private viewing experience, rather than a common area for sharing and networking.

In its short life as a publicly traded security, iQiyi stock has bounced around like a pogo stick. In less than 90 days, shares soared as much as 184%, before falling 32% over the next 16 days. The stock is still up more than 100% from its price at the end of its first day of trading. Quite often, double-digit moves will not be accompanied by any news.

The company is not yet profitable, and doesn’t expect to be for some time, as it is spending heavily to stock its content library. iQiyi has a frothy valuation, with a 12-month price-to-sales ratio of 8.5 – significantly higher than the range of 1 to 2 which is considered good (or below 1, which is considered excellent). With a sky-high valuation like that, the volatility of this stock is likely to continue for the near future.

That said, for patient investors with a long time horizon, iQiyi has a shot at the streaming title in its native China.

China is still uncomfortable with internet companies.

Only 500 shares ![]()

Way below my purchase. Can it please rally more…