Fund Outperforms Despite Holding Just 22 Growth Stocks

Managers of the $15.4 billion Edgewood Growth Fund (EGFIX) are choosy. They want growth stocks that are poised to deliver long-term earnings power. They aim for companies that are at an early stage of their profit cycle. And they seek companies with those traits that are trading at big discounts to their fair market value.

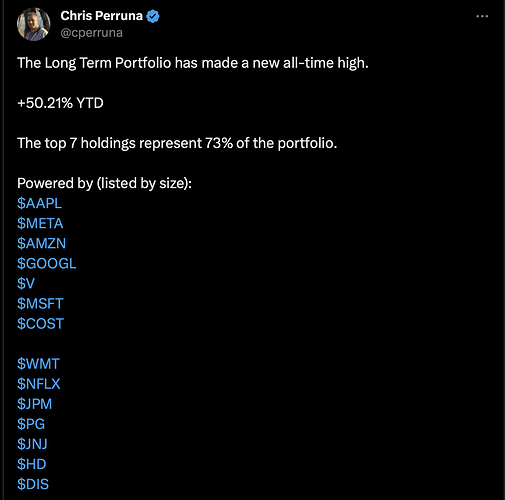

Not much different from most investors. They own MSFT, ADBE, V, and PYPL. One of them is a cloud king.

What Mountain Climbing Teaches Top Fund Manager About How To Invest

Vinton: The majority of the portfolio is invested in what we call established leaders. Those are the Microsoft s (MSFT) of the world, the Mastercard s (MA) of the world.

We have a smaller portion invested in emerging leaders. Those are companies like Tyler Technologies (TYL) in the software area.

Then we have a really small component of companies with an exponential amount of growth potential. But they’re a little further out on the risk spectrum. Those are our seeds, which can grow big.

Essentially cash cows, stars. and question marks. This fund owns AAPL ![]() TWLO

TWLO ![]() TEL, CTLT, NOC, MSFT, ASML and EW. One of them is a cloud king.

TEL, CTLT, NOC, MSFT, ASML and EW. One of them is a cloud king.

It seems MSFT is the preferred bet for index cloud platform (Azure) rather than AMZN (AWS).