Here is the complete review given by Forbes:

When the credit crunch struck in 2008 and created a tidal wave of foreclosures across the United States, private equity giant Blackstone Group was among a number of Wall Street firms that saw an opportunity to bet on an eventual housing recovery. The firm, under the guidance of its billionaire head of real estate Jonathan Gray, created a company called Invitation Homes in 2012 that spent an estimated $9.6 billion dollars scooping up thousands of properties nationwide and turning them into rentals.

Now, Blackstone’s big bet on the U.S. residential real estate recovery is planning to list on stock markets in an initial public offering that may fetch a valuation north of $5 billion. The move comes as home prices touch new highs in many cities and amid continued upward pressure on rents. For Blackstone, the IPO will mark the beginning of an exit from one of the biggest bets in its history.

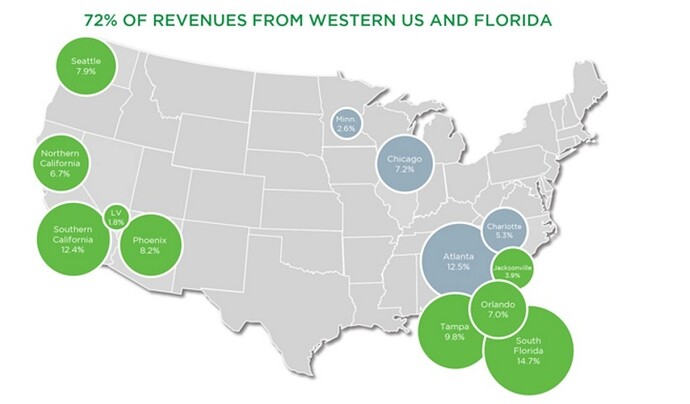

Using a mix of its own investor capital and novel asset backed securities tied to rental streams, Blackstone spent billions to buy nearly 50,000 homes nationwide, building the largest private portfolio of single family homes in the country. Most of its purchases came in areas hard hit by the real estate downturn like Southern California, Florida, Phoenix, Atlanta, Chicago and Las Vegas.

“We realized in studying the sector that there were already 13 million homes in the United States that were being rented out, but just done so on a mom-and-pop basis. And so could you build a scale institutional single-family business much like what happened in the multifamily business in the 1990s,” Gray said of the idea at a mid-2015 investor conference.

As housing rebounded and demand for apartments surged in urban areas, Blackstone quickly filled its homes. Invitation Homes now boasts a 96% occupancy rate and an average monthly rent of $1,623. To boost occupancy and income, Blackstone also plowed $1.2 billion into home improvements, or $25,000 a home. This spending was more than Blackstone initially expected, Gray has said in public comments over the years. But it’s now likely to give Blackstone a bigger bounty than it ever dreamed of when creating Invitation Homes.

To date, Invitation Homes has paid out nearly $1.5 billion in dividends to Blackstone and its limited partners. American Homes 4 Rent, which owns roughly the same number of single family homes as Invitation Homes, presently carries a market capitalization north of $5 billion.

Invitation Homes is listing its shares as a real estate investment trust (REIT), meaning it will have to pass the majority of profits onto investors in the form of dividends. For now, Blackstone will be the main beneficiary as the company’s controlling shareholder. As of the third quarter, Invitation Homes generated nearly $700 million in revenues and core funds from operations of $192 million. Its net operating income nine months into 2016 rose to $418 million from $362 million this time a year ago.*

Comparable single family rental firms like Colony Starwood Homes and Silver Bay offer solid dividend yields of around 3%. However, the value some investors see in these stocks comes from home price appreciation, which bolsters net asset values, in addition to rising rents that translate into dividend increases. Invitation Homes may get a strong reception due to its exposure to many of the hottest real estate markets such as the the Southeast, California and cities like Seattle and Charlotte.

When discussing Blackstone’s plans to IPO Invitation Homes, Gray said in mid-2015 he expected a listing in late 2016 or early 2017. “We want to have really great metrics for public market investors. We want to show how strong the retention rates are. We want to be able to show you how much CapEx needs to be spent. We want it to be a very clean, simple business that pays dividends and has appreciation from the underlying assets,” he said. (Forbes used AlphaSense to locate Gray’s comments)

The decision to stay put long after competitors like Colony American Homes, Starwood Waypoint, American Homes 4 Rent and American Residential Properties listed their shares may have been a wise maneuver.

Once on public markets, single family home stocks faltered as investors began to understand the expenses associated with managing broad portfolios of individual homes. Returns didn’t match up with capital spent on the post-crisis distressed home buying gold rush. Some stocks became the target of activist investors, who urged consolidation as a means of building scale and steadying profits.

In 2015 Starwood Waypoint acquired Colony American Homes for $1.5 billion and in December of that year American Residential Properties merged with American Homes 4 Rent.

Invitation Homes intends to pay down some of its $8 billion in debt through its share offering. It will list shares on the New York Stock Exchange under ticker ‘INVH.’ But the move may also fuel a new runway for growth.

The home buying opportunity isn’t what it was when Gray & Co. stepped into the market after the crisis. Banks aren’t foreclosing on homes and portfolios of assets are no longer being disposed at bargain prices. It’s likely the best available purchases will come from continued M&A among public and private landlords.

Using IPO proceeds to de-lever and create a public market currency may eventually spawn a second growth spurt for Invitation Homes. According to an analysis from KBW, there are presently eleven private single family home rental businesses with portfolios of over 1,000 homes apiece, including businesses built by Cerberus, Apollo Global and PIMCO. Many of these firms may see a better exit opportunity by selling to a public peer, rather than going down the IPO route alone.

Source: http://www.forbes.com/sites/antoinegara/2017/01/06/blackstones-big-bet-on-the-u-s-housing-recovery-files-to-go-public