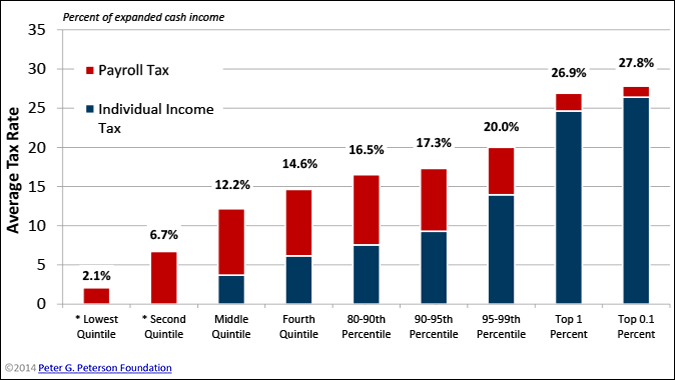

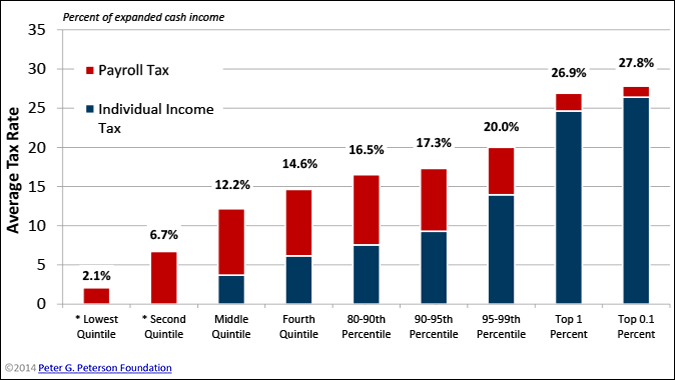

Using the pre-Trump tax reform tax schedule, the tax payable for tax payable income exactly $470,700 per annum is 28%. So even though top 1% to 0.1% earn much more than $471k, the average tax rate is less than 28%.

Using the pre-Trump tax reform tax schedule, the tax payable for tax payable income exactly $470,700 per annum is 28%. So even though top 1% to 0.1% earn much more than $471k, the average tax rate is less than 28%.

This chat is pretty suspicious. Maybe if you are a working bee who gets all income from W2, your tax rate is like that. My effective tax rate, after deductions, is much lower than the chart. If you are living off your rental properties you may even pay zero income and payroll taxes because of depreciation.

It’s only income tax, but you can see the breakdown of effective rate by income level. You can see 0.2% of households with income over $200k paid zero income tax. It was 53% of those under $50k. The most common rates for those over $200k are 15-20% and 20-25%. There’s more paying over 25% than under it. You can even see the percent of income that gets preferential rates.

Federal income tax is highly progressive.

Simple solution here, those like Buffet who think they pay too little should donate to the government their fair share. The rest of us should spend more, then the government can get more money from sales, excise, property taxes and DMV fees. There are plenty of revenue sources for the government besides Fed income taxes.

If higher taxes worked CA shouldn’t be in such financial trouble along with the highest rates of poverty and homelessness.

We have the highest taxes in the nation.

The chart certainly matches my experiences… We pay a buttload in taxes.

Keep in mind that top 1% means 1 out of 100. So that column probably includes all the SV worker bees. Top .1% is 1 out of 1000. Maybe that’s more mega-landlords, but also probably includes a significant # of people getting W2 income and stock.

Looking at the chart carefully, I notice the income is cash income, I guess is the gross cash income, not tax payable income, and of course exclude RSUs. Since taxes of vested RSUs are not paid in cash, likely not included in the computation, hence people could be paying more taxes than is indicated in the chart.

RSU taxes are part of W2 income. Taxes are paid by the company by taking away shares if the stock isn’t public, but still included on our W2.

Are there taxable non-cash income?

“Small sample bias – sparsely populated regions more likely to have low Gini coefficient

Gini index has a downward-bias for small populations.[58] Counties or states or countries with small populations and less diverse economies will tend to report small Gini coefficients. For economically diverse large population groups, a much higher coefficient is expected than for each of its regions.”

Scandinavian countries have the population of the Bay Area. They are a small fraction of the sample size of the US. They also don’t have anywhere near the economic diversity of the US. You couldn’t have a country the size of the US be successful without economic diversity.

I don’t understand, are we in denial that the top 1% percentage of total wealth isn’t increasing?

Certainly this information could be incorrect. But what are they missing?

It is not a zero some game. The leftist jealousy towards the rich is silly. What is important is the standard of living overall is up hugely in my lifetime. Gates wealth does not hurt me. The fact that people are getting wealthy raising all of ours standards of living should be celebrated not attacked.

The robber barons of the nineteenth century got rich exploiting cheap labor. The tech wealth is not exploiting poor but is actually helping everyone. Jealousy is not an economic policy.

What about the last 20 years? Don’t think they are saying over your lifetime.

The last 20 years have had huge advances in technology and medicine that have benefits for everyone. The problem with the left is they dwell on the negatives which are mainly caused by their policies in big Democratic blue state cities.

As a far as people on this forum most have gotten rich in the last ten years thanks to the huge RE price boom in the Bay Area. Even including buyinghouse.

Everyone here is crying all the way to the bank.

What they’re missing is the reasons for it. Blaming it on the rich not paying their fair share of taxes is factually incorrect. Claiming the federal tax code isn’t highly progressive is factually incorrect.

Of course the top 1% have a record percent of the wealth. They are the savers that invest. Stock and RE assets are at/near record highs, so of course the net worth of people saving and investing will be higher. The net worth of people who are net borrowers isn’t going to increase no matter what happens with tax code or asset values. The majority of Americans are net borrowers, and blaming the rich for that isn’t logical or helpful. All it does is turn most of America into victims for their own decisions.

The whole conversation gets dumbed down to sound bytes that make people react emotionally even if the sound bytes are factually incorrect. Once people emotionally attach to the sound byte there’s a 0% chance of any real discussion in the topic. Just look at here and how much resistance there is to hard data on tax rates by income level. The facts are rather obvious in terms of tax rates by income level. It doesn’t fit the sound bytes people are emotional about, so there’s an inability to logically process the info.

Yeah. And what’s crazy is people think they’re entitled to it. I was telling my husband that I believe that a certain person who panhandles at one of the Palo Alto corners isn’t homeless because I saw him with the latest model iPhone, and my husband said “Why shouldn’t the homeless have cell phones???” Flip phone sure, but the latest version??? ![]()

I gave him that iPhone.

Pretty much the right wing’s attitude can be summarized as: the rich deserve to be rich, because of their virtues like working hard and saving money, and the poor deserve to stay poor because they are just bums, don’t work hard and always ask for handouts. Do I get it right?

That’s the moral theory of wealth: I am wealthy because I am righteous. The converse also holds in their mind: you are poor because you are not.

Trying to point out the unequal starting points of people is somehow just emotional, guilty of being envious of the rich.

The history of America is literally people who moved here to work for a better life. No one promised them a better life or free stuff. It was the opportunity to work for it. We didn’t even have an income tax until the 1900’s.

Immigrants manage to move here barely speaking English and manage to become successful. People born in the US have significant advantages over those people. It shouldn’t be that difficult for people born here to achieve a moderate level of success.

The part that’s really crazy is blaming the rich for the disadvantages of the poor. The biggest disadvantage for kids is a single-parent family. It also accounts for the vast majority of poverty. That is personal choice. All our decades of creating programs and increasing spending has done is increase the number of single-parent families. It’s literally the exact opposite of what’s best for kids. We’ve also learned no amount of K-12 spending makes up for those disadvantages. You can’t even discuss the idea that single-parent families are bad for kids though. It’ll offend half of America.

What’s the moral authority of poverty? America was built by hard working people. They are disgusted by lazy people gaming the system. Welfare should require drug testing just like many jobs do. The poor should work as hard as anyone else and not have more benefits than working people. Most rich people work hard. All taxes combined should not be more than 50% and everyone should pay a least a little bit of taxes.

Exactly. I have a cousin who works at Lowe’s during the summer when her kids are off school. The state pays for her daycare. Since she only works summer, she gets section 8 housing, food stamps, etc, etc, etc. She takes advantage of every program there is. She even keeps a written journal of which non-profits she hits up and when. They’ll pay your utility bill for you but only about once every 6 months. Rotate between them and you never have to pay a bill yourself. She won’t work during the school year, since then she’d make too much to receive all the benefits. Why on earth should I pay more taxes to fund more benefits for her?

Data says her kids will be far more likely to end up living off government benefits too, since it’s how they were raised. The cycle repeats and not for any reasons other than laziness and entitlement.

I’d honestly support UBI if it meant completely scrapping all the federal, state, and local welfare programs. We all know what’d happen. Poor people would blow their UBI check the day it comes, then people would say we need to bring back the old programs to help these poor people. We’d end up with UBI and the existing programs.