Today AH. PLTR earnings.

https://www.barrons.com/articles/palantir-earnings-stock-price-7a847b7a?siteid=yhoof2

Today AH. PLTR earnings.

https://www.barrons.com/articles/palantir-earnings-stock-price-7a847b7a?siteid=yhoof2

Sorry for those who don’t understand PLTR and what is AI esp ontology-based AI. Btw, CRWD also used ontology-based AI.

Palantir Technologies Inc. edged out expectations for the latest quarter, as the software company said Monday that its artificial-intelligence story continues to play out.

In the fourth quarter, Palantir’s U.S. commercial business saw 70% growth in revenue to $131 million. “The demand for large-language models from commercial institutions in the United States continues to be unrelenting,” Chief Executive Alex Karp said in a letter to shareholders. Palantir’s “momentum with AIP is now significantly contributing to new revenue and new customers.”

As I told those who don’t update their info, the bull case for PLTR can be summed up in one word: AIP

I wonder if this means they solved the bottleneck with how to onboard new customers faster. If they did, that changes their revenue trajectory.

@manch’s ex-countryman has wisely dropped TSLA and replace with AMD. And boost PLTR ![]() to number 2 position.

to number 2 position.

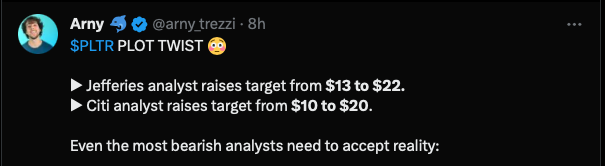

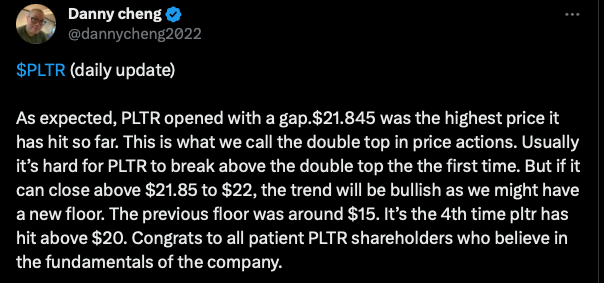

Disclosure: Took 15% off PLTR holdings. $21.85 is strong resistance. Might or might not be broken above. Above would be very bullish.

.

Double top or a failed double top?

Danny has similar opinion…

I’m amazed at the amount people put into options. They are literally gambling with that type of trade.

.

I know. Not sure whether they are new to option or just born that way.

All rocking.

PLTR continues to moon ![]()

Investing is about the future. Don’t put too much weight on past financial snapshots.

Bragging:

2023 gain 200%

2024 ytd gain 30%

Reality:

-7% ![]() from Dec 31, 2021

from Dec 31, 2021

The reason I lost a bundle in 2022 is because I average down in Mar and Jul thinking is the bottom, and didn’t sell during the dead cat bounce. Bottom finally in Oct.

I am with John. They serve different subsegment with a slight overlap.

I own 4 data stocks.

CRWD - Cybersecurity (edge)

NET - Website hosting + web security

PLTR - Data analytics (end2end ![]() )

)

SNOW - Datawarehousing

![]()

With above, value of growth stock portfolio is above that on Dec 31, 2021.

YTD gain = 40%

2023 gain = 200%

NET tripled since Puru panic sold.

![]()

How big is his following?

Disclosure: Didn’t read the deep dive nor understand what Antonio claims. Just sharing.

Many cybersecurity stocks, bought this one because I thought leadership is outstanding. Long ago, did read the technical details of a few cybersecurity stocks but don’t quite understand and completely forgotten now.