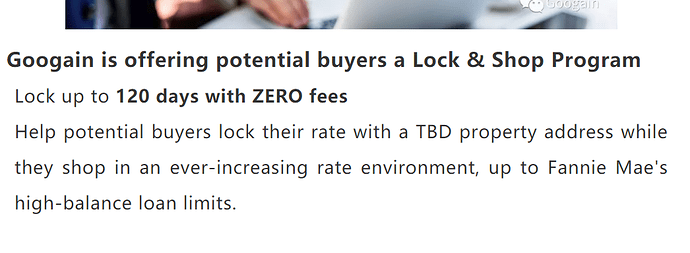

They claim they can exclude the payment you are making on the current home in their loan evaluation.

I wonder if it involves a bridge loan. Those used to be common.

common in a good or a bad sense? Like any place in financial collapse of 2007/8?

It doesn’t sound like a loan. It sounds more like counting RSU as income kind of thing.

They were available long before that. It made sense to allow people to buy then sell their existing home. That way they don’t have to move somewhere temporary in between.

That’s my Tracie’s firm that is offering it. Maybe I ask her about it.

This might be what I need, if legit with no strings attached

Wells fargo said if you list your home for sale they could exclude it from DTI.

Nope, not seeing your PM. Come on, I get plenty of PMs. All you do is click on your big old N ball in the top right and there in the right side is the email icon. No worries, I PM’d you with Tracie’s number for you to ask about this feature from her company. Good luck!

My experiences with Googain have been good.

In what way?

purchase and refis. good rates and prompt service

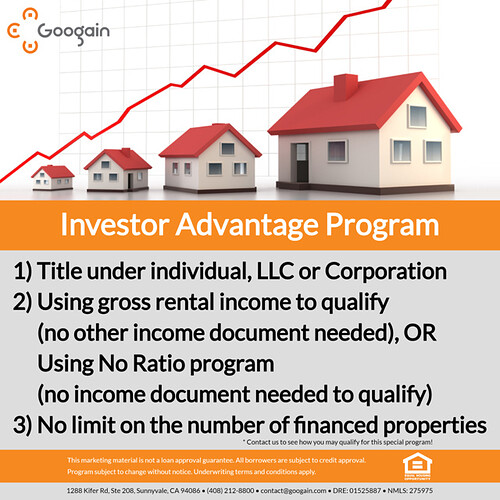

So, I spoke to Tracie and she said there are all these programs now. This one sounds good where the loan is based on the projected rental income and not on your debt/income level. Ok, buy, buy, buy!!!

What’s the LTV and rate for the rental program?

80% and rates are a tad higher. Call for more info…

Just put your gal’s contact info here out in the public. Save people’s time PM’ing.

T R A C I E (510) 828-4988 (an obvious follower of the lucky 8’s)

As always, YMMV as credit scores and financial situation are all different. Yes, she did happen to lock me in once on a 2.5% fixed 15 year loan. Keep in mind my financials are steady and pretty decent and I do have a credit score of 810. Good luck!!!

Here is another program: