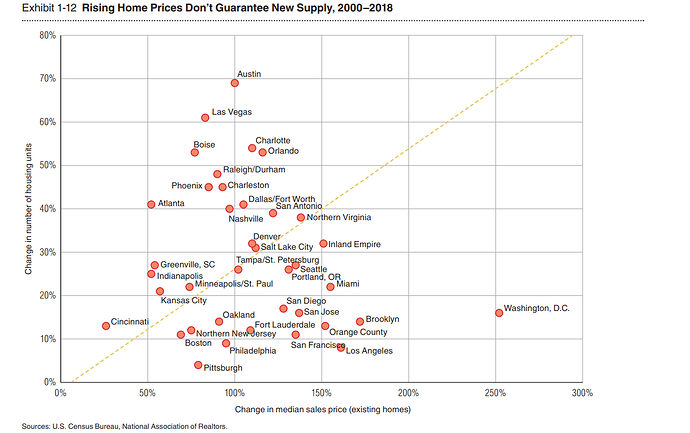

This is why I wont buy in Austin. …They can build too much…Look at the difference with DC with restrictions on building compared to the wild west laissez affair Texas build baby build…5 times the build rate

I have been semi interested in Washington DC for years but never really seriously consider it. It’s amazing that it has doubled SF appreciation for the last 17 years. Obama and Bush have definitely made the DC people rich!

With Trump planning to “drain the swamp”, is DC still worth buying?

Also I heard that water pipe could get frozen and burst if you happen to have a vacancy in the winter, is it a real concern?

I wouldn’t buy there…But obviously locals are rich…Endless supply of money in the swamp

Buy Austin. Despite the no restriction in building, prices shot up 100%! Plenty of choices. It reminds me of Singapore in the early days, build build build, prices up up up. Way to go, baby.

Looking at the data, LA is super. Can Philadelphia climb?

Despite restricting building to 1/7 of Austin, price in SF only manage 40% more gain?

Is it cash flow positive or are there inherent risk dealing with political tenants?

250 is two and half times 100…100% over 18 years is only 4%, rule of 72, a year barely beats inflation and is about what your mortgage is…You will have to make it on cash flow alone in Austin. .which will mostly be devoured by maintenance and ever rising taxes

Well, DC is 250% and SF is only 135%. Don’t forget the subprime crisis.

4% appropriation is not bad since you still have the 4% cap rate. And a 5X booster due to leverage

Any1 has RE in Washington, DC? If not, is just an academic exercise comparing our property investment vs it or the message is we all made the wrong RE investments or the message is we should sell all current RE investment to buy there since past performance is an indication of the future? All of us have properties in SFBA. We should evaluate those amongst each other. Looking from past data, Oakland doesn’t look like good investment despite not much construction can’t even make 100% gain but from what I read here, is super investment if invest in 2009! Looking backwards is so cool

Poltical tenant is fine. I’m interested in promising politicians as a tenant, and am willing to donate the house for a museum when he becomes the president

However, no thanks to the stupid crying baby activists

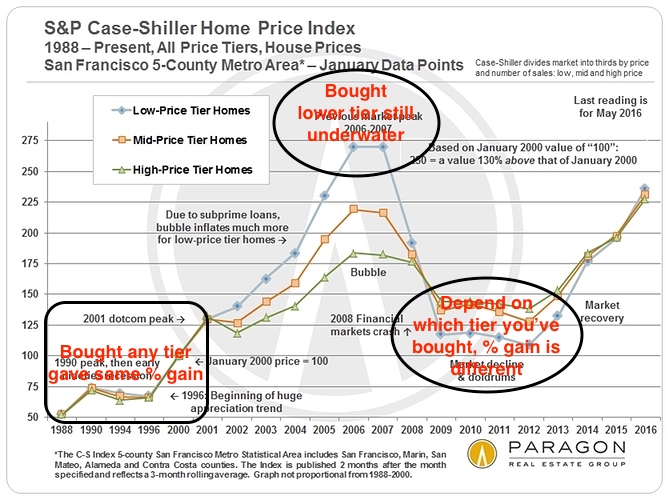

Just a simple diagram to show when and what tier matters. Always bear in mind, investing is about the future, not about the past.

If 1988 is a year all 3 tiers at their fair value, they are all the same today, no difference. 2007 could be an aberration exaggerated by subprime flooding

No aberration. Is because of the hyper growth of internet companies creating a sudden disturbance where short commute to those companies are worth a lot suddenly. Check the origin of the divergence. Since 2014, the price appreciation is climbing at roughly the same rate, so the population redistribution could has stabilized i.e. the rate of change could be harmonized again and no longer matter what the tier you’ve bought now since they would change at similar rate.

2001-2007 was the dot bust period with a housing boom aided by low rate and subprime lending. Dot com boom was from 1996-2000. Second wave of tech boom is from 2012-2017