You are like that salty wet uncle who sees salt in every word.

If AAPL gets down to 52 week low I’ll buy some more with new money

No matter how hard it falls, still much better than Bayview.

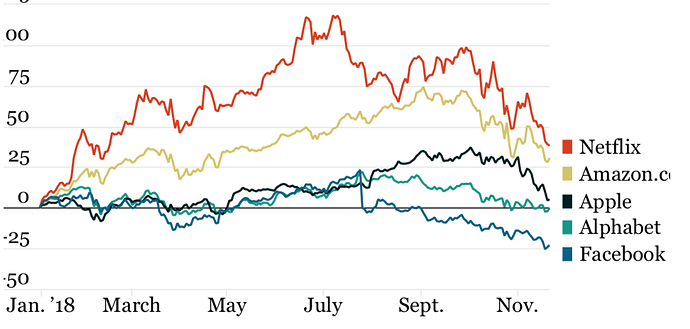

The FAANG Stocks: A Case-by-Case Analysis Tae KimUpdated Nov. 23, 2018 8:58 p.m. ET

“These kind of market drops usually create buying opportunities.”

Individual investors don’t have to swing at everything. They can wait for the best “fat pitch.”

Apple (ticker: AAPL)—Not Yet

During the last disappointing iPhone product cycle—the 6S and 6S Plus—Apple stock fell 32% from peak to trough in 2015 to 2016. That fall has almost played out again. A similar decline would suggest a bottom of $165 for Apple’s stock. Apple closed the week at $172.29.

Facebook (FB)—Good Value

“There is going to be a regulatory overhang, and the stock is facing headwinds from selling pressures and market liquidity,” says Sarat Sethi, managing partner at Douglas C. Lane & Associates. “But the company has unbelievable, valuable properties in WhatsApp and Instagram that will be monetized.”

Netflix (NFLX)—Too Many Clouds

With rising streaming competition coming from Walt Disney (DIS) in late 2019, plus a pricey valuation and debt-laden balance sheet in a rising interest-rate environment, Netflix shares may fit in the “don’t swing” category.

Amazon.com (AMZN)—Slowing Growth

Perhaps more worrisome is the declining growth of Amazon’s core e-commerce business, which drives the traffic and flywheel for all of Amazon’s other highly profitable businesses, including cloud computing, its third-party marketplace platform, and advertising. Amazon’s “online stores” revenue—the products it directly sells to consumers—grew 11% in the third quarter, down from 22% a year earlier.

With Amazon’s valuation fetching a heady 56 times Wall Street’s 2019 estimated earnings, it doesn’t leave much room for error. Investors should be wary of the stock until growth resumes.

Alphabet (GOOGL)—Most Attractive Bet

On top of its core ad business, Alphabet has several early-stage businesses in secular growth markets such as cloud computing and artificial intelligence. The biggest potential upside could come from the company’s Waymo subsidiary, which is regarded by many experts as the current leader in autonomous-driving technology.

Thanks to the long runway for its core business and the call options from its other still-young efforts, Alphabet stands out. It’s the FAANG worth swinging for the fences.

My rank is

- AAPL

- AMZN

- GOOGL

- NFLX

- FB

The reason FB is not regulatory control, which is also applicable to GOOGL & TWTR, but revenue growth and expense control.

I still suspect profit margin can not be maintained at 37.1% level and revenue growth is questionable increase at 20% year over year basis.

Amazon now has their own CPU’s:

• Amazon (AMZN +0.4%) Web Services begins using more efficient ARM-based server chips with the AWS Graviton Processors announced at the re:Invent conference.

• Amazon says the processors are optimized for scale-out workloads that can spread across multiple smaller instances.

Continuing my journey of reading first hand material on companies, tonight I read up on Amazon and AMD.

Amazon’s earnings conf call was quite informative. Amazon was slowing down headcount and fulfillment center footage growth so they are showing a ton load of profit. Their HC growth was some crazy number like 40% or so last year, I forgot the exact number. Obviously you don’t need to hire that many more people year over year.

Amazon’s earnings statement sucks. Very little information. The only business segment they break out is AWS, which makes more income than their entire retail operation. I wanted to find out the seller service margin but Amazon hid it inside overall retail. Revenue is 10B last quarter, out of 30B for retail overall. I bet margin is quite good but I have no way to find out.

Heard the Credit Suisse interview of Lisa Su. It’s quite informative. As expected Su sounded very smart. Fabbing server chips on TSMC 7nm is a game changer. I am now a fan.

Also, found this on Lisa’s Wikipedia page:

Su and Nvidia’s co-founder and CEO Jen-Hsun Huang are close relatives; Su’s grandfather is Huang’s uncle.

![]()

There’s a reason for that. Company earnings statements and quarterly presentations are some of the best competitive intelligence you can get. Why hand potential competitors a blueprint if you don’t need to do it?

Since Aug 28, 2017,

F10 +13.65%

AAPL +10.60% So disappointed, fell behind F10 and Google

GOOG +21.43%

AMZN +78.66%

NFLX +71.21%

DimSum -5.94%

Replacement for FAANG,

As the famous ‘FAANG’ trade falters, these five tech stocks are the new favorites of top analysts

MPVTC

I have been researching Salesforce the last few days. Very interesting company. It’s the only company I know that gives guidance all the way to 2020, and states explicit revenue goal for 2022. It’s also way more than just doing customers management for sales. That part I didn’t know before. They have close to 100 short videos on their IR site going over their capabilities, organized into different areas like sales, service etc. Very informative.

Also their earnings call is pretty interesting. Benioff just talked about whatever he felt like talking. Pretty freewheeling as far as conf call goes.

To be or not to be? Can $1T within 5 years?

Still researching. Did you know Salesforce runs e-commerce sites for corporations? Aka directly competing with Shopify? I did not know that. It’s very broad company and Benioff seems to have boundless ambition.

Not sure about 1T, but doubling in 5 years seems like a certainty.

Multi-year subscription deals.

Don’t hold any of the five, hold their competitors,

MSFT - AAPL (kind of)

PYPL - SQ

VMW - NTNX

TMUS - VZ

CRM - SHOP, VEEV (close enough)

Not close at all.

CRM’s closest competitor is SAP or Oracle. SHOP and VEEV are just niche plays.

Close enough.