I don’t have amzn and techy!!!

GOOG is the only one I don’t have.

Feeling the peer pressure now. Based on closing price, AAPL is up by 1.6% from Aug 28 underperforming F10. Need to consider opening a new account to purchase F10 ![]()

I’m slowly working towards smaller cap names. I’m not sure I’ll hold apple past the mythical iPhone 8 upgrade super cycle. I may start trimming FB soon.

My small cap portfolio appreciates 2.3% since Aug 28 so underperforms F10.

Since Aug 28, F10 appreciates 2.9%, my micro-cap portfolio appreciates 3.63%.

If you have to put all your money into only one, which one would it be?

I wouldn’t make major decisions based on 1-week of performance. If you want to go week-to-week, then start day-trading options.

Typically, stock market peaks in Aug and bottom in Sep/ Oct.

This year, FANG peaks in late Jul. So can start fishing in mid/late Sep.

Since Aug 28,

F10 … +1.14%

AAPL . -1.76%

mCap .+7.71%

sCap . +0.08%

mCap = abbreviation for micro cap stock portfolio of LQMT, SYNA, AMBA, SPWR

sCap = abbreviation for small cap stock portfolio (10x)

wuqijun - the most risky portfolio is performing the best

As they should. Why else would you invest in them? High risk = high reward

Positive analysis of GOOGL…

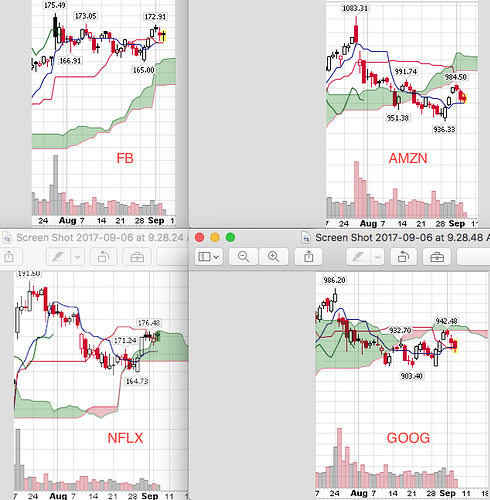

FANG is declining.

Two of ANT declining, TSLA up

Two of BAT up, Alibaba declines.

Since Aug 28,

F10 … +5.31%

AAPL. . -0.98%

TSLA…+9.88%

mCap. .+7.87%

sCap… -1.52%

So far, data shows that F10 is better than sCap, Marcus would say that is only a few weeks, time will tell

Luckily didn’t do BAGD’s style of putting all in immediately, would be -20% instead of just 1.52% lower.

AH, NVDA hits by bad news, buying opportunity coming up😀

That’s not much of a drop. It’s been on fire.

Should decline eventually to $155-$160  Patient. I have some short puts ($140), would add if it hits $160

Patient. I have some short puts ($140), would add if it hits $160  So far, make good money shorting puts

So far, make good money shorting puts  and is willing to buy if below $140

and is willing to buy if below $140

I rolled my Jan calls this week, and sold 2week OOM against them. Ready for the seasonality to start in October.

Since Aug 28,

F10 … +4.44%

AAPL. . -5.93%

TSLA…+1.57%

mCap. .+9.56%

sCap…-1.70%

mCap continues to blast ahead and beyond

Apple and Tsla, 2 of my big bets, continue to get hammered and slapped in the face…