My ETFs are 20%-30% taxable account, just for holding long for capital gain.

I prefer direct stocks (REITs or TECH or any others) for higher returns (Other stocks) + Dividends (REITs).

For me, Stocks are returning more growth than ETFs

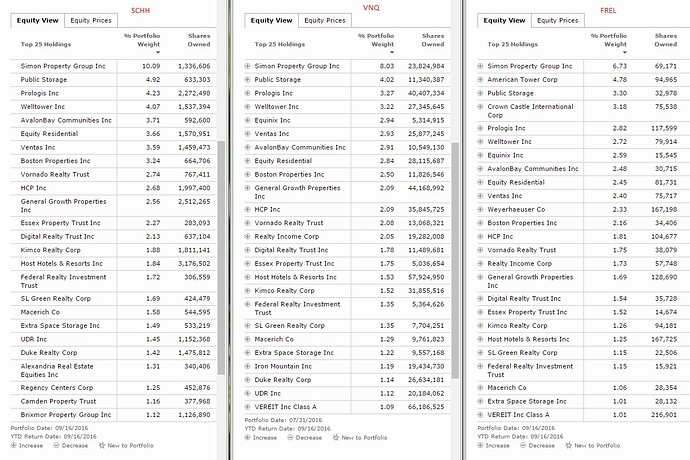

I had SCHH and VNQ, but sold both to consolidate commission free in fidelity FREL. For REITs, we have three big companies (all are commission free) SCHH, VNQ and FREL. Their holdings almost same, but percentage differs. It is really tough to differentiate as we need to see which REIT sectors are booming and what is making better returns etc.