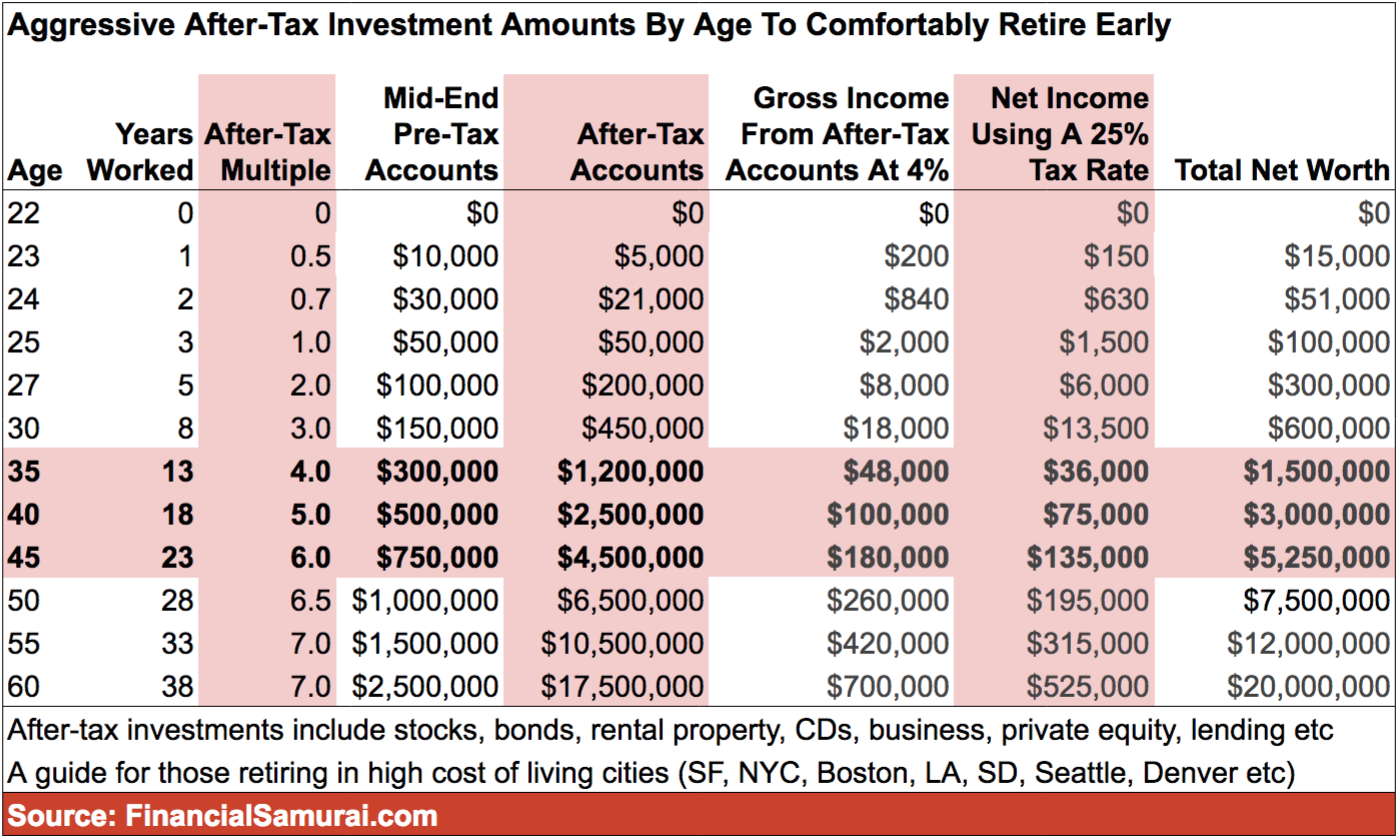

If you retire at 40 with $2,500,000 in after-tax investments, you’ll only be able to generate $100,000 a year in gross income or $75,000 in after-tax income based on a 4% rate of return. Is this enough? Not according to the Department of Housing and Urban Development, which considers $100,000 a year “low income” for a family of three living in San Francisco, for example.

Buy $2.5M of AAPL.

Yield 1.31%.

Sell some AAPLs when 1.31% dividends is used up.

Don’t worry about capital reduction since AAPL appreciates at annualized rate of 22%.

He’s assuming 4% return on the $5M. You can get that with tax free muni bonds which then eliminate the income tax. He’s also assuming zero principal reduction.

4% is the golden standard every retirement advisor uses.

This shows that income gap and wealth gap is actually much smaller now than centuries ago. The so called “rich” people are not that rich at all. The key reason is that labor cost is becoming expensive. The difference between a “rich” person and an “average” person is very small, or much much more smaller than 100 years ago.

If that’s the standard, then you’ll be accumulating more wealth.

In terms of nominal dollars, sound very wide. In terms of quality/ standard of living, not that much different ![]()

$5M too little. $10M is good.

the right answer is how much do you plan to spend (what’s your lifestyle going to be) when you retire. That will give you the topline number.

$10M will definitely give you a better lifestyle than $5M.

Will it really be a measurable difference? What would be different?

If someone goes to such advisers, they will get only 4% returns. Avoid those retirement advisers.

This person says retirement at 40 which is not right. At 40, if a person has 5M, he/she is Super Rich even today’s standard.

They are talking 5M at the age of 40. The holder, with 7% S&P500 buy and hold, can make 5M to 10M at age 50, then 20M at age 60.

Absolutely measurable. Can take 2 trips to Europe rather than 1 and buy 2 Teslas instead of 1.

This is luxury life like Crazy Rich…

Need $10M at 40.

He/she is super rich then.

The simple way to calculate.

Take last 5 years of credit card statement to find out how much year over year we spent. Calculate average expenses (all expenses) using the five years.

Say 100k/year, then this is your expense.

Multiple Teslas and multiple Euro trip is your own desire to enjoy, there is no limit.

Even if we have 100M, we will say not enough.

$5M, 1 trip. $10M, 2 trips. $20M, live there half the time.

Unless 5M or 10M is from lottery win, most people will continue to invest after retirement at 40 or 50 and even 60. It’s a good habit it’s hard to stop completely.

If you are worried, just use your 5M to buy 10 apartment buildings in SLC or Phoenix with 50% leverage, or 5 buildings with no leverage. Hire a PM to manage for you. It’s still a good retirement with a small amount of work to manage the PM and think about your strategy.

Many 75 year olds are still working on high stress jobs. I think it is nice to retire at 40-60.

It’s hard to imagine a retirement where you do nothing but eat, sleep, exercise and travel. You may like 1 day of taking care of your investment or finances per week.

What so hard to imagine that? It’s hard for me to imagine having to spend 8 hours at the office pretending to like your boss.