A twitter explains history of MQ and how MQ works but… what about the effectiveness of its monetization approach? Apparently, not good. It doesn’t have pricing power.

AFRM tumbles on earnings dragging UPST along.

Long UPST. No AFRM.

-

They don’t even show R&D expense on their P&L. They only show Sales and G&A. They are a tech company how?

-

Their provision for losses is growing much faster than revenue.

-

If you do the math, the average transaction size is decreasing. They have 150% more consumers and # of transactions per consumer grew 15%. Yet, GMV grew 117%. My hypothesis is they are going riskier and riskier and smaller on transactions to try to keep revenue growing.

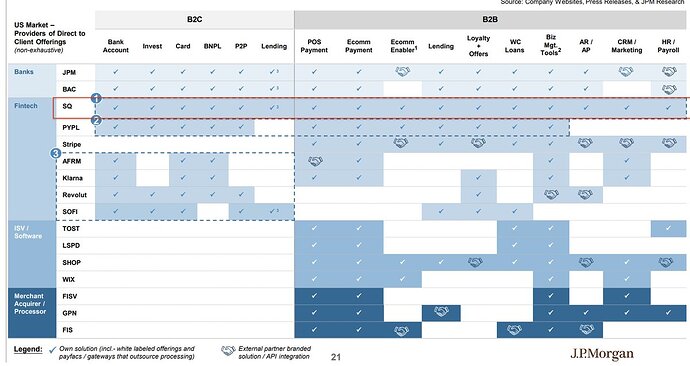

I believe that time of paytech is over. This activity is commoditized and lot of channels to make online payments/credits.

When will this BNPL insanity end?

When consumers default on the payments, and they fail in epic fashion.

How are they so financially superior to Affirm? The difference is crazy;

Can it grow to $300B?

Lending club just reporting earnings. They were part of the last big innovation in fintech. Their market cap is a huge $1.5B now. They didn’t change the world.

Red or green, depending on your purchase price.

The last big thing that change the world is iPhone. I am expecting a project out of blockchain to be the next big thing, not here yet unless you count crypto coins. For some foreign nations, crypto coins are life-changing. Metaverse… may be 1-2 decades later.

Somehow I got the feeling he is thinking this way because he is a finance guy and don’t understand engineering. He looks down on hardware stocks like TSLA AAPL NVDA.

“Roughly 30% said they’ve struggled to keep up with the payments and have had to skip paying an essential bill to avoid defaulting.”

Exactly. This is just another subprime, and it’ll eventually have sky-high default rates.