I think most don’t achieve FIRE until their kids are grown. There are too many unpredictable expenses while kids are young.

Mandated by ACA, insurance companies can no longer set payout limits for essential health benefits:

Instead of inventing numbers, that will be obsolete when you retire, you should buy books about how to invest for retirement. And by that I don’t mean only the Russian roulette of the stock market, which can be good for some people and a disaster for others. And if you do participate in the stock market, certain rules you follow, and many rules are written by people who have had failures and successes during their lives.

Also, you need to know when to call it quits watching the stock market. I know some people in my area that invested in HP, IBM and Apple from the beginning, have their homes paid for, SS check coming, and are just enjoying life going to eat at restaurants in Woodside, traveling to Germany, Europe, whatever they please and they are not talking about working one day more. 66 years old, no kids, no grandchildren, no nothing! They, contrary to what I am saying, just cash their stocks and that’s it.

In order for you to retire, and I mean retirement, not your “I will work for Walmart or McDonald’s or volunteering for fun because I am bored”. No, retirement is about getting away from any responsibilities that stop you from enjoying the last years of your life.

1- You need to aim at your Income being tax free.

2- If not, such income should qualify you for the minimum, if not 0 tax bracket. Otherwise, under the current rules, your SS check will be taxed 85%, I think is the type of double taxation we all talk about.

3- Need to have a long term care program. Nowadays, any cheap life insurance with living benefits will suffice. Aim at having a $1M coverage, or at least a $11K a month for 48 months. It will help you to not “spend down” your hard earned money to qualify for Medical. Otherwise, you being cocky, will need to spit $15K a month nowadays, I don’t know how much in the future for a monthly payment for homecare.

4- As I said, your assets, your investments should be under the lowest tax rate or fees possible. And they never, ever be subject to the effects of a bad economy. And, if they are, can you recover?

5- Liquidity is something you need to have. Most of investors during the last recession lost their assets because all their money was invested on them. Owning 7 properties is good, but depending on the rent of each one is not that good. I learned that from talking to many people who went to foreclosure.

6- Though I think retirement is about being old, I rather see a young 40’s old person retired and going worldwide on adventures than a 70 old guy on wheelchair still worried about his bills while he can pay for them no questions asked.

Many ways to retire, but the question is: Do you love your money or gambling nature, or hoarding homes activity than living la vida loca? We live only once. And nobody knows when they are going to kick the can. Do we?

I used this strategy at 21 worked out well. Don’t wait to buy, buy then wait

Buying a primary in BA won’t get you FIRE in BA. It can get you FIRE in less expensive areas. Say you bought a Sunnyvale house for 600k couple years back and it’s now worth 1.8. Tripled. But if you chose to stay in Sunnyvale you still need a place to live. How can you FIRE in BA?

Buying primary is necessary but not sufficient.

Primary home will never give you FIRE. Only rental properties and stocks can do the job.

They say not to buy a single family house as primary, buy a multifamily house as primary and live rent free and mortgage free. Your tenants are supposed to pay your mortgage.

So Teri is on the right track on thinking of duplex. Everyone should try to buy a duplex after graduation. Or just buy a 5 bedroom house and rent 4 rooms out. You should achieve FIRE in 10 to 15 years after graduation.

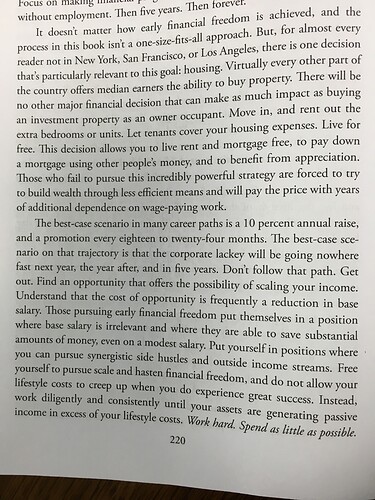

He excluded SF, NY and LA from the places for using rentals to achieve FIRE, probably due to high downpayment and low rent.

We should buy 2-4 units and then promote this book to all the millennials. Make this book a required book for college graduates or high school graduates

Buying multifam, living in one unit and renting out the rest is a good strategy.

What book are you referring to?

Set for life

Thanks. Just looked at the description. It’s more for the under 30 age group. Are there any tips in it for someone like me (over 40)?

You can skip the 1st half. The second half is useful for everyone

Maybe you can list out the bullet points? I was thinking of that book too and afraid would be too many things that are not useful.

House hacking is not for every one

The book is well written though I did not read the earlier part about saving money and changing career to sales etc. I think I like the book since it’s written very clearly and even engaging. But mostly I find the opinion matches mine and it just reinforces my idea about FIRE. I guess the author agrees with me more than anyone on this forum.

I think it’s not a book on how to get rich quick. It simply convinces people that rental property is the best way to reach FIRE. It’s not a book where you find actionable tips, it’s more about well researched approach to FIRE.

Only thing surprising is that he labelled financed education as a negative asset (again, I am not a fan of over-education).

He also labelled expensive primary home in upscale neighborhood as toxic asset, so is the expensive cars.

All in all, it’s a book for beginners. But I like reading it for its FIRE philosophy, not for its formula to savings and investment.

Over education is an indulgence. I graduated at 21, worked immediately and bought my first house at

22 with partners…While I was flipping houses my friends went to graduate school. Not one ever caught up with the lost income and opportunities I took advantage of. invest early and don’t incur huge student debt…

Is this book a well known book? Do you guys already know of this book?

I accidentally saw it on the library shelf and decided to borrow it after flipped a few pages.

Most of us read, listen or refer to BiggerPockets.com and I believe that book came out from there and they promoted in a few of their episodes (given author works there).

It’s written by that house hacking guy up in rural Washington?

OK. I am an elitist. In my mind, there is major league and there is minor league. Coastal California, NY, Boston etc are major league areas. Flyover states where houses sell for 200K a pop are minor league.

I don’t think advices coming from minor league players apply well in major league areas. Before you take anyone’s financial advice, ask yourself, do I want to be like that guy? Do I want to live in similar areas and have similar lifestyles? Only take the next step if the answer is yes.