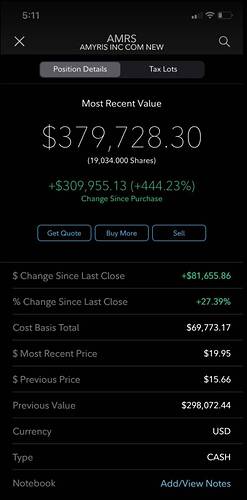

I do not have cash and do not want to go over margin now. They released earnings recently, loss more than expected. This may not go up immediately and waiting for my cash release after market is up !

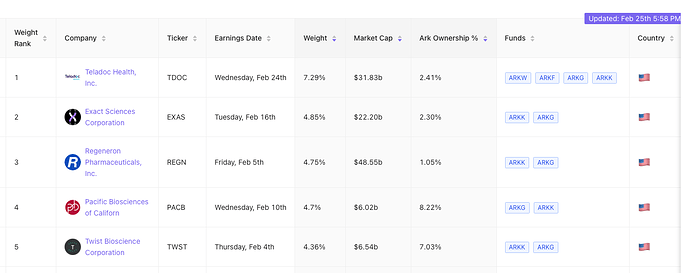

Cathie sold AMZN GOOG AAPL to buy TDOC SQ TSLA

I have cleared some money but that may settle Monday. I have buy TDOC and DCA for CRSP and TWST whatever qty possible by me. None buy and hold but swing trade.

If I can free up some more money tomorrow (if market swings up), that would be nice too!

Recently, Cathie is in love with BEAM and EXAS. She has been selling TWST… don’t know whether there is something wrong with the business or just selling high to raise cash.

Massacre of genomics.

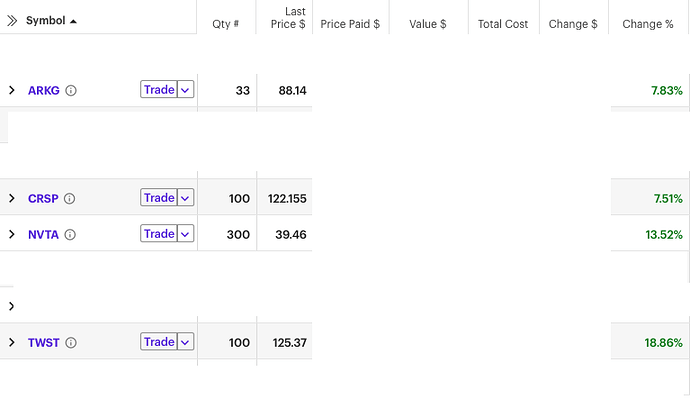

My holdings,

ARKG - 30 shares, very RED.

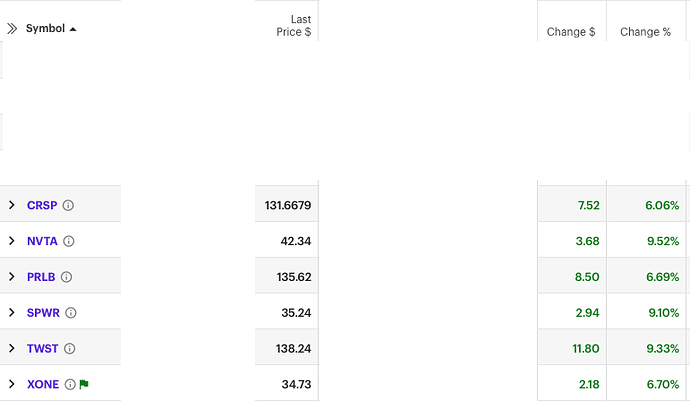

CRSP - 100 shares, very RED.

NVTA - 200 shares, very RED.

TWST - 100 shares, very RED.

MRNA - very RED.

REGN - very RED. Today is very green?

TDOC - Sold in time.

Biotech is a burial ground

Even AAPL got hit 17% not because of AAPL mistake, but market correction, do you agree or not?

.

DMTK OM TMDX

Nice! I’m long TMDX and DMTK. I rode the last run-up and sold but after a recent correction, I loaded heavy. I’ll go in/out though via up/down cycle. Very speculative for both so volatility will be huge. I don’t think TMDX is a 10 bagger though.

10-bagger is no longer exciting, so many stocks shot up by 10x over the last few years. Look for 100-baggers ![]() like AAPL AMZN TSLA.

like AAPL AMZN TSLA.

friend in Apple asked me to buy more Apple shares as AR/ VR projected to be next big thing

Is the reason why I am buying U ![]()

Blindly follow Cathie into IONS would be disastrous. Better look at the technical first. Cathie’s EW guy is not that good or Cathie over-rules him.

Never buy biotech on a Monday or any other day

The analysis found that 53% of biotechs and 51% of nonbiotechs failed to maintain their IPO market value, while both groups generated similar amounts of shareholder value. … "Despite the extraordinary performance of the biotech sector in recent years, biotech is still often portrayed as a high-risk investment.Jan 7, 2021

The biotech industry tends to attract investors when it is most overvalued and scares investors when it provides the most opportunity," says Dr. Selena Chaisson, director of health care investments at Bailard, a boutique wealth and asset manager based in San Francisco.Jan 29, 2021