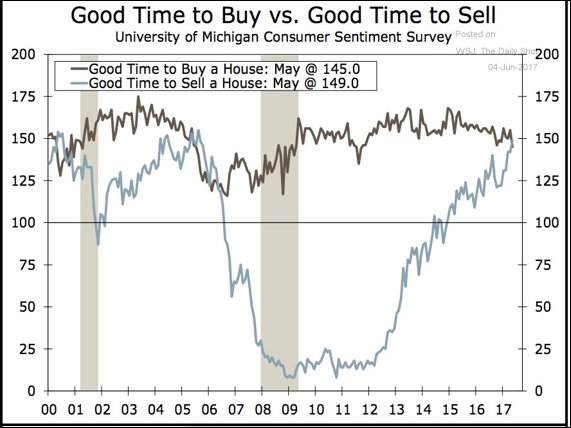

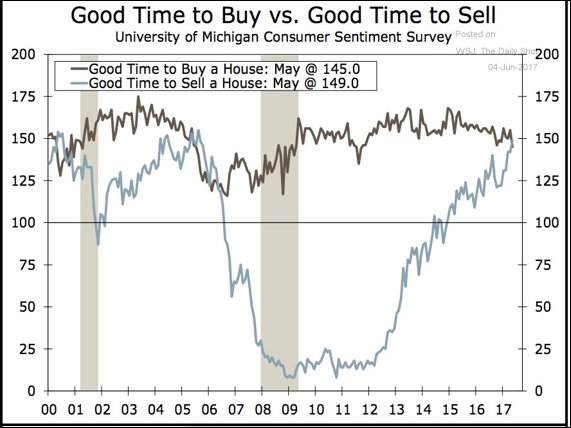

For the first time in a decade, more Americans think it’s a good time to sell than to buy. Maybe finally there will be more inventory on the market?

For the first time in a decade, more Americans think it’s a good time to sell than to buy. Maybe finally there will be more inventory on the market?

If you can come up with some app/program where you can connect mostly sellers together so that Sec 1031 exchanges can sync up more better to the benefit of all parties, I would be your first customer. A lot of people want to sell and exchange up/down but the fact remains they can’t find anything so nothing gets done.

Your pain comes from lack of inventory. There is not enough liquidity in the RE market. Hopefully things will normalize in 2018? TBH I am not that hopeful… I thought 2016 will see more inventory but turns out I was wrong. 2017 looks to be another bone dry year.

Who wouldn’t say it’s a great time to sell given prices and low inventory? The problem is where do you live after you sell? Actually selling depends on a lot of other things. Selling your home for a high price only to buy another for a high price doesn’t gain anything. It only matters if there are a lot of people that want to down size, relocate, or sell and rent for awhile. It’ll be very telling what happens as more and more baby boomers retire. If they retire in place, then supply will remain very tight. If they choose to down size and/or relocate, then inventory could increase. In CA, I’d be willing to bet most will try to keep the home in the family for prop 13 rights.

Wishful thinking here, but if the government wanted to knock out two birds with one stone it would allow some loosening of the rules around exchanges or allow similar treatment to capital gains as primary homes. Come on, is 45 days enough honestly to identify several properties? I say, no. Do away with that. Go with a as long as you replace an equal or higher priced home within 180 days or one year, you are good. Keep it broad. I know, not gonna happen anytime soon, but think about it if you reduce the pain points regarding selling, more people would sell and then viola there is your increased inventory. Out of box thinking is what is going to help us out of this housing crunch. If we want more starter homes out there for the millennials well incentivize owners to put it on the market. So, cheaper the home or sale price the higher the tax break.

Selling one property for another isn’t solving the overall lack of inventory problem. It just shifts it from one area to another. They’re far more likely to develop polices that motivate or force landlords to sell and not buy another rental property. Renters are already a majority or are becoming a majority in more and more big cities. That means the political climate will become very anti-landlord. It already is shifting that way with some of the rent control laws that completely go against property rights. The masses will use their political anger to take what they feel is rightfully theirs from greedy landlords.

Well, I am all for any kind of policy to get the properties churning. The reality is that if we want our precious Bay Area to remain relevant in the long term we need to be able to house a lot more people easily. Just because I own does not mean I think we can just keep our toys to ourselves without eventually answering for that stupidity down the road.

Make it hard to be a landlord. Although, I’m a landlord of many SFHs, but I feel making it hard to be a landlord is the right public policy, against my own interest ![]()

@sfdragonboy I got an email from RealtyShares with: "Do you own a real estate investment property? If so, you may qualify for a 1031 Exchange. RealtyShares is now placing 1031 investors with sponsors who are willing to accommodate investments via a 1031 exchange."

You might want to find out more.

Good data to find answers will be:

Yields are crap, so I think it’s pushed more people into owning rentals. I don’t see bond yields becoming attractive anytime soon.

Unless you count Venezuela bonds which are selling at 80% discount right now. @wuqijun loves high-risk, high-reward scenarios. If Venezuela actually makes the coupon payments and pays off the bonds when they mature in 10-20 years, then the ROI would be massive.

![]()

![]()

and NIMBY-ism keeps going in the other direction. No development. Here’s sunnyvale limiting neighborhoods to one floor only. what’s the chance that zone will rezone to R2 or higher and allow for multi-plex or high density housing:

while Palo Alto doesn’t want any hotels:

Have these people taken a look at room rates? and the high room rates causes people to start doing short term rentals like AirBnB/HomeAway which then turns around and reduces housing stock.

When we have the next stock bubble many landlords will be tempted to sell their houses to buy stocks. The fact that we haven’t seen that yet bodes well for the current stock valuation. We are far from any bubbles, except bitcoins.

If you are investing in real estate, You should never sell your property until and unless the market is down. 2017 is a good time to invest in real estate.

Buy low sell high…Why would you sell in a downturn. …Now is a great time to sell if you have to move or trade up…

Agreed! The best moves are usually against the herd if you are able to. So, that means buying when everyone else is down/selling and selling when top dollar is there for you. It is just a question of whether you really want to sell or not and pay the capital gain or are you even able to find a suitable replacement property.

If you looked at the chart I posted, the herd is not as stupid as people assume. The last time more people thought it’s better to sell than to buy is 2006-7, and that’s exactly the peak of the last cycle. And going further back, in 2000/1 people also thought it’s better to sell. and you know what else happened in 2001?

Well, I am coming more from the perspective of an individual investor making the “right call” (and not necessarily saying the herd was wrong) by buying low and selling at an predetermined target price. Sure, the market could still continue to go up but as long as the investor has met his/her financial goal/objective he/she could care less about what the herd thinks. Cashing out when you are up is not always a bad thing…

Are fellow bloggers the herd or smart money? So, sell or buy?

[quote=“manch, post:18, topic:2494, full:true”]

If you looked at the chart I posted, the herd is not as stupid as people assume. The last time more people thought it’s better to sell than to buy is 2006-7, and that’s exactly the peak of the last cycle. And going further back, in 2000/1 people also thought it’s better to sell. and you know what else happened in 2001?

[/quote]House price peaked in 2007-2008 right?

The interception is in 2005, so 2+ years later then peak.

If this holds true, the peak is in 2019-2020.