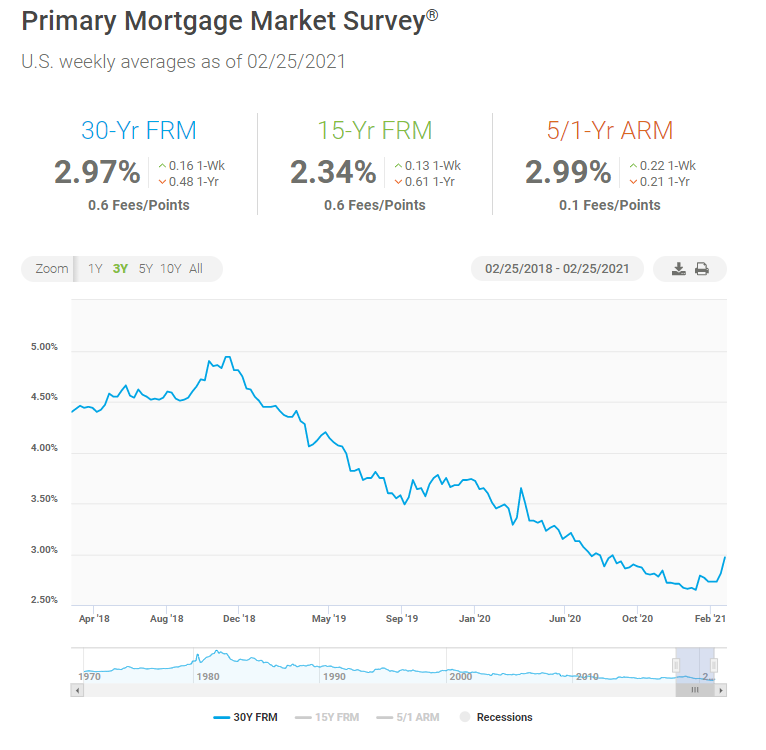

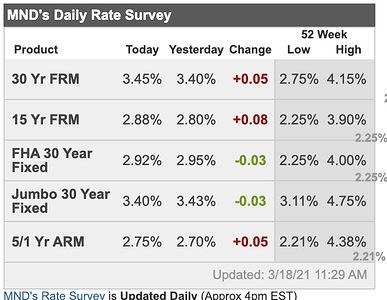

Still very low but on the way up.

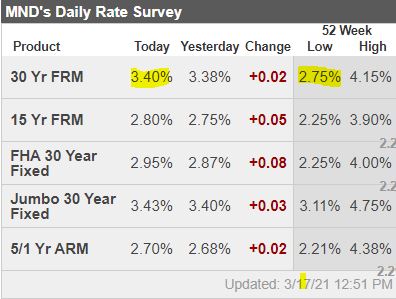

Rising rates only has moderate cooling effect on housing, says Black Knight’s Andy Walden

Should amend the title to mortgage rate is not sufficiently high to dampen housing euphoria

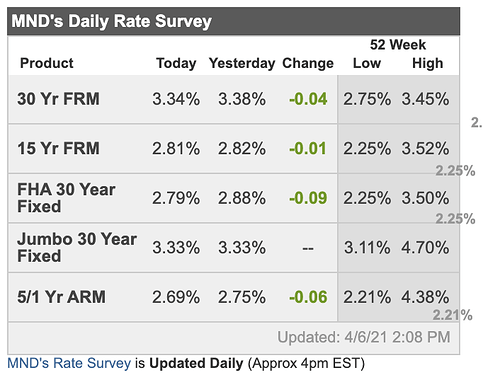

It’s getting there.

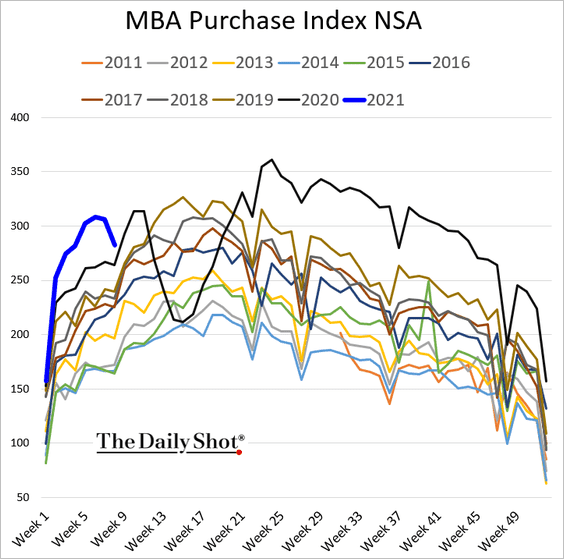

Isn’t no inventory past 3 months one of the major reason for drop?

Could be. But we should have more inventory as the weather warms up. The next couple weeks will tell us where the market is heading. Rates should continue to move higher.

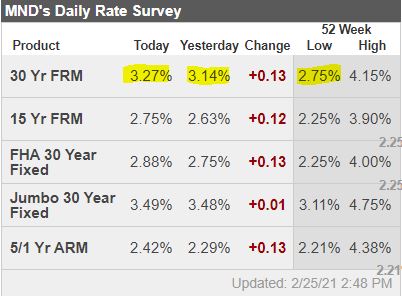

I am in the midst of refi’ing multiple loans. Rates are all 3-3.125% 30-yr fixed, some are jumbo, some are cash-out, some are no point no fee. I have one more loan lagging behind and loan broker told me current rate is 3.5% with everything else being equal to my other loans.

If 30 fixed continues above 3.25 on average, a 2.75 or lower 10/1 or 7/1 would be a reasonable alternative until we see a retracement for 30 fixed below 3.0 percent. Non Owner is nearly impossible to refi on an ARM so if your current Non-Owner rate is 3.875 or lower, stay put is my advice

Thanks for reading

It is interesting to see the 5/1 ARM higher than 30 FRM

Does it mean the lenders anticipate rate is not jumping much 5 yrs from now???

It means no one wants to buy 5/1 ARM MBS securities right now.

Once the 10yr hits 1.5, this should be the end of this run up. I may very well be wrong here, but that’s where this quick rise in rates may slow down considerably IMHO.

Thanks for reading

Another stock crash and rates will be down again. Meanwhile RE prices keep rising faster than rates.

Loan application to purchase a home. Quite a big drop last week but still higher than the last 10 years. May dip below 2020 if current downtrend continues.

Closed today a refi from 4% to 3.24% 30 year fixed no points - investment property - conforming loan.

Good you did it soon. I saw lenders have 7% cap on investment property from April 1.