Gosh, imagine how many more companies may be giving bonuses to their workers. Could be a boon for the economy…

Doesn’t the koolaid taste great? There are cookies too.

We shall see. It’s the classic YMMV… I am just glad the capital gains exclusion remained at 2 out of 5 years. That was huuuuuuge…

Lately, we have interviewed people in our office, they are trying to cash in their 401Ks as soon as the new tax laws start to be a certain thing. They hear, not my fault, this is going to be a temporary break until the next recession or correction comes . None the less, they want to go full into the Cryptocurrency. I just serve them, their money, their dreams.

We got another guy visiting us at the office this morning. He runs and organization that serves many SV companies and he loved our services.

We are going to be swamped with so many clients. After noticing how employees can manage their own money, some times up to 80% without any penalties nor taxes and still having that 80% earning 12.5% or 16% depending on the strategy, and knowing this is going to be forever  …this guy fell in love, he will be our spokesperson and we will be visiting companies by the 10s a month.

…this guy fell in love, he will be our spokesperson and we will be visiting companies by the 10s a month.

I can’t say the same for the regular folks who won’t qualify for that much tax cut, my condolences to them, but hey! An IUL will help them to recapture their expenses…

I am telling you, this following year will be so fraudulent, I mean, so productive for me

Not maybe, it is indeed good. People are paralyzed and can’t believe that tax relief is actually nice!

More lies. They aren’t earning 12.5% or 16% when they borrow the cash value. They have to pay 6% to borrow, so they are earning 6.5% to 10% in a good year. Then as your own data shows in 40% of the years they’ll earn less than the 6% it costs to borrow the money. That means at the end of the year they’ll actually owe money if they borrowed the full cash value of the policy. I know you can’t comprehend this, but any financially competent person can.

Another company…

Some millionaires and billionaires said that they do not need tax cut. Can those guys and girls give their tax savings to charities?

Giving shareholders’ money to employees is considered good?

No give it to me instead… lol

They are just trying to assuage their liberal guilt… a horrific disease…

They’re doing it for PR. The expense from such giveaways is far far lower than the what they will gain.

Actually it’s the moderate and conservative CEOs and billionaires giving employee tax reform bonuses now. Liberal CEOs and billionaires are having a big headache on how to spend the extra cash, on vacations, houses, cars or political ads?

Also by doing this year instead of next they are saving on taxes. They may just be being forward next year’s bonus.

When you are super rich it is hard to spend it all. So give to me… don’t waste it on political donations… lol

For sure. Happy New Year!

I am so excited, we are going to get $1K return, with it, I will be able to buy me a new car. Or remodel our kitchen.

Ooh…wait! Are we in 1950?

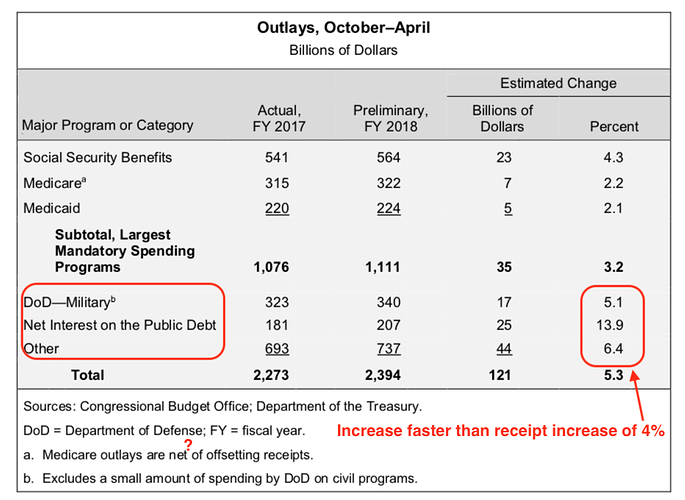

Tax revenue is increasing despite horror stories about tax cuts reducing revenue. The issue is spending growing faster than revenue. Social security and debt spending is going up.