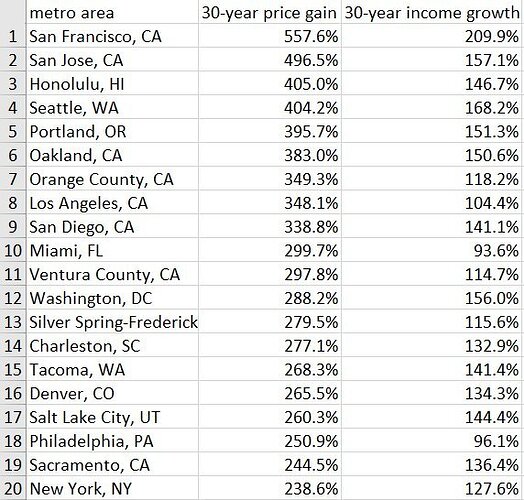

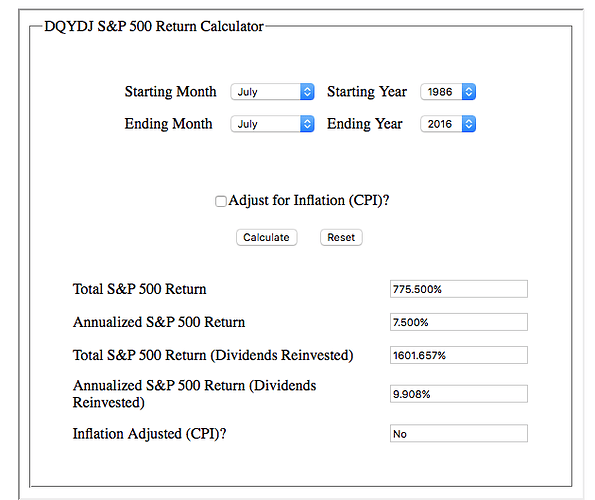

So SF RE return is 558%. S&P is 776%. From 1986 to 2016. 30 years.

Of course almost nobody buys RE with all cash. If you do 20% down that’s 5x leverage. Nobody can hold S&P with 5x leverage. You will get wiped out. In fact you will get wiped out in just one year: 1987.

5x leverage SF real estate return would have been a whopping 28x return over 30 years. Not bad.

All real estate are either 4x or 5x leveraged funds, Nice term for bay area!

Is that a fair way of comparing? S&P is just buy and hold, and forget about it. RE needs attention, PITI, PM, maintenance and whatever.

Good point. Also, S&P required reinvesting the dividends. Compound growth. What happens to the positive cash flow in RE comparatively?

The lack of leverage in holding S&P for 30 years will overwhelm whatever cost of holding RE. You also don’t pay any tax on rental income because of depreciation.

So maybe @Jil can crank out some spreadsheet model to do a more detailed analysis. But you know me. I am biased. So I am a believer in RE already. ![]()

Answer is there should not be any positive cashflow. Owner should keep re-mortgaging to wring out any cash to buy more properties.

Do you understand the difference between cashflow and P&L?

RE is a better investment (I believe this is true in SV) doesn’t imply the way you compute the comparison is correct ![]() which is my point.

which is my point.

I think we discussed this before on another thread about cost dollar averaging. I just can’t resist to challenge more here ![]() . Yes, the great plus of real estate is high margin but there is no free lunch as usual. Yeah, it is true that there is no margin call in RE and as long as you can pay your mortgage, arguably you can just wait until the next bull to come. But if you have too high of a debt ratio and spread your equity too thin, then in the down turn, you can’t even sell your properties to get cash. As rent went up so much in the last few years, it is not unlikely that rent will drop back down across bay area in down turn. Also, if a tenant lose their job and move out of bayarea, your cash flow will be hit 100% for that property, at least for a while. Not that I say that will happen, but you are counting on the winter to be mild and brief…

. Yes, the great plus of real estate is high margin but there is no free lunch as usual. Yeah, it is true that there is no margin call in RE and as long as you can pay your mortgage, arguably you can just wait until the next bull to come. But if you have too high of a debt ratio and spread your equity too thin, then in the down turn, you can’t even sell your properties to get cash. As rent went up so much in the last few years, it is not unlikely that rent will drop back down across bay area in down turn. Also, if a tenant lose their job and move out of bayarea, your cash flow will be hit 100% for that property, at least for a while. Not that I say that will happen, but you are counting on the winter to be mild and brief…

But can’t you sell if winter proves to be brutal? And here in California I forgot what winter is…

Also about accounting for PITI and PM: they either scale with income which is rising at less than half the rate of property value, or in the case of property tax rising at 1% thanks to prop 13.

I don’t see those numbers will affect the long term prospect of RE investment in SV.

For Long hold S&P and this home.

https://www.redfin.com/CA/Milpitas/1134-Edsel-Dr-95035/home/1102817

Appreciation works at 8.65%, Cap in current price 3.65%. Total YOY return is 12.15%

Cap I calculated Net income (after expenses). If we calculate cap at original price, it is way up !

Multiplex investment property beats S&P.

We can have many such examples when we take more than 20 years held home.

Careful choice with good location rocks in long term hold for bay area.

Like you said, I re-mortgaged again and again, taking cash out, buying properties. I still have appx $500k level HELOC unused.

This is fine while we are earning, either through job or investment etc (or as long as income stream is there).

The real issue is low cap rate for bay area homes. Even with multiplexes, cap rate is low in bay area.

My Real concern is how long we can leverage the home with mortgage. Presently, holding as long as I can.

At one point, we need to get rid of loan, especially around or after retirement. I am breaking my head what to do with huge loan amount at teasing rate 3.5% range. Excellent leverage, I do not prefer to pay off by selling one property !

Got rid of all my loans…But it is nice to have a line of credit for emergencies

Well done. Too much loans will be like swimming naked, is ok when time is good. We know who is swimming naked during recession.

Yes, holding it exactly, but not spending it as I am planning for semi/retirement.

The issue is power of compounding, even at 5$-6% YOY, is excellent for us with 5x leveraged home. The growth is on 5x while PITI almost remains same. With LTV less than 50% pre-2012 purchases, if I continue hold, value doubles in 10 to 12 years and loan reduces to LTV 25% level with just maintenance of property at cash flow positive, tax negative using depreciation.

The more we hold, better we are. At one point, when we have big profit, there is no point in selling other than forced selling.

See here, unless the owner is passed, where the inheritor gets tax free money, there is no point in selling this home. Very likely the sale is resulted by inheritance at step up basis.

https://www.redfin.com/CA/Milpitas/1134-Edsel-Dr-95035/home/1102817

I don’t understand why people always have loan-free as a goal. At today’s low rate it’s a crime NOT to max out on loans.

Another reason why I don’t understand the logic of taking out 15-year mortgage. Can people really not find any productive use of their money than to repay loans at < 3% interests rate? We just saw S&P returns over 700% over 30 years. If you just put that money buying and holding S&P index fund it would beat repaying 3% loans by a mile.

Once financial independence is achieved, there is no need for maximizing wealth. Enough is enough. Goal is to reduce attendant work and sleep well at night. Free to do whatever and go wherever you like.

How many cycles have you experience since you started RE investment?

Perfect ! I agree !