^^ This guy has a ton of good data and he has proven with his data that Bay Area RE (and many other areas) is in a super bubble and will burst in 2022. Do you guys follow him? Waht do you think?

Looks like he has been predicting a crash for a while. Does not look like a sound advice / credible – housing did not crash in late 2021, Austin TX has been to the moon when he recommended not to buy.

.

Price surging is not due to speculation, is for genuine fundamentals. So crash is unlikely.

California Lawmaker Proposes 25% Tax on Real Estate Investors to ‘Level Playing Field’

Similar to Singapore’s ABSD. But can CA do this? Property transactions are transactions between private parties.

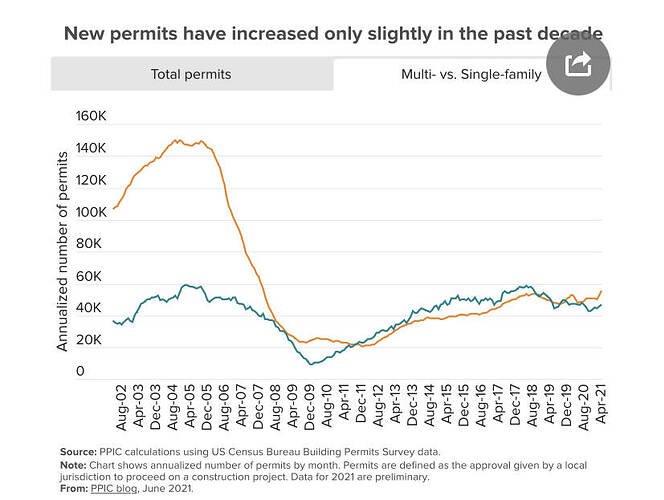

Permits don’t mean much if developers can’t get labor and cost of materials keep surging. How to price a development?

I follow him for 2 yrs. As @spacehopper mentioned he’s a pessimist. He shows good data but the inference many times is bad since he thinks 1-dimensional and doesn’t consider multiple factors.

Of course you’re right but it’s a start. It’s something

Small 1370 sq ft Sunnyvale house just sold for $3.22M! ![]()

![]()

![]()

RTO Madness??

![]()

.

Buyer(s) are madly in love with the re-modeling. Obviously Nouveau riche techies.

But the Bay Area real estate market is doomed! You just wait! Someday it will go down!

Been waiting since my first purchase in 2012! Stop the insanity.

Must be a relief ![]()

![]() . Insomnia must be gone now.

. Insomnia must be gone now. ![]()

But the Bay Area real estate market is doomed! You just wait! Someday it will go down!

I agree it will go down. I think we are at a local peak and prices in RBA, like for this Sunnyvale house, will go down 10-20% over the next 12-18 months, since stocks are going down and interest rates are headed up.

But after a couple of years of going down, prices tend to go back up again. So, I would expect that by the end of the decade - in 2030 - this same house will be worth ~ $5M

stock has been going down past several months and it didn’t deter home buying. There’s already talk about stock bottom nearing soon. Rate going 1% up doesn’t make a big dent. I see 10% up next 12-18 months. Large bunch of my friends who never thought about buying homes are in buying spree all over USA. Some even are buying blindly without any knowledge/ research. This’s like a mass hysteria. Anyways let’s see what happens.

Large bunch of my friends who never thought about buying homes are in buying spree all over USA. Some even are buying blindly without any knowledge/ research. This’s like a mass hysteria. Anyways let’s see what happens.

i.e. even the shoeshine boy is buying houses. Sounds like a ‘peak’ to me…