True blue Singaporean, only invest in RE.

IMO, he can clear off his primary mortgage if the rates are ARM or above 4.5%.

If he puts 500k (25%) , gets 1.5m loan at 5%, he needs to earn a growth of 6.25% ( both appreciation and cash flow after expenses ).

I guess now he may not have SALT deductions benefit using mortgage + property ( either less or very minor over standard deductions). He has to analyze which is better.

Since he own primary, going to rental is investment side. He has to weigh pros and cons analysis without which he can not take any decision.

Even though FED stopped rate hike, economy goes down, naturally real estate and stock will go down.

Highly risky at this time.

Better for OP to think though the process wisely than hearsay investment.

This is sensitive and my last update on this thread.

Good luck.

How come your last update says what I have said with the omission "for newbies*?

*luckily I include newbies otherwise BA_Lurker would feel offended.

The last thing a highly paid FANG employee in their early 30s should do is to pay down mortgages. OP has a long time horizon and can recover fully from whatever economic headwind in the short term.

No, don’t pay down any mortgages. Rather he should lever up even more.

This duplex in Sunnyvale looks OK. Can use up all of OP’s cash and mortgage allowance. What do people think?

https://www.redfin.com/CA/Sunnyvale/360-Kenmore-Ave-94086/home/665472

You are bleeding cash. Sunnyvale is great if you are planning an appreciation play. Not my cup of tea as I don’t like to bleed cash every month

Rent should cover principal and interests. Only cash bleed is property tax. Yes, rentals in prime Bay Area are mostly appreciation plays. Duplex is already better in terms of cash flow.

Market is near the top. If OP invests for the long term (over 10 years), RE is still investable. Timing the market is hard, people’s aging never stops. May as well buy a few houses and let them to be your property for a long time.

It’s not a good time, but you can not choose which year you were born.

It’s good that wages and RSUs are very high now, it’s bad that RE price is also very high. Overall, it’s still a blessing.

Generally not a fan of buying a pig in a poke…will revisit later this year.

Inside the bag is a suckling

Rent out the current home and buy a new primary. It’ll cash flow better than buying a home now as a rental. Plus, you can keep the lower primary home rate on the current home and get a primary home rate on the new home. Buying with an investment mortgage rate isn’t ideal.

You can check out the various passive investments and their score at this website.

I use boggleheads 3 index fund approach - set my stock/bond allocation based on risk and stick to it. My only investment in real estate is through REIT. I want to explore real estate crowd funding - but its just so much more effort than index fund investing. I spend my free time with family and self improvement - so i highly value ease of investment.

Too late to get on the bandwagon on most overvalued investments. Everyday investors get rejected by overbid in these out of state RE areas described. Vacancy etc. A little late IMO. Suggest you to see an investment adviser at your brokerage stating you were too aggressive and look for something more defensive.

Do not assume FAANG employers can take in more highly trained tech workers. Many smell soon more companies will have retrenchment programs to get profit up or even stay profitable. When one or both in the family are on indefinite furlough and rental is vacant that half mil savings will evaporate sooner than you think.

I am having a skype meeting with one Austin Agent. Let’s say how he convince me that Austin is a better choice over SJ.

I mean, I gave this a second thought. Yes, in SV, it’s very hard for me to get on the boat, since 0.5m is pretty much just a down pay to a SFH, with another 1m mortgage, it will be huge negative cash flow. But in the meantime, it’s also unrealistic to split that 0.5 and buy 5 SFH in Austin with 1m mortgage. So, we might just end up with 2 SFH in Austin with one full cash and one with small mortgage. With this been said, it’s not Apple to Apple comparison anyway.

Again, if I want to buy SV, I am force to take all my leverage to take loan for a SFH, if the bubble burst in the near future, I will be in big trouble. But in Austin, I can pretty much skip the mortgage part, even another 2008 comes, I just still HOLD. (God, I really hate to say HOLD now thanks to Cryptocurrency)

So we have 3 people on the Austin bandwagon…

With $500k, hold it with savings account at 2.5% interest rate (risk free spilt into two or three banks accounts FDIC insured). When the bubble burst in SV, get in strong areas of SV. This is what I would do.

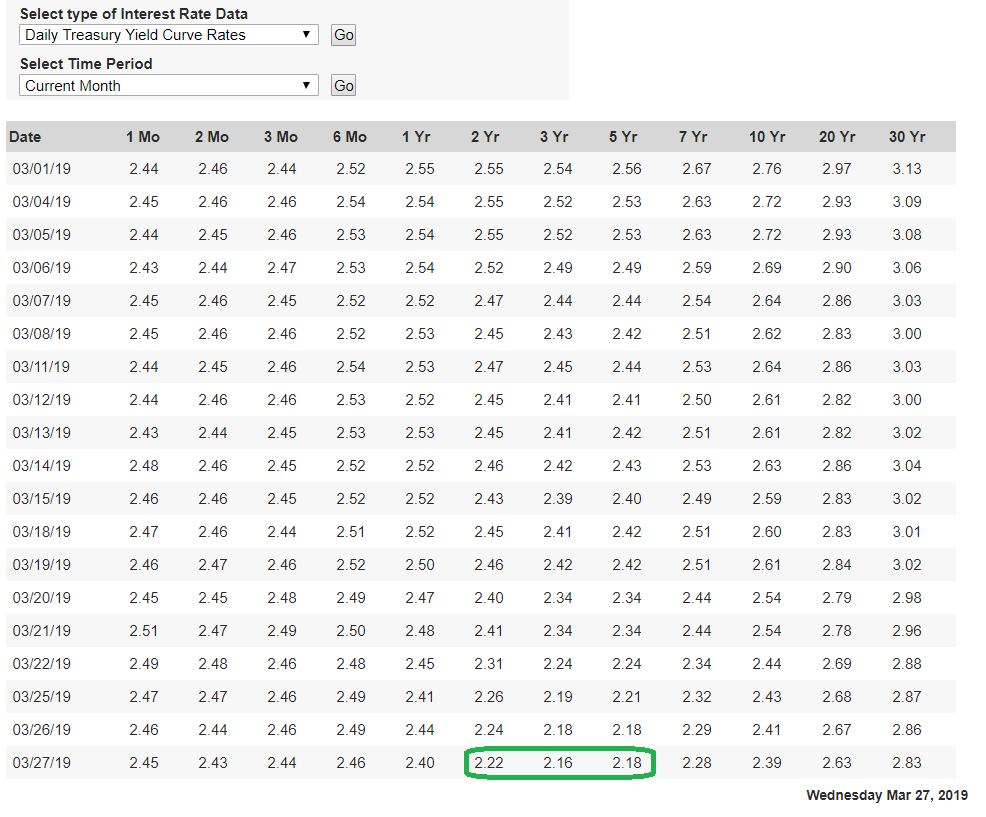

Exactly, the same bond buyers are doing, looking for 2y3, 3yr and 5yr bond buying spree. At the expiry, they will move to stocks.

Ok, done talking with the Agent. His investment plan for Austin is:

- Buy multiplex instead of SFH. (Rule of thumb, no SFH for investment if your budget is under 10million…)

- Nice cash flow and some appreciation.

- Sell it after 3 - 5 years and put the money into another multiplex.

- Repeat 1 with 1031 exchange.

He showed me one current listing example (purely number talks):

550 - 600K very old Fourplex, 25% down pay, monthly rent 4k. Cap around 7.8. Cash flow after everything (interest, insurance, 8% management fee, property tax, blablabla) around 1k.

The part I don’t understand is: why to sell that property after 3-5 years if you have good cash flow anyway, why not HOLD it? He mentioned about maintenance issue if HOLD.

Anyway, he said he will send me the excel, which I will do the detail calculation, he looks like an experienced guy.

7.8% is yield, not cap rate.

What is the max yield possible in bay area ( like Sacramento or Oakland or Hayward or any other city)?

My agent recommends differently,

SFHs to duplex,

7-10 years old,

$250k-$350k,

Single story: 3 bedrooms, 2 baths, preferably 1 spare room

Double story: 4 bedrooms or 3 bedrooms + SOHO/ media room, 3 baths

Rental strategy is to rent slightly below market to rent out fast and then gradually increase rent to encourage longer tenancy. Vacancy is expensive.

Project management: Leasing is 70% of monthly rent, monthly PM is 8% of monthly rent, Renewal is 10% of monthly rent.

Avoid renting out with fridge and washer/ dryer as tenants tend to damage them.

Profile of a SFH that I have bought about 1 year ago,

Double story, 4 bedrooms, 1 media room, 3.5 baths, 3 car garages

3500 sqft on 8200 sqft lot,

Hardwood flooring, bedrooms carpet, wet area tiles

Built in 2005,

Paid $325k, rehab $5k, rent out at $2300.

Property tax $10k, Insurance $1k, HOA $750.

What is the max yield possible in bay area ( like Sacramento or Oakland or Hayward or any other city)?

Failed your travel distance criteria, so didn’t bother.