The bottom line is, this policy is so ill conceived and simply paints Biden as a Socialist. Bernie Sanders must be burning incense and bowing to Grandpa just about now…

How can we conclude greediness just based on rate? Home and car can be marked up in price and given lower rate.

Loan companies are the question here.

What auto retailers/colleges/manufacturers/house sellers price their products is another story. We can discuss that, but I’ll skip that.

Biden is a lifelong politician. If his voters want a Communist he will come to the voters dressed up as a communist so that he gets elected.

Anyways, let’s skip politics on this thread otherwise you will be shipped to Siberia aka the ‘politics’ section ![]()

Even though this debt forgiveness doesn’t solve anything and I think it’s a political stunt. My question is why wasn’t there a single post criticizing PPP forgiveness? Why is it if common man gets something it’s socialism but not the other way around?

Some info on characteristics of student loan that may help you guys in forming your PoV.

For cases filed on and after October 17, 2005, and under current law, both federal and private student loans are not dischargeable in bankruptcy unless you can show that your loan payment imposes an “undue hardship” on you, your family, and your dependents.

Now can be forgivable for those who earn a good salary?

No No No there are many many people criticizing both PPP and loan forgiveness. PPP was in response to something not seen in 100 years, where WFH became a phenomenon, cities emptied, millions of people died. Comparing PPP and student loans, is it the same? Didn’t the common people get enhanced unemployment such that they got paid more for sitting at home than in their past jobs? There are so many jobs today that there are not enough people but people can’t pay off student loans? So, saying common people didn’t get anything is incorrect information at best.

I wish I could get my student loan that I paid back. My wife wishes she could get it back too. Both of us had RA/TA, i.e. we had to work to get lower/no fees.

India used to be/is still a socialist country. China communist. None of these countries want to go back. People in America should build up on what made them successful not regressive policies which have failed everywhere.

I just took PPP as an example. @manch mentioned about farm subsidies. Person without kids living in TX has to pay high property tax which mostly goes to school. Point is there’s some kind of subsidy in every part of our lives but only few get into focus and get bashed.

China may be a communist country as a whole but india can’t be generalized that way. Check the southern 4 states of India and their policies. You will be appalled by the number of welfare schemes for poor. They are in top 10 in various metrics. One of the southern state is communist state- Kerala. Check about Kerala, Tamil Nadu if you get time.

What was India Pre 1992 and post 1992? India is better than it used to be post 1992. Kerala is only where it is due to expatriate money from gulf. Do you know how many people from Kerala work outside Kerala? Tamil Nadu is better, i.e. more balanced but what is it’s per capita income?

Seriously, India with per capita nominal income of $2000/capita, need to at least move to middle income status. Countries such as South Korea, Taiwan, Singapore went from poverty to rich/middle income countries in 30-40 years. Even the ASEAN countries have done better at least twice better.

India is a socialist country even when compared to some European countries, whose per capita income is 15 to 20 times of India’s. Point is those countries have money to spend unlike India.

China WAS a communist country. Only it’s government is communist today. Economically unless it affects Xi negatively they’re capitalists. Their per capita income is 5x than India’s.

PPs were not bad? Ok good.

Subsidies are generally bad. Whether farm or others. We don’t want more.

I’ll come back to the topic of this thread.

Student loans forgiveness is a giveaway to the Bernie and Warren faction. Economically student loan forgiveness is a bad policy and have been said to be the same by notable Economists from Obama Administration. I mean I could have pointed out to Republican economists but then that wouldn’t have been credible?? ![]()

Are you kidding? These debts are sold to collection agencies. They come and collect your belongings, impound your car, harass your parents, call up your siblings, and are insanely rude to the people who now own your phone number and just want them to stop calling because they don’t even know you. THEN they might not even clear your name when you pay off the debt.

Hey man (woman?), me wifey and I make too much money to get any:

- tax breaks from rentals

- any of these payments from covid or whatever

Not that I am complaining… LOL

I don’t know about past history much but have some knowledge about present. Yes Kerala used to get NRI money but it’s on decline. Debt to GDP has increased. I was only comparing within India where Gujarat is more like TX, Tamil Nadu more like CA. India is not even comparable with other countries you mentioned.

I know someone who just changed the number and filed bankruptcy and whole balance got wiped off, but yes what you say happens as well

man ![]()

yeah, but bankruptcy sucks

Also, you can change your number, but they still harass your relatives.

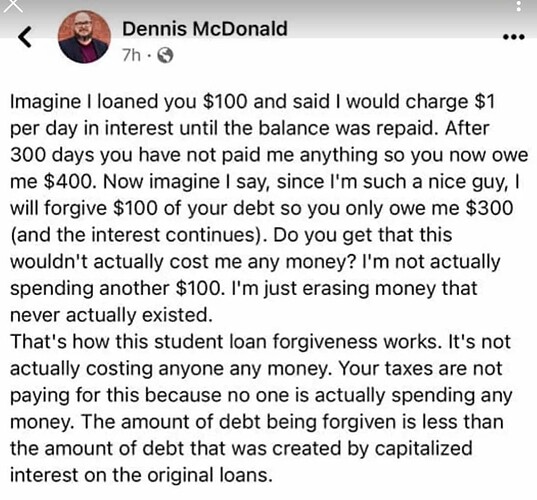

Seriously? That person could have invested the $100 in something else and earned a return. I’d love to see the math on all that was forgiven was capitalized interest. Interest only capitalizes if people are making payments smaller than the interest on the loan.

This logic is really bad. As marcus says, that 100$ that was forgiven could’ve been invested somewhere else. I hope Dennis McDonald does not apply similar logic to his own financial planning.

Student loans at extremely low rates(0%?), could have been made available to households at or lower than say $50000/year income.

That would have been a good policy IMO and helped the really poor students.

73% of anticipated recipients say they expect to spend their debt forgiveness on non-essential items, including travel, dining out and new tech, according to a recent survey from Intelligent.com.