SPDR S&P 500

The guru purchased 39,400 units of the exchange-traded fund

Vanguard S&P 500

The renowned investor bought 43,000 units of the ETF,

WB bought S&P index fund  SPY and VOO

SPY and VOO

Indexing still has a role in your portfolio, Cramer said. In particular, a low-cost index fund that mirrors the S&P 500 should be the “bedrock of your retirement account,” he explained.

The overall S&P 500 index works because the S&P 500 is itself an actively managed fund, Cramer said.

By index fund, I have always meant S&P index ![]()

This is another reason to own smaller companies that aren’t in SPY. They’ll often be in other indexes, but the volume is tiny. Most of the volume is individual shares not ETF trading.

“Flows into funds tracking the S&P 500 index raise disproportionately the prices of large-capitalization stocks in the index relative to the prices of the index’s small stocks,” authors Hao Jiang, Dimitri Vayanos and Lu Zheng wrote in the paper.

They found that so-called noise traders tend to push up the price of fashionably big companies as they enter the S&P 500. As a result, those companies arrive with higher index weights which in turn trigger more buying from capitalization-weighted funds tracking the gauge.

Now and then, influencers are paid to boo-boo passive investment in broad based indices.

Frankly, I don’t know whether Kris is boo-boo-ing QQQ or both.

Do you think there’s an passive index investing bubble?

Irrelevant. The right way to invest in index is DCA purchasing.

We already know that statistically most people have <$2k saved. They aren’t investing money. The number of people who save enough per month to become a multi millionaire over 20-30 years of compound growth is tiny.

That’s a 50% increase in 4 years. Wow.

If the financial standards had been indexed to inflation since the 1980s, a married household would need a roughly $3 million net worth or a $911,352 joint income to be accredited in 2022, the SEC said. Just 5.7% of households — about 7.4 million — would qualify, according to its data.

Over 24 million U.S. households — about 18.5% of them — qualified as accredited investors in 2022, the Securities and Exchange Commission said in a report issued Friday.

So SEC unintentionally expose about 17 million households to risky investments?

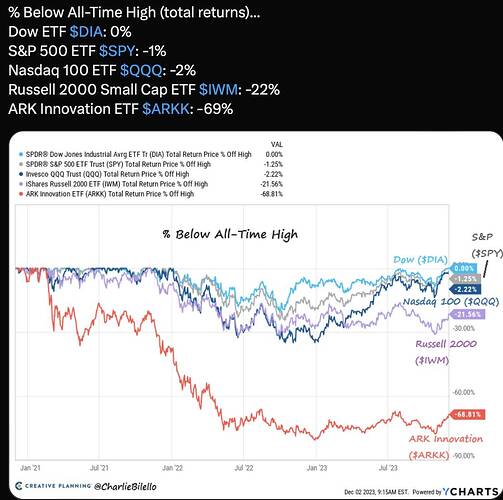

Selectively use peaks as the start points?

For index investing, we adopt DCA approach, not buy once n hold approach.

Exactly. He interprets buy and hold (hopefully forever) as buy once and hold.

If you want to buy once and hold, you have to buy at 30% margin of safety as recommended by WB. This actually is for individual stocks. For indexes, should be DCA.