Upon this post, I put ALL-IN $1M to QQQ and SPX calls! Wish me LUCK. Anyway, I thought Apr 23 is 2mrw!!! F… Which timezone is Mr Market using?

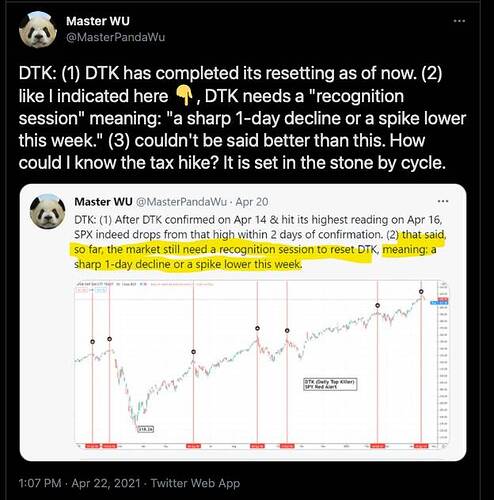

Panda has been right about all the bearish actions.

DTK has reseted. Now we need to wait for the next DTK red alert to get the hell out of the market. Is up to you to choose to ![]() or

or ![]() I choose to believe his DTK.

I choose to believe his DTK.

That’s the “sharp 1-day decline”? That’s all?

.

Is critical in that it resets DTK ![]() So we can continue to party! Still the next DTK red alert. I have to wonder whether the DTK will signal red alert next week? Panda says is one month after the first DTK… which mean 2-3 weeks later… mid May… should be the May 10 week… Will he be correct again? 2-3 weeks of rally brings indices to fairly high level

So we can continue to party! Still the next DTK red alert. I have to wonder whether the DTK will signal red alert next week? Panda says is one month after the first DTK… which mean 2-3 weeks later… mid May… should be the May 10 week… Will he be correct again? 2-3 weeks of rally brings indices to fairly high level ![]()

Yes, cause of the drop is irrelevant. I went from doing simple TA, to doing FA, to EW after realizing that whatever news claimed is the cause of the drop/ rally is irrelevant.

Revisit 4120 2mrw? Chart said Monday, Panda said 2mrw.

This capital gain tax hike is a head fake. Some folks within the Biden admin just floated out a trial ballon to make the real proposals look mild by comparison. I don’t believe they will double the tax rate for real. There won’t be enough votes in the Senate anyway.

.

Price action is the truth. We don’t want to see QQQ drops below 334 2mrw.

Since I have a bad memory, are you and Panda saying we will ride a rocketship for the next month or so?

Obviously you don’t read chart. I posted Panda’s latest chart 3 posts prior. My count is slightly different.

His max target is SPX 4256, mine is SPX 4244 to 4286… I don’t consider those as rocket ship target.

Anyhoo, if market continues to dive 2mrw, TOP could be IN… RUN.

.

Only 2 days ago. I might live to regret for ignoring the bearish divergence. Greed! instead of being objective. Could be a bridge too far.

Even though QQQ doesn’t continue downwards and stay above 333.97… the alternative count is still in play.

Update: Reading too much bearish comments by Panda make you bearish… my preferred count looks good ![]() Make a lot less now because of closing too early. Now just console myself like Ah Q, never wrong to take profit.

Make a lot less now because of closing too early. Now just console myself like Ah Q, never wrong to take profit.

For chart below,

Preferred count in green labels.

Alternative count in red labels.

Yep I took profit and sitting mostly cash now except a few positions. Might be a bit of chop chop next week but I want to remain cautious. Things now look overextended. Short squeeze possible though.

I admire you and Panda, very good trading skill.

Hah!  I’m nowhere near Panda or your level of TA. I just compile a lot of social media expert’s analysis, trend and sentiments. Seems to work for me at least.

I’m nowhere near Panda or your level of TA. I just compile a lot of social media expert’s analysis, trend and sentiments. Seems to work for me at least.

I am following your path but you seem to be expert

Panda needs some soul searching for his EW skill… the bounce from yesterday low is impulsive!

SPX is either in wave (1) of wave v or in counter-trend wave (b) of wave iv (the expanded kind that I said moons ago, see below).

Btw, both means decline ![]() after completion

after completion ![]() Could be AH Friday or PM/MH Monday.

Could be AH Friday or PM/MH Monday.

QQQ looks good… I will BTFD if there are any dips… looking forward to 350 ![]() next week.

next week.

WB has been saying pretty much every year it’s wrong to take profit on your long term winners.

![]()

.

But I am trading ![]()

.

Hopefully is great minds think a like.

97% cash 3% in QQQ calls just in case it continues to rocket ![]() Should be down Monday and may be Tuesday… then take the bull by the horns one more time

Should be down Monday and may be Tuesday… then take the bull by the horns one more time ![]() Ride to SPX 4244 QQQ 350.

Ride to SPX 4244 QQQ 350.